- DOGE trades at $0.1993, down 2.7% but holding key support levels.

- Technicals show tightening volatility, bullish divergence, and accumulation near $0.18.

- Analysts believe DOGE could soon rally toward $0.27–$0.30 if resistance breaks.

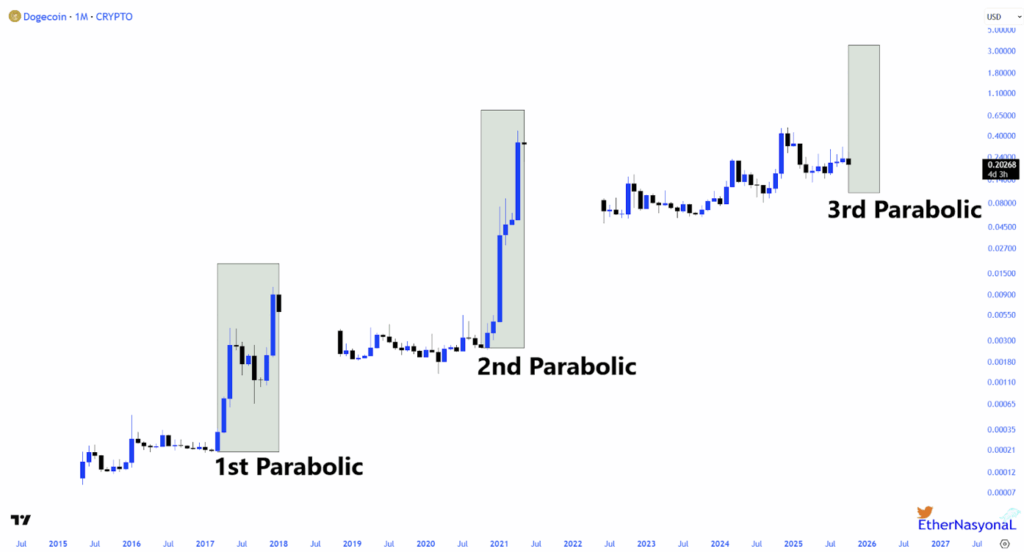

Dogecoin seems to be gearing up for something big again — or at least, that’s what several market watchers are starting to believe. The meme coin, once written off as just another crypto fad, is now showing eerily similar patterns to what it displayed before previous explosive rallies.

Crypto analyst ETHER NASYONAL recently pointed out that DOGE has historically completed all its major accumulation phases before entering strong parabolic moves. According to him, the current cycle hasn’t seen that final explosive leg yet — and that could be the calm before the storm.

At the time of writing, DOGE trades around $0.1993, down roughly 2.7% over the past week. But even with that dip, its broader market structure looks healthy. The coin’s been consolidating steadily, and that kind of slow grind has often acted as a springboard for massive price swings in the past. After reaching highs above $0.45 earlier this year, Dogecoin has since cooled off, hovering in a tight range — a setup some analysts see as quiet accumulation before the next big expansion.

Technical Levels Hint at a Major Turning Point

Looking at the chart, DOGE is currently trading below the 20- and 50-day EMAs, which sit around $0.2197 and $0.2134. However, it’s still above the 100- and 200-day EMAs, near $0.1907 and $0.1564, respectively. That mix of short-term weakness and long-term support paints an interesting picture — the coin might just be coiling up for its next leg higher.

Right now, resistance sits between $0.208 and $0.215 — that’s the key area bulls need to reclaim. If DOGE manages to push above that, it could trigger a quick run toward $0.229, and possibly extend to $0.297 if momentum builds.

Support, on the other hand, lies near $0.184, with a more critical base level around $0.156. A drop below those zones might invite short-term corrections, but as long as DOGE holds above $0.18, it suggests accumulation by longer-term holders rather than panic selling.

Volatility Shrinks — A Breakout May Be Coming

One of the most interesting signs right now is volatility. The Bollinger Bands are tightening, which often happens just before major directional moves. In simpler terms, the market’s getting quiet — and quiet usually doesn’t last long in crypto.

The RSI is showing a weak bullish divergence near lower levels, hinting at hidden buying pressure around the $0.18–$0.19 zone. Meanwhile, the MACD lines are closing in on a positive crossover, another technical clue that momentum might soon shift in favor of the bulls.

All these subtle signals together — shrinking volatility, hidden accumulation, and slow structural buildup — point to something brewing beneath the surface.

The Calm Before the Next Dogecoin Surge

Dogecoin’s been here before — quiet, overlooked, and then suddenly rocketing upward when the market least expects it. As long as it keeps its footing above $0.18, the odds favor a potential move toward $0.27–$0.30 in the near term.

It might not happen overnight, but Dogecoin’s technical and structural strength suggests it’s not done surprising the market yet. This could very well be the setup before its next big run.