- DOT fell more than 4% after getting rejected from the $2.27–$2.40 zone.

- Volume spiked nearly 80% above average during the key reversal moment.

- Momentum flipped bearish as lower highs and fading participation took over.

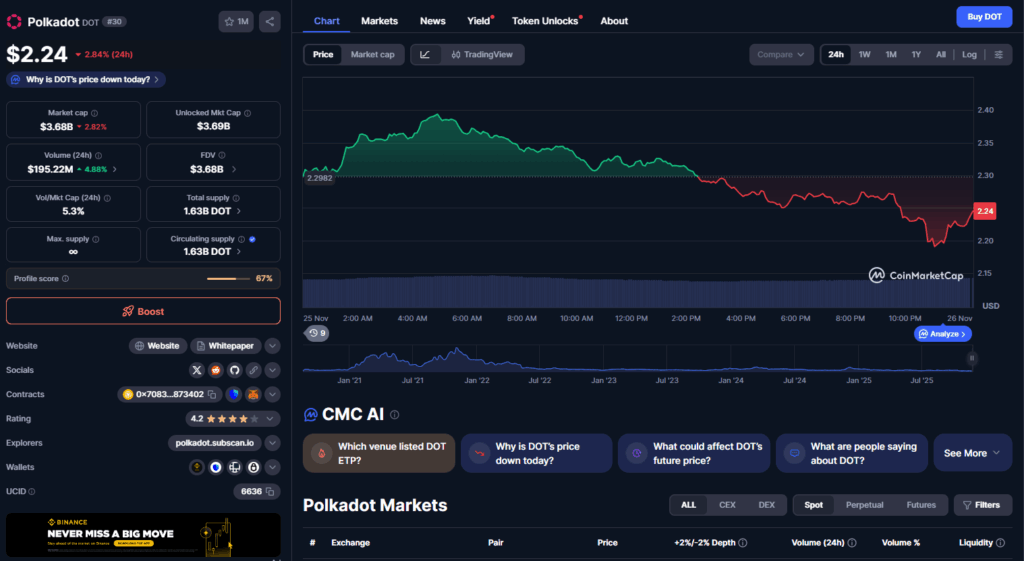

DOT slipped more than 4% on Tuesday, falling toward $2.19 after getting rejected from a key resistance zone the previous evening. The token briefly pushed to $2.40 before rolling over, forming a steady string of lower highs that set the tone for the rest of the session. The pattern wasn’t subtle at all – momentum faded fast, and sellers quickly took advantage of every weak bounce.

Rising Volatility Signals Growing Bearish Pressure

Over the last 24 hours, DOT carved out a tight but volatile $0.21 trading range, showing nearly 9% swings intraday. The move reflected a market where bulls tried to build something early on, but bearish pressure flipped the script. According to the technical model, aggressive sell-side flows accelerated right after the rejection at $2.27, shutting down any meaningful attempt at a recovery.

Volume Spikes as Buyers Step Back

The most dramatic trading burst hit around 13:00 UTC on Monday, with volume jumping 78% above its daily average. That spike lined up exactly with DOT’s rejection from resistance, marking the moment momentum broke down. After that, each rebound attempt saw weaker participation, making it pretty clear that buyers were stepping back and letting sellers dictate the pace.