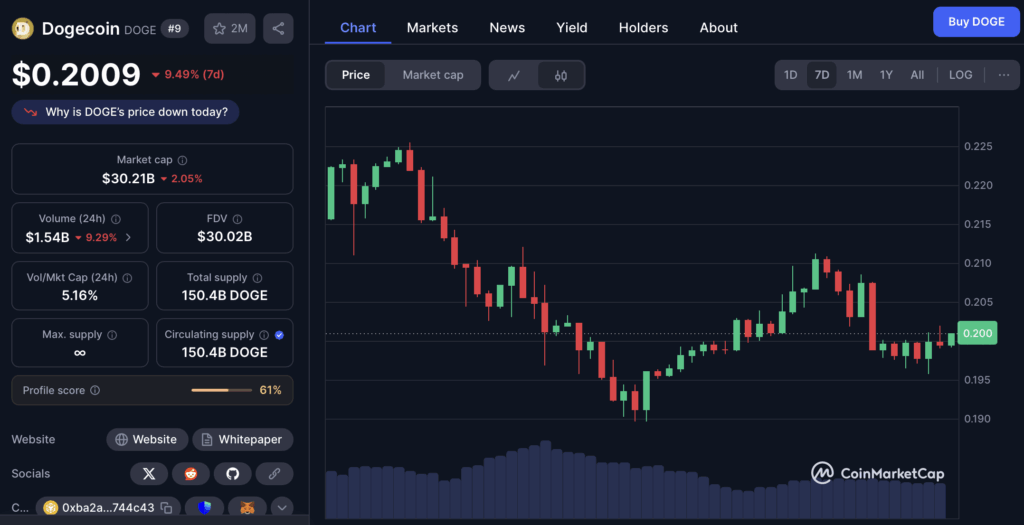

- Dogecoin fell 5% in 24 hours, dropping from $0.21 to $0.198 as a massive volume spike of 877.9M tokens smashed through key $0.201 support.

- Selling pressure dominated, with volume surging on dips and fading on bounces — turning $0.205 into strong resistance.

- If $0.198 fails to hold, traders see $0.185 as the next target, while bulls need to reclaim $0.201 to avoid further losses.

Dogecoin had a rough ride Monday — dropping about 5% in just 24 hours — as trading activity went absolutely wild. The key question now? Can DOGE cling to the $0.198 zone or will it keep sliding toward $0.185.

Volume Spike Turns the Tide

Between late Sunday night and Monday evening, DOGE slipped from $0.21 down to $0.20, bouncing around in a narrow $0.013 band. It tagged lows of $0.198 and highs just over $0.211 — but the real drama came at 14:00 on August 5.

That’s when trading volume suddenly exploded to 877.9 million — almost four times the usual daily average of about 269 million. The selling was brutal, smashing DOGE straight through its $0.201 support like it wasn’t even there. By the close, it was stuck at $0.1985, with multiple failed bounce attempts. Bears were clearly in the driver’s seat.

Meme Coins Lose Steam

It’s not just DOGE feeling the pressure. Across the board, meme coins are losing momentum as retail hype cools and big holders cash out. Even though DOGE teased a rally last week, slipping below $0.205 pretty much killed that storyline.

On Monday, it even started the day strong at $0.211 around 01:00, but by mid-afternoon, the floor fell out. Price tumbled from $0.205 to $0.199 on that monster sell-off, and then at 19:51, another sharp hit dropped it to $0.1975 — on 19 million in volume, more than 70x the usual hourly churn. Now, $0.205 has flipped from a floor into a brick wall.

What Traders Are Watching Now

For the day, DOGE moved in a 6% range between $0.198 and $0.211. The problem? Volume roars when price dips but dries up when it tries to bounce. That’s classic bearish control.

If $0.198 fails to hold, the next likely stop is $0.185. Bulls really need to reclaim $0.201 quickly to avoid triggering more stop-losses. Right now, with every push lower attracting fresh sellers and rebounds barely registering, the market feels tilted firmly in the bears’ favor.