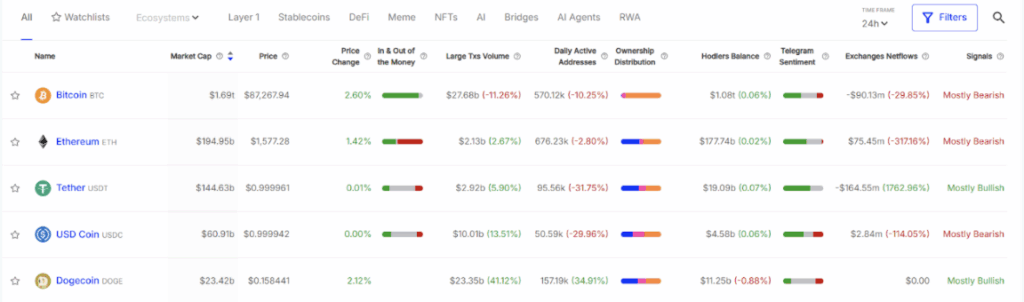

- Dogecoin outperformed Bitcoin in large transaction volume (+41.12%) and daily active addresses (+34.91%), even though Bitcoin led in price gains and total trading volume.

- Speculation around a potential Dogecoin ETF is fueling bullish sentiment, especially after Doge Day celebrations on April 20 reignited hype.

- If the SEC approves a DOGE ETF (possibly by May 18), it could spark a major price breakout in 2025, backed by rising whale activity and community momentum.

Dogecoin’s been stirring up some serious noise lately—yep, even more than Bitcoin in a few surprising spots. According to fresh data from IntoTheBlock, DOGE actually outperformed BTC when it came to large transaction volume and wallet activity during today’s broader market bounce.

That’s right—Dogecoin clocked in a 41.12% jump in whale-sized transactions and a 34.91% surge in daily active addresses. Meanwhile, Bitcoin? Kinda lagged, with a drop of 11.26% in large transaction volume and a 10.25% dip in wallet activity. Not something you’d expect on a day when the market’s looking green.

BTC Still Rules the Charts… Mostly

Now, don’t get it twisted—Bitcoin’s still the big boss in terms of price and volume. CoinMarketCap numbers show BTC picked up over 3% on the day and absolutely exploded in trading volume, up a massive 206.23%. Dogecoin’s price, by comparison, nudged up just 0.69%, though its trading volume wasn’t slouching either, spiking 71.40%.

So, while BTC held down the retail and trader scene, the real eye-opener was the whale action—or lack thereof. Big money seemed to ease off Bitcoin today, and that shift? It may’ve left just enough room for DOGE whales to swim in.

Is a DOGE ETF Around the Corner?

Here’s where things get a little more interesting. Even with Dogecoin trading near recent lows, the vibe around it has turned surprisingly bullish. Why? One word: ETF.

Rumors are heating up again, especially after the April 20th Doge Day celebrations lit a spark in the community. During all the memes and mayhem, one thing stood out—whispers about the SEC still reviewing multiple DOGE ETF proposals started picking up steam.

And we’re not talking small names here. Bitwise, Grayscale, 21Shares, and Osprey Funds all have proposals on the table. The buzz? That the SEC could green-light one of them as soon as May 18.

If that actually happens, watch out. A DOGE ETF approval could be the rocket fuel that pushes prices way higher in 2025—especially with whale activity already heating up and more users jumping in daily.