- DOGE shows a repeating long-term cycle with expanding volatility and renewed buying interest.

- Breaking above $0.16 could target $0.182, while failure risks a retest of $0.135.

- Long-term bullish targets reopen only if DOGE reclaims $0.21–$0.22 on strong momentum.

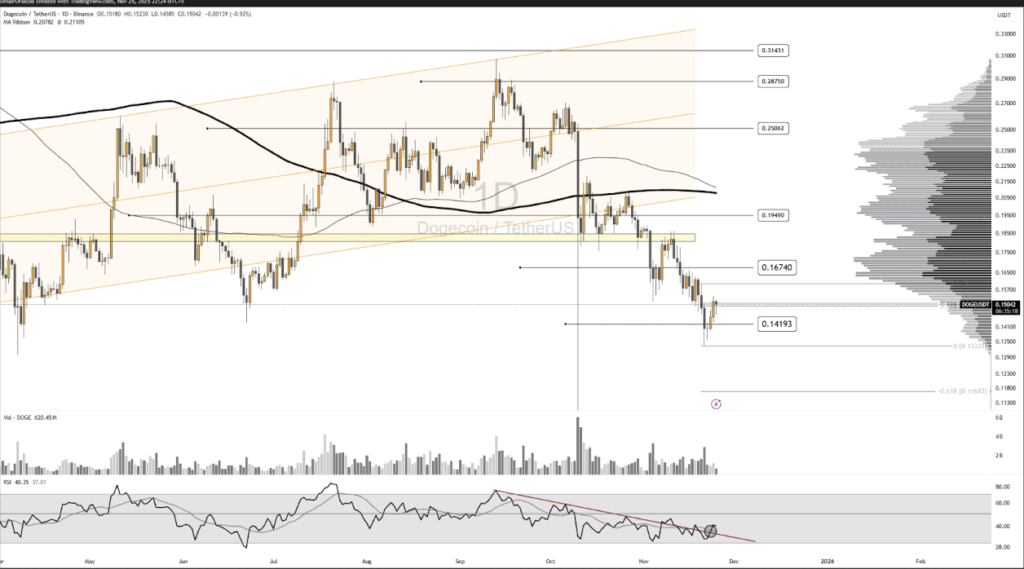

Dogecoin is once again showing a cyclical pattern that has historically appeared right before some of its biggest rallies. On the weekly chart, DOGE’s long-term behavior is almost predictable: massive surges, then long, sleepy consolidation phases where it feels like nothing is happening at all. After topping out in early 2021, the coin slipped into a multiyear downtrend, with volatility shrinking through 2022 and 2023 — the Bollinger Bands practically narrowed to a pinch, signaling fading excitement and thin momentum.

Then, late 2023 into early 2024, something shifted. Bullish pressure returned, volatility exploded outward as the Bands expanded again, and DOGE ran straight toward the 1.618 Fibonacci extension around $0.35. That level turned out to be heavy resistance, forcing price into a corrective drift. Throughout 2024–2025, DOGE kept making lower highs while failing to stay above the 9-week DEMA and 20-week SMA — forming a stacked structure of resistance overhead while support held in the $0.14–$0.15 zone.

RSI breaks trendline with actual volume — a rare signal for DOGE

Analyst Umair Crypto noted that DOGE recently jumped about 7%, breaking its RSI trendline with real volume behind the move. This matters because previous spikes lacked conviction and faded quickly. Now the chart is approaching the 4-hour golden zone after already bouncing on its first test near $0.151. If DOGE pushes through $0.16, the next big resistance waits at $0.182. But if the breakout fails… a drop back toward $0.135 is possible, maybe even forming a double-bottom pattern that traders love to latch onto.

Volume nodes and moving averages clustered between $0.16 and $0.18 will play gatekeeper for the next trend. Hold above them, and DOGE gets breathing room. Slip below, and we’re probably looking at another round of sideways drifting. Traders insist that staying above the $0.14–$0.15 region is absolutely crucial right now.

Bigger bullish targets depend on reclaiming a major range

For DOGE to build a convincing long-term bullish setup, it must reclaim the $0.21–$0.22 zone — a region where the top Bollinger Band meets stubborn price congestion. Only a clean break above that area resets the higher-time-frame structure. If momentum holds, extended Fibonacci targets for the next leg of the cycle sit at $0.48 (2.618), $0.61 (3.618), and $0.69 (4.236). These numbers sound ambitious, but DOGE has hit wild extensions in past cycles when volatility peaks.

Market still shows indecision, but the cycle isn’t broken

Bollinger Band behavior shows the lower band expanding while the upper band slips downward — a combo that signals growing downside volatility and steady sell pressure above. Toward the end of 2025, Dogecoin’s candles show hesitation rather than breakout energy, suggesting the token is in the “middle of the cycle” pullback phase. Traders are watching the $0.14–$0.15 level closely, since losing that zone could reset the entire structure. Here is where DOGE either reloads for its next wave or sinks deeper into consolidation.