• Bitcoin briefly surpassed $100,000 on Monday

• Bitcoin later retreated to $96,880

• The decline in Bitcoin’s value mirrored broader market trends, with major cryptocurrencies experiencing significant dips

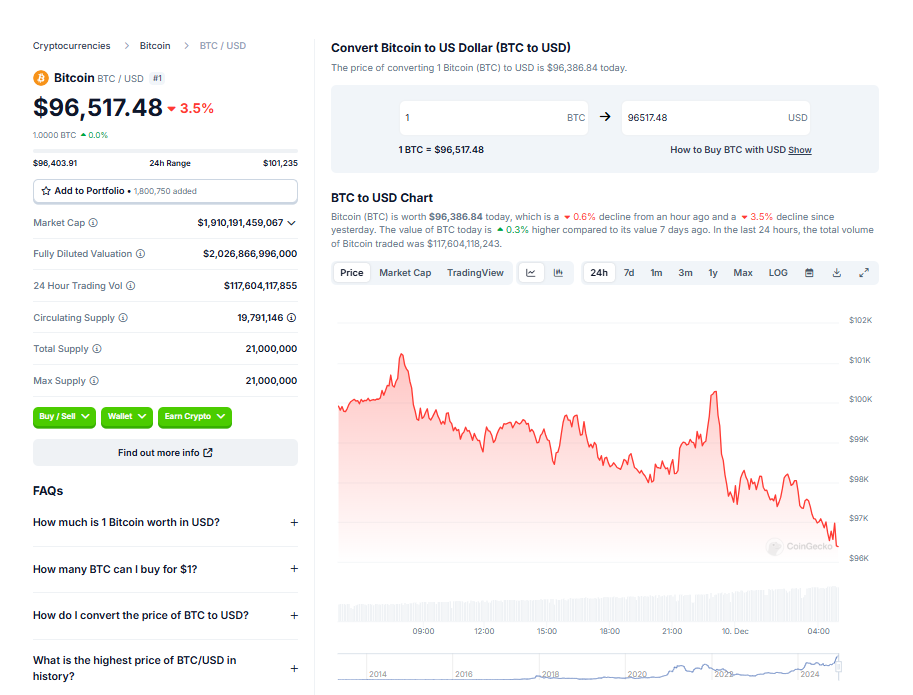

Bitcoin briefly reclaimed its six-figure position on Monday, surpassing $100,000, before retreating to $96,880 as of this writing. The decline in Bitcoin’s value mirrored broader market trends, with major cryptocurrencies experiencing significant dips.

Bitcoin’s Volatility Above $100K

Bitcoin reached a milestone on Monday morning, crossing the $100,000 threshold for the second time. However, the cryptocurrency quickly dipped, shedding 3% and stabilizing at $96,880. This follows last week’s all-time high of $103,679, achieved after Bitcoin surpassed its previous peak during Election Day when Donald Trump secured a second term.

The six-figure mark remains a psychological barrier, with fluctuations continuing to impact market sentiment.

