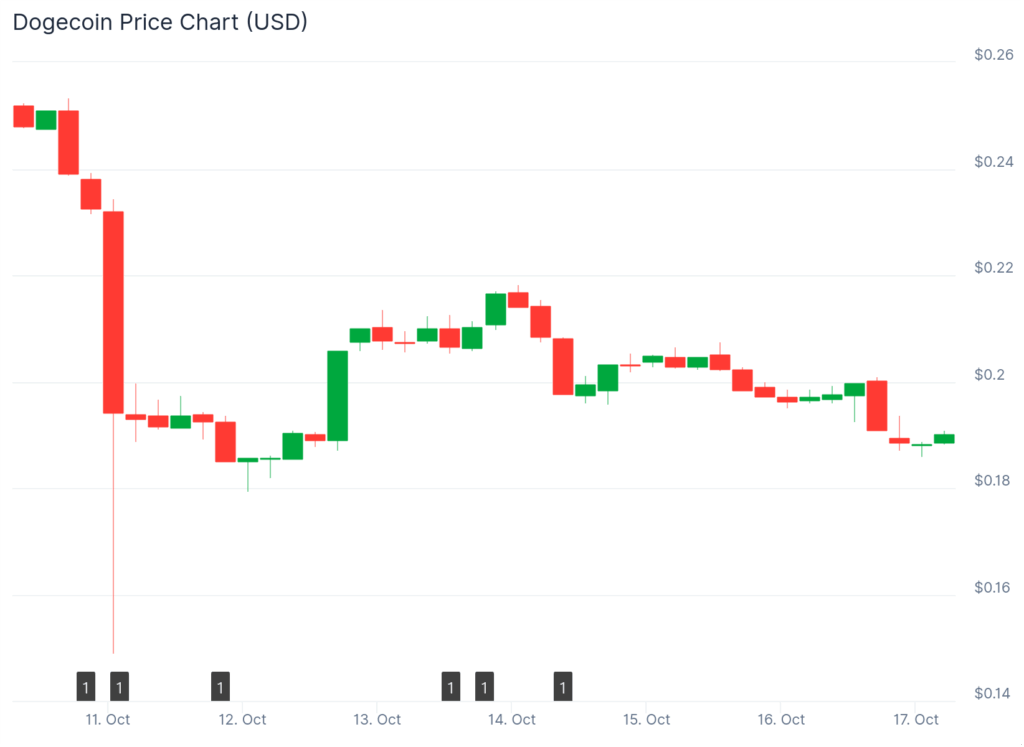

- Dogecoin dropped 21% this week as whales dumped $74 million despite news of a Nasdaq merger and potential payment integration.

- Thumzup’s DOGE payment plan was only exploratory, leading traders to take profits and trigger further selling pressure.

- Analysts say holding the $0.19 support level is crucial, with a possible rebound toward $0.25–$0.33 if momentum returns.

Dogecoin just had one of its roughest weeks in a while. The meme coin slid about 21%, trading near $0.20, even after some big headlines that should’ve boosted morale. The “House of Doge,” a corporate group backed by the Dogecoin Foundation, announced plans to merge with a Nasdaq-listed firm, while Thumzup Media revealed it was exploring DOGE payments for creators. But the hype didn’t last — traders took profits fast, and whales dumped a staggering $74 million worth of DOGE right after.

Big Announcements, Small Impact

Initially, the news of a Nasdaq merger created a spark of excitement across the Dogecoin community. It sounded like a step toward legitimacy, maybe even a hint of mainstream adoption. Then came Thumzup’s update — the social media rewards app said it wanted to integrate Dogecoin payouts to help creators earn faster and skip transaction fees. The problem? It wasn’t an actual launch, just a possibility. That single word — exploring — sent traders running for the exit. DOGE slipped another 3% that day, showing how fragile sentiment still is.

At this point, Dogecoin is down roughly 73% from its all-time high of $0.74. Market fatigue and a lack of clear follow-through from corporate partners have left retail investors skeptical. Even exciting announcements can’t seem to lift the coin when whales are offloading.

Whales Offload $74 Million in DOGE

On-chain data confirmed that large holders sold about 360 million DOGE, worth nearly $74 million, in the middle of all this news. The timing suggests many whales used the hype to exit while retail investors were still reacting. The sell-off came as broader crypto markets slipped, with Bitcoin and Ethereum also seeing red.

Still, the Dogecoin liquidation stood out. The token had shown hints of life earlier in the month, bouncing toward $0.25, but once momentum faded, selling accelerated. Traders say it’s a classic case of “buy the rumor, sell the news” — especially with DOGE, where speculation often drives the entire narrative.

Key Levels: $0.19 Support and $0.33 Target

Technically, all eyes are now on $0.19 — a critical support line that could decide DOGE’s next move. Analyst Ali Martinez noted that Dogecoin is still trading within an ascending channel, suggesting a potential recovery if it holds that base. A bounce could push prices back toward $0.25 and maybe $0.33 in the short term.

If that level breaks though, things could get uglier fast, with the next support near $0.17. The RSI sits around 45, showing weak momentum and fading enthusiasm. For now, DOGE’s fate depends on whether buyers step in — or if whales keep pressing sell.