- U.S. Election Betting: Kalshi’s Polymarket Rival Quickly Gets Traction

- In just three weeks, Kalshi’s presidential prediction market has passed $30M in volume

- It still trails the $2 billion traded on Polymarket since January

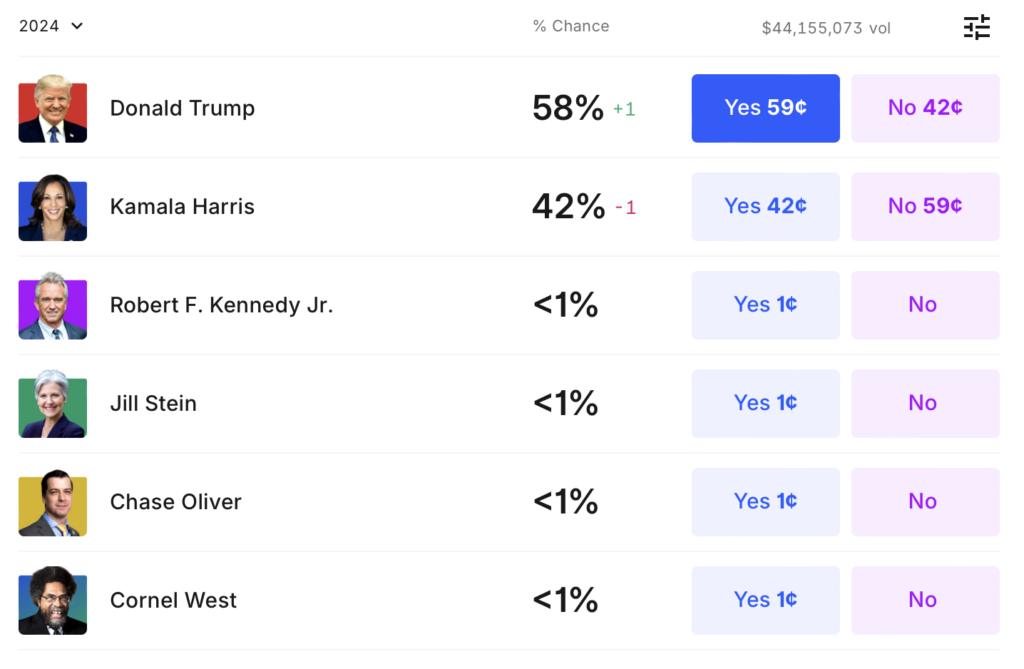

US election prediction markets have seen huge growth and adoption in recent years. In this market, participants can essentially “bet” on election outcomes by buying and selling shares that represent candidates’ chances of winning. The share prices fluctuate based on demand, reflecting the market’s consensus on the probability of each outcome.

Kalshi’s Prediction Market Quickly Gains Traction

In just three weeks since its launch, Kalshi’s presidential prediction market has already passed $30M in volume traded. However, it still trails far behind Polymarket, where over $2 billion has been traded since January.

How Prediction Markets Function

Prediction markets leverage the “wisdom of the crowd” by aggregating information held by all participants. Since participants are financially motivated to make accurate predictions, the market prices end up being quite accurate predictors of actual outcomes.

For example, if a prediction market contract for Candidate A winning the election is trading at 60 cents, that suggests the market believes Candidate A has a 60% chance of winning. As new information emerges during the election cycle, market participants quickly react and the contract prices adjust accordingly.

Challenges Facing Prediction Markets

US regulators have often taken issue with prediction markets, arguing they are akin to illegal online gambling. For example, PredictIt operates under a no-action letter from the Commodity Futures Trading Commission that only allows it to take bets capped at $850 per user.

There are also concerns around market manipulation, where bad actors could skew contract prices by flooding the market with trades. Platforms need robust systems to detect suspicious activity patterns and participants.

The Future of Prediction Markets

If regulators take a more permissive stance, prediction markets could become a hugely valuable source of real-time data for campaigns, media organizations, and the public. The high financial stakes incentivize information discovery and aggregation.

Kalshi’s early success suggests prediction markets are here to stay in some form. It remains to be seen whether a platform will eventually dominate the nascent industry like Google did with search, Facebook with social, or Amazon with e-commerce. The platform that can attract the most liquidity tends to benefit from a flywheel effect and will likely emerge as the winner.

source: Kalshi

Conclusion

Prediction markets represent an exciting evolution of political forecasting and public opinion tracking. If regulated properly, they could become a mainstream part of how elections unfold. It will be fascinating to watch this market evolve in the coming years.