- Dogecoin is up 5%, testing $0.21 resistance after shedding 35% over two weeks — but derivatives data shows weak conviction.

- Whale wallets offloaded over 740 million DOGE since mid-July, while open interest and funding rates remain muted.

- Technicals show signs of life with momentum indicators recovering; a break above $0.21 could open the door to $0.26 or higher.

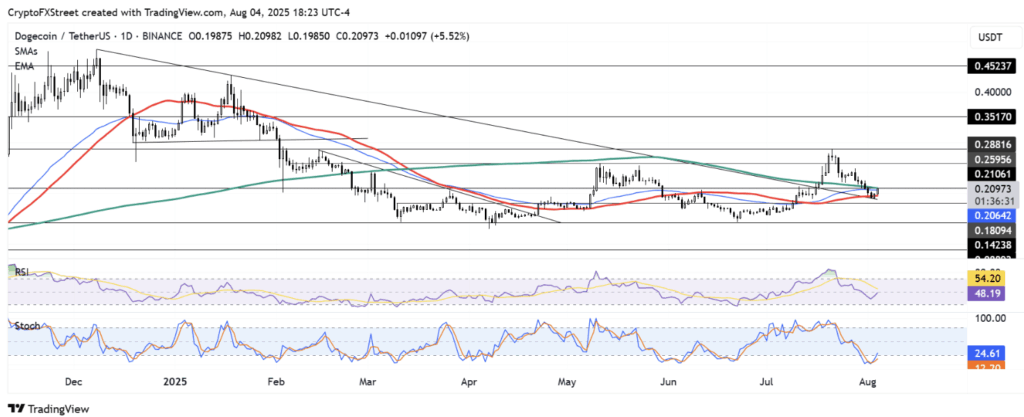

Dogecoin’s wagging its tail again. After a rough stretch that saw it slide more than 35% in just two weeks, the top memecoin is trying to claw its way back. On Monday, DOGE jumped about 5%, nudging right up against the $0.21 resistance zone — a level that’s proving pretty stubborn.

That said, even with this little pump, the broader picture still feels wobbly. Derivatives data and on-chain metrics? Yeah, they’re not super convincing just yet.

Derivatives Data Still Looks Weak — Whales Aren’t Helping Either

Despite Monday’s bounce, Dogecoin’s futures open interest has been sliding for a while now. From mid-July through early August, OI fell from 19.69 billion DOGE down to 15.36 billion. That’s not ideal if you’re looking for strong conviction behind a recovery.

And it’s not just futures cooling off. DOGE’s funding rates — which were running hot just a few weeks ago — have chilled out hard. Now they’re stuck near the floor, signaling weak bullish appetite from leveraged traders.

To make matters worse, big holders (a.k.a. DOGE whales with 10M–100M tokens) have been offloading. Since July 17, they’ve dumped more than 740 million DOGE, according to Santiment. Not exactly what you wanna see if you’re betting on a strong rebound.

Technicals Look… Kinda Promising?

Now for the slightly better news. DOGE has bounced off a major descending trendline that stretches all the way back to December 2024. That’s something. Right now, it’s knocking on the door at $0.21 — a level bolstered by both the 50-day EMA and the 200-day SMA. Break through, and it’s got a shot at flipping $0.26, maybe even making a run at that six-month ceiling near $0.28.

Momentum indicators are perking up too. The Stochastic Oscillator is lifting out of oversold territory, and RSI is flirting with the neutral 50 line. If both of those break higher, we might get some legit follow-through.

What Happens If It Breaks Down Again?

Still, it’s not all sunshine and rockets. If DOGE can’t hold support above $0.18, things could get ugly again. A failure here might send it back toward $0.14 — and that would erase most of the recent gains in a hurry.

For now, traders are watching closely. If the bulls can push past $0.21 and build momentum, this might not be just another bounce in a downtrend. But if resistance holds, the memecoin could be in for another leg down.