- DOGE trades around $0.1875 with strong support at $0.18 and steady accumulation.

- Whales sold 440M DOGE in 72 hours, but larger wallets quietly added more.

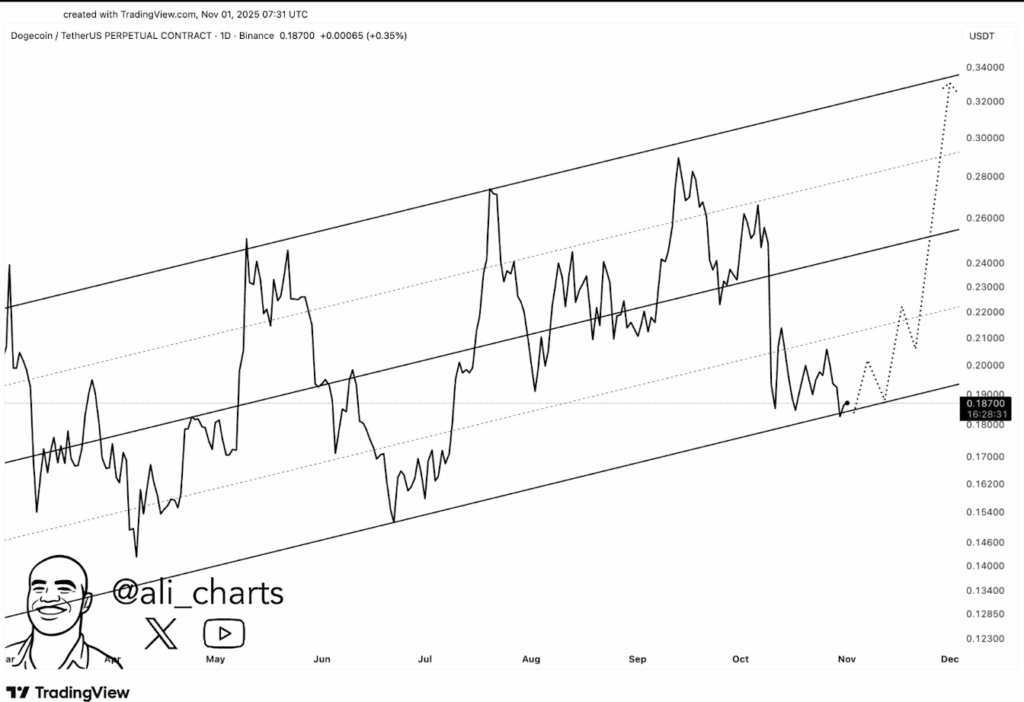

- Analysts see $0.26–$0.33 as potential targets if Dogecoin breaks above $0.20 resistance.

Dogecoin (DOGE) has been quietly holding its ground lately. The meme coin trades around $0.1875 with a daily trading volume hovering near $1.66 billion. Its market cap sits at about $28.4 billion, giving it roughly 0.75% dominance in the crypto market. Over the last 24 hours, it’s up a modest 0.53%, but that small gain carries more weight than it seems.

That little uptick shows steady buying pressure building near the $0.18 zone—an area traders are watching closely. Analysts say if DOGE manages to hold this level, it could mark the end of its consolidation phase and possibly kick off the next leg higher. A clean break above $0.18 might open the path toward $0.20, a psychological mark that often flips market sentiment from neutral to bullish.

$0.18 — The Accumulation Zone to Watch

Crypto analyst Ali recently posted that $0.18 remains the key “buy the dip” level for Dogecoin. According to his chart, holding that zone could spark a rally toward $0.26 or even $0.33 if market conditions turn supportive. It’s not just about hype either—this level matches historical accumulation areas where past rallies began.

Right now, DOGE’s price action looks calm, almost suspiciously so, especially when most of the market is still shaking off volatility. If it continues to hold steady here, traders might be staring down another accumulation phase before a bigger breakout. The sentiment seems cautious but quietly optimistic, which is often how DOGE likes to set the stage before surprising everyone.

Whales Offload — But It’s Not All Bearish

On the flip side, on-chain data paints a mixed picture. Whale wallets—those holding between 10 million and 100 million DOGE—sold about 440 million tokens in just three days, according to Santiment. That’s one of the largest mid-tier whale sell-offs seen lately. These accounts held roughly 15.51% of the total DOGE supply on October 29, but that dropped to 15.15% by the end of the month.

That selling pressure helped fuel DOGE’s 5.76% weekly dip and added to its 27% slide over the last month. Along with that, whale trading activity above $100,000 spiked to 119 transactions on October 30 before plunging to just 15 by week’s end—a clear sign that many big players went from active distribution to taking a breather.

But it’s not all selling. Larger whales, those holding more than 100 million DOGE, quietly increased their share from 19.28% to 19.46% during the same period. Mid-level holders (100,000 to 10 million DOGE) remained steady, showing neither panic nor euphoria.

Calm Before the Next Run?

Dogecoin’s current setup looks like a tug-of-war between fading sellers and slow, quiet accumulation. The $0.18 support zone has become the battleground, and how price reacts here could define the next few weeks. If buyers continue defending it—and larger wallets keep scooping up dips—DOGE could be gearing up for a fresh push back toward $0.20 and beyond.

While volatility’s cooled for now, history shows Dogecoin doesn’t stay quiet for long. Once momentum flips, it tends to move fast—and the next wave might already be forming just beneath the surface.