- Dogecoin drops over 11% after hitting its yearly high, reflecting weakening market sentiment.

- Bearish divergence in technical indicators suggests a possible consolidation or further correction in the near term.

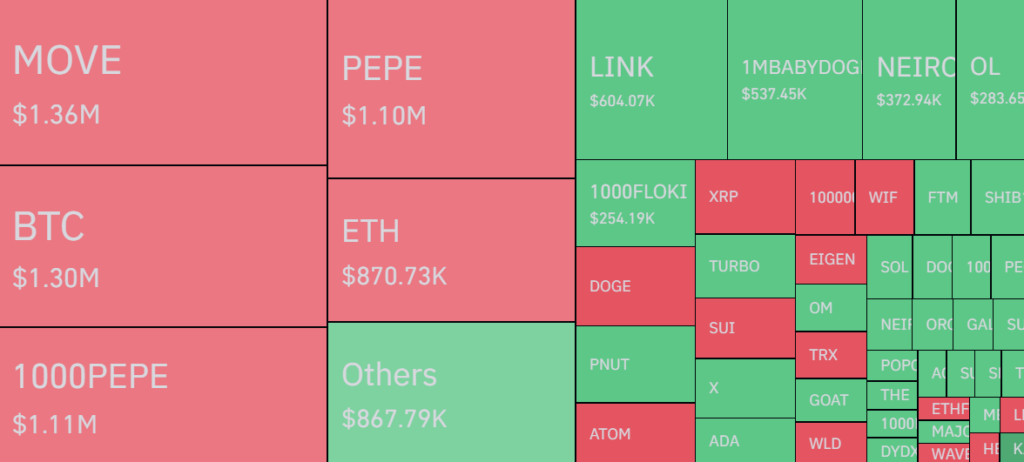

- Broader crypto market liquidation of $445 million adds to downward pressure on DOGE’s price.

Dogecoin’s price fell sharply on December 9, dropping by 11.6% to $0.428 after reaching a yearly high of $0.484 the previous day. This decline coincided with broader weakness in the cryptocurrency market, as Bitcoin slipped below the $100,000 mark and Ethereum struggled to hold gains above $4,000.

In the past 24 hours, the crypto market witnessed liquidations exceeding $445 million, with Dogecoin futures alone accounting for $25.42 million. The majority of these liquidations were long positions, reflecting overly optimistic market sentiment. Traders betting on Dogecoin’s continued rally were caught off guard when the broader market turned bearish, resulting in forced sell-offs.

Technical Signals Indicate Bearish Reversal

Dogecoin’s pullback was preceded by technical warnings, including a bearish divergence between its price and relative strength index (RSI). As the price climbed to higher highs since November 11, the RSI charted lower highs, signaling weakening bullish momentum.

Additionally, Dogecoin encountered resistance near the upper boundary of its ascending channel pattern. Although the memecoin briefly surpassed this level, long wicks on the candlesticks indicated limited buying interest.

As of December 9, Dogecoin risks further declines toward the 20-day EMA at $0.410, with a possible drop to the 0.236 Fibonacci retracement level at $0.391 if sell-offs persist. Dogecoin’s recent movements suggest a phase of consolidation or correction as traders reassess their positions in a volatile market environment.