- Dogecoin surged 5% to $0.20 after Elon Musk’s X launched a marketplace for unused usernames, sparking speculation about DOGE payment integration.

- Open interest rose over 10%, but short traders still dominate, showing mixed sentiment in the derivatives market.

- Holding above $0.18 is key for bulls, with potential upside targets between $0.26 and $0.28 if momentum continues.

Dogecoin is back in the spotlight—again—thanks to Elon Musk. The meme coin jumped 5% to $0.20 on Sunday, October 19, right after Musk’s X (formerly Twitter) announced a new marketplace for unused usernames. Traders instantly started speculating that Dogecoin could be integrated into X’s payment system, sparking a surge in trading activity and open interest. Whether this hype leads to a full-on rally or another quick fade, well, that’s what everyone’s watching.

Musk’s Marketplace Ignites Fresh DOGE Hype

The new XHandles marketplace lets verified users purchase inactive usernames, a move that immediately caught the crypto crowd’s attention. Many traders think this could be a soft test for future crypto payments, possibly with Dogecoin in the mix. Musk’s long-standing connection with DOGE only adds fuel to that theory—after all, he’s been one of the token’s loudest advocates for years.

Interestingly, Musk’s involvement with Dogecoin even went as far as him being briefly appointed to head “DOGE,” a U.S. government oversight agency, earlier this year before stepping down in May. Though no official confirmation links Dogecoin to XHandles yet, the speculation alone was enough to give the market a jolt.

Derivatives Data Shows Traders Divided

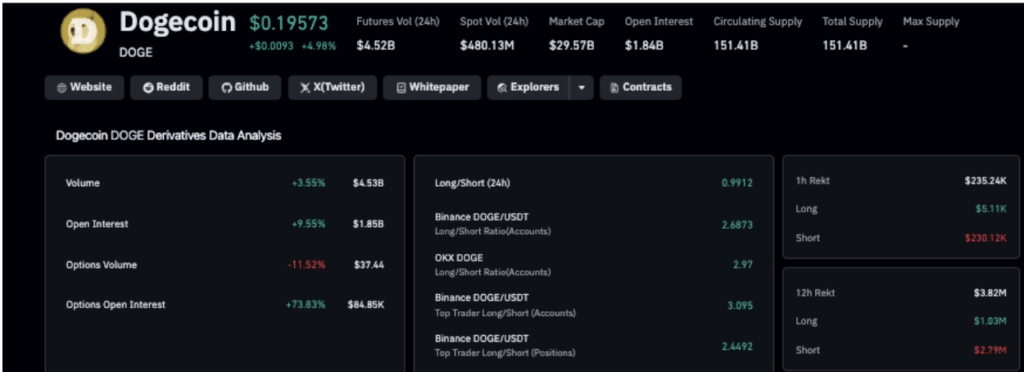

Despite the price bump, the derivatives market still looks conflicted. Data from Coinglass shows that open interest for Dogecoin spiked 10.6% to $1.9 billion, while trading volume rose 6.2% to $4.6 billion. That means traders are gearing up for action, but not everyone’s betting on green candles.

Around 70% of liquidations in the last 24 hours came from short positions, totaling roughly $3.3 million. Still, the long-to-short ratio sits close to 0.99, meaning bearish traders haven’t fully backed off yet. For now, bulls are cautiously testing resistance, while shorts seem to be betting that this rally might be temporary.

Can Dogecoin Hold Its Ground?

After falling nearly 35% from its early October peak of $0.27, Dogecoin finally found footing around $0.18 before bouncing back to $0.20. The Relative Strength Index (RSI) sits at 40.7, hinting at a slow recovery but not a confirmed trend reversal just yet. Trading volumes are steady but modest, suggesting the market’s still regaining confidence after last week’s massive $1.2 billion crypto wipeout.

If DOGE can break through $0.22, analysts believe it could rally toward $0.26–$0.28, aligning with upper Bollinger resistance. But losing the $0.18 support would likely reopen downside risk toward $0.16. For now, sentiment is cautiously optimistic—especially if Musk’s new X marketplace turns out to have Dogecoin payments in the pipeline. And if that happens… the dream of $1 DOGE might not sound so crazy after all.