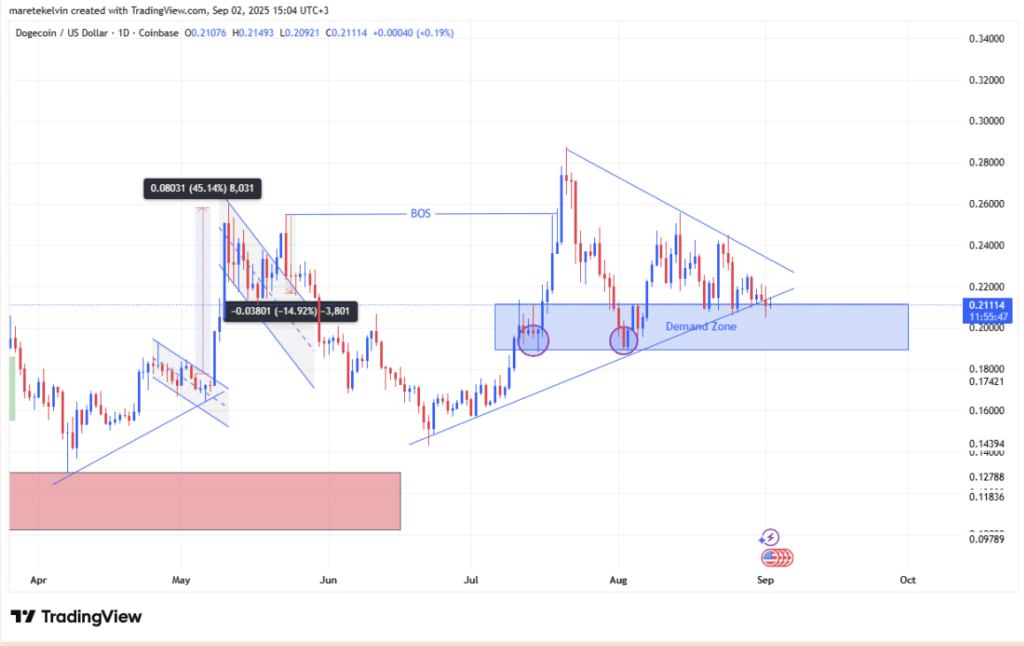

- Dogecoin has been consolidating inside an ascending triangle near the $0.20 support, with price momentum building toward a decisive move.

- Trading volume has surged, hitting $13.49 billion in late August, a sign traders may be positioning for a breakout similar to its late-2024 rally.

- Market cap climbed to $31.7 billion, reflecting growing investor interest, though retail-heavy participation raises the risk of false breakouts.

Dogecoin has been quietly grinding inside an ascending triangle for the past two months, one of those chart patterns traders often circle in red because it tends to signal continuation. Price has tested the $0.20 support zone several times now, and each bounce has kept momentum alive. With the range tightening, a resolution feels close.

Trading Volume Picks Up Steam

What’s unusual here is volume. Normally, you’d expect it to fade during a long consolidation, but instead, Dogecoin’s activity has climbed. Weekly trading volumes hit $13.49 billion in late August, according to Token Terminal, suggesting traders are stacking positions ahead of a bigger swing. The last time this kind of buildup happened in late 2024, DOGE went on a huge bullish tear.

Market Cap Growth Sparks Attention

Dogecoin’s circulating market cap climbed to $31.7 billion on September 1, reinforcing the idea that investor interest is heating up again. That kind of influx often brings both opportunity and volatility. If the triangle breaks upward, technical buyers may rush in. But with heavy retail involvement, false breakouts can come just as fast.

For now, the battleground is simple: hold current demand levels and confirm with volume, and bulls might get their rally toward the next leg up. Fail to hold, and DOGE risks slipping toward lower supports. Either way, the consolidation phase looks nearly done—what happens next could shape the tone for weeks.