- Dogecoin surged 15% this week, backed by Cleancore’s $235M investment and rising institutional demand.

- ETF speculation, led by Rex-Osprey’s proposed DOGE ETF, is boosting long-term confidence despite lower retail activity.

- Technical indicators suggest a possible breakout toward $0.29, marking a 20% upside target.

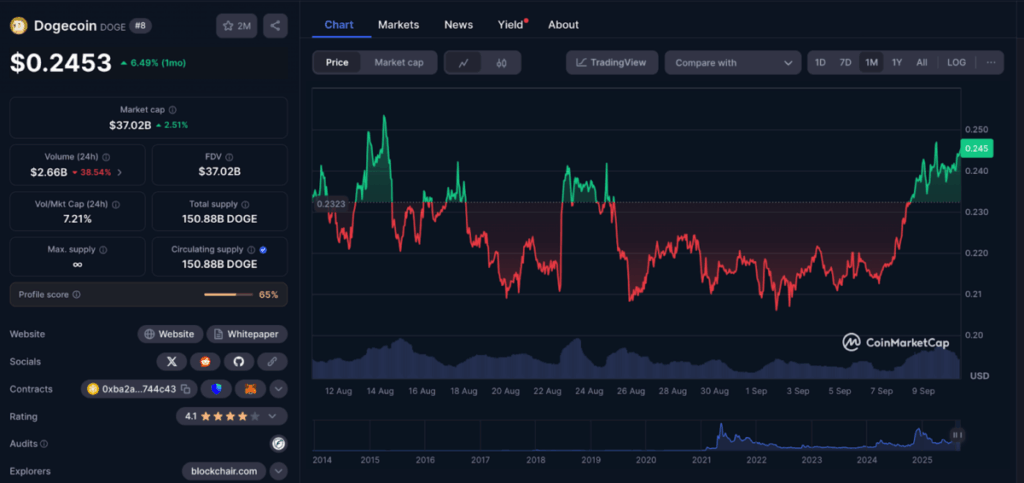

Dogecoin has quietly become one of the week’s surprise movers, climbing from $0.20 to $0.25 in just a few days. That’s a 15% gain, and it’s not just random hype this time—big money is starting to line up behind DOGE. Institutional players and chatter around a possible ETF are fueling the momentum, making DOGE suddenly look like one of the strongest performers among the top 10 coins.

Cleancore’s $235M Allocation Adds Corporate Legitimacy

The first spark came when Cleancore, of all companies—a cleaning solutions provider—announced a massive $235 million allocation into Dogecoin. The firm set its sights on scooping up a billion DOGE over the next month to diversify its balance sheet. That single move gave Dogecoin a kind of corporate legitimacy usually reserved for Bitcoin or Ethereum, putting it in the same breath as layer-1 giants like BTC, ETH, SOL, and BNB, all of which have been pulling in institutional treasury inflows this year.

ETF Speculation Heats Up as Trading Volume Shifts

The rally gained even more traction when Bloomberg ETF analyst Eric Balchunas dropped a post hinting that Rex-Osprey’s DOGE ETF—ticker DOJE—could be hitting the U.S. market soon. The fund is expected to use the same Investment Company Act structure that was used for the Solana Staking ETF earlier this summer. Despite this bullish backdrop, trading volume actually slipped 38% midweek while DOGE prices nudged up another 2.4%. That unusual combo suggests whales and large players are quietly driving the move, while retail activity takes a backseat.

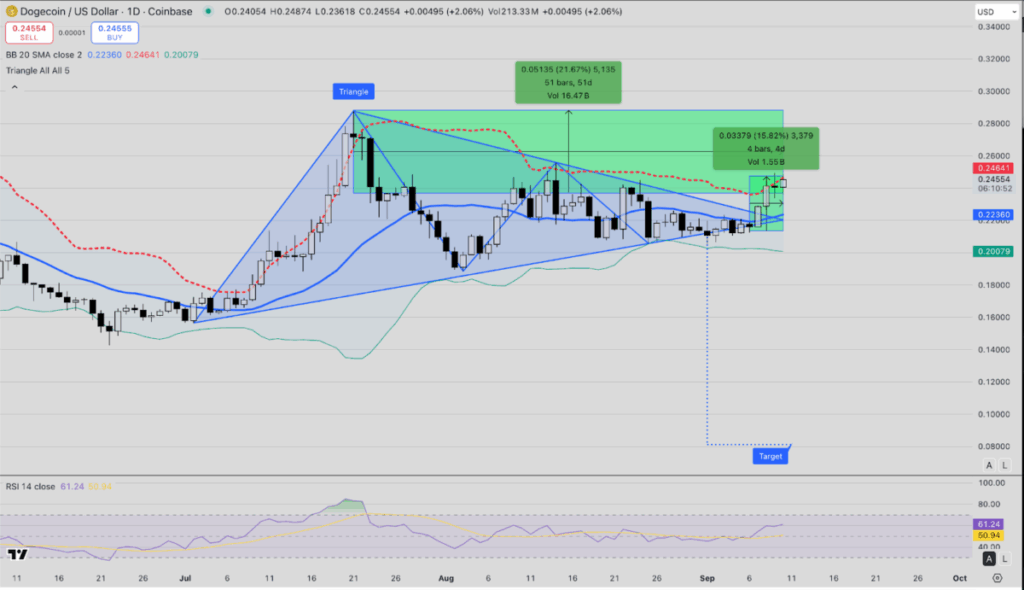

Technical Patterns Point Toward a $0.29 Target

From a technical lens, Dogecoin is showing strength after breaking clean above the 20-day Bollinger midline at $0.223. The RSI is holding near 61, which signals bullish momentum without tipping into overheated levels. Still, DOGE faces resistance at the Bollinger upper band around $0.246, which could act like a short-term ceiling unless volumes kick back in. If buyers manage to keep pressure steady, the 50-day triangle breakout pattern sets up a potential run toward $0.29—roughly a 20% upside from current levels.