- Trump Jr. says he’s not tied to the $TRUMP coin and is focused on stablecoins and mining.

- He claims the family turned to crypto after being shut out by traditional banks post-politics.

- Stablecoins, he argues, could help support U.S. dollar dominance by buying huge amounts of Treasurys.

Donald Trump Jr. has made it clear he’s not directly tied to the $TRUMP meme coin, even as it remains central to his family’s crypto ventures. In an appearance on CNBC’s “Squawk Box,” he emphasized his focus is more on serious crypto projects like stablecoins and Bitcoin mining. Meme coins, known for their volatility and reliance on hype, aren’t really his style.

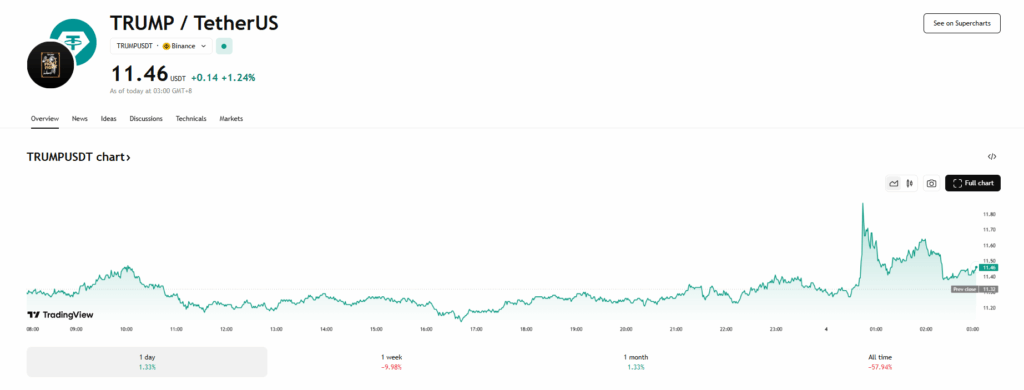

While the Trump coin briefly reached a $15 billion market cap, it quickly plummeted—though not before its creators made hundreds of millions in trading fees. Trump Jr. noted the coin launched just before his father’s inauguration, and blockchain data shows a cut of each transaction was quietly funneled to wallets controlled by the team. Despite criticism and scrutiny, the Trump Organization still holds 80% of the token supply.

Politics Pushed the Trumps Into Crypto

Trump Jr. described their move into crypto not as some flashy trend grab, but as a reaction to being cut off from traditional banking after entering politics. According to him, they went from being able to call any New York banker for a loan to being completely “debanked” and ignored. This financial lockout, he said, opened their eyes to the potential of decentralized finance.

He argued that crypto offers a level playing field, even for high-profile figures who suddenly find themselves out of favor with the banking system. Their answer? Leaning into blockchain and launching USD1, a stablecoin through World Liberty Finance, as a hedge against centralized exclusion. It’s a pivot rooted in necessity, not hype.

Stablecoins as a Lifeline for U.S. Dollar

Trump Jr. defended the legitimacy of stablecoins, suggesting they might even help bolster the U.S. dollar globally. He pointed to companies like Tether that are now massive buyers of U.S. Treasury, sometimes outpacing foreign governments in scale. This shift, he claimed, could help maintain the strength of U.S. financial infrastructure.

He argued that USD1 and others like it aren’t undermining the dollar—they’re propping it up. And in a financial world growing more skeptical of old systems, stablecoins may represent one of the last strongholds of trust. Trump Jr. wrapped it up with a bold statement: “Stablecoins could be the savior of U.S. currency.”