- Dogecoin is down 67% yearly and continues slipping, yet the Bubble Risk Model and on-chain activity show signs of a quiet accumulation phase instead of distribution.

- Spot buyers purchased around $50 million worth of DOGE in a week, with retail demand rising even as overall trading volume weakens.

- A massive sell wall at $0.20 threatens upward momentum, but if DOGE can push past short-term resistance, it may reclaim the $0.14 level first.

Dogecoin — still the biggest memecoin by market cap at roughly $23.28 billion — keeps getting dragged lower as market sentiment softens. On the year, DOGE is down a painful 67%, and even its day-to-day chart hasn’t offered any relief, with another 2.4% drop in the last 24 hours. It’s been a slow grind downward, the kind that wears on holders more than they admit.

But buried under the bearish mood, a few signals are flashing that maybe—just maybe—the broader trend isn’t as straightforward as it looks. AMBCrypto believes these hints could end up shaping Dogecoin’s next major move.

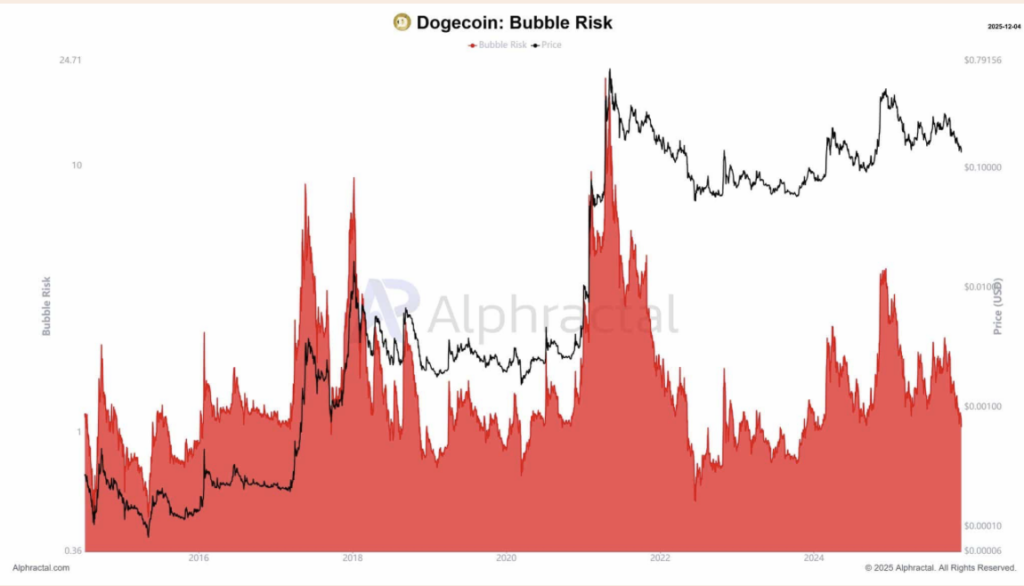

Bubble Risk Model Shows No Bubble — Just Quiet Accumulation

One of the strongest signals right now comes from the Bubble Risk Model, which isn’t pointing to an overheated market at all. Instead, the indicator is trending lower, not higher, meaning there’s no “bubble” forming around DOGE at this stage. When bubble risk is low, it usually means investors aren’t chasing hype—they’re accumulating quietly.

This lines up neatly with what’s happening on-chain. Santiment data shows daily active addresses jumping sharply, with the latest reading hitting 73,560. That’s not the behavior of a market abandoning a token. It looks more like slow, steady positioning beneath the surface.

Is Demand Actually Picking Up Again?

So the big question: is demand truly increasing, or is it just noise? Right now, the data leans toward real demand building—mainly from retail buyers in the spot market.

The Exchange Netflow metric shows buyers in control. Around $3 million worth of DOGE was recently scooped up, pushing the week’s total to $50 million in net purchases. That’s roughly 2% of DOGE’s entire market cap—pretty sizable for a memecoin in a downtrend.

Yet, trading volume continues to decline, which usually reflects weakening confidence. It’s a weird mix: volume fading, but spot demand rising. Sometimes that combination precedes a short-term bounce.

If retail momentum continues, DOGE could push back above $0.14 soon. But, of course, nothing is ever that simple.

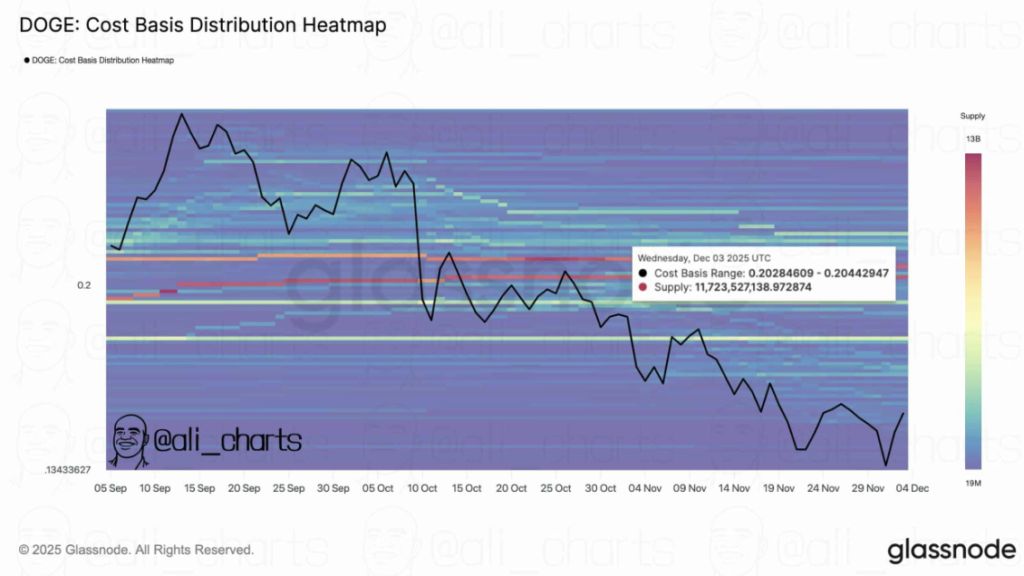

A Massive Sell Wall Still Threatens DOGE’s Rally

Even with these small bullish signs, Dogecoin’s upside is fragile. Data from the liquidation chart shows 11.72 billion DOGE stacked at the $0.20 level. That’s a huge cluster of potential sell pressure — basically a wall waiting to smack price back down.

If DOGE does make a run toward $0.20, that zone could trigger a sharp reversal as those sell orders get filled. It’s one of the biggest threats to any near-term recovery.

Final Thoughts

Dogecoin’s chart still looks bearish, and sentiment isn’t exactly glowing. But behind the scenes, accumulation is picking up, retail buyers are nibbling, and on-chain activity is rising. If that trend continues, DOGE might squeeze out some relief — as long as it doesn’t collide headfirst with the massive selling barrier at $0.20.