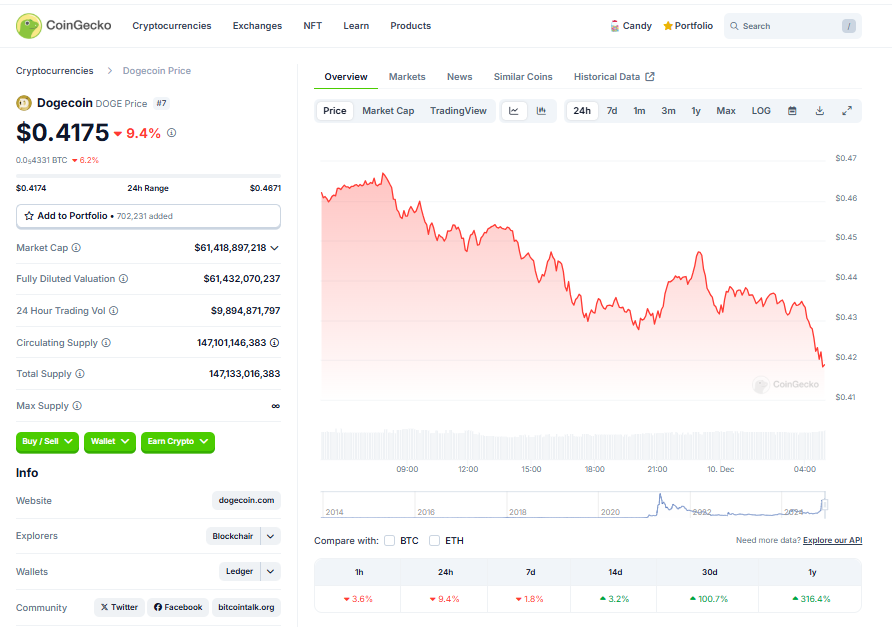

Dogecoin Cools After Three-Year High

Dogecoin (DOGE), the original and largest meme coin by market cap, also saw a decline, dropping 8% over the past 24 hours to $0.428. This comes after DOGE hit a three-year high of $0.48 over the weekend.

Despite the pullback, Dogecoin remains up nearly 1% for the week and an impressive 106% over the past 30 days, reflecting ongoing interest in the asset.

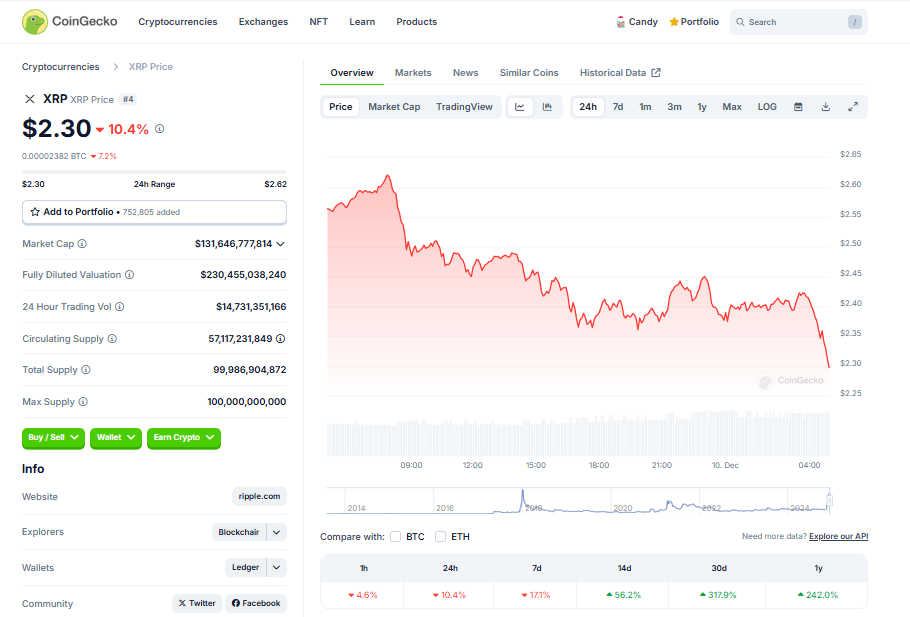

Ripple’s XRP Retreats After Seven-Year High

Ripple’s XRP experienced a similar trend, falling to $2.38 after peaking at a seven-year high of $2.82 last Tuesday. XRP’s price is down 14% for the week but remains up 333% over the past 30 days, highlighting its exceptional performance in recent weeks despite the recent slide.

Broader Market Declines Impact Top Altcoins

Other major cryptocurrencies also saw declines, with Solana (SOL) dropping 6% to just under $222, Ethereum (ETH) falling 5% to $3,786, and Avalanche (AVAX), Shiba Inu (SHIB), Chainlink (LINK), and Polkadot (DOT) each down approximately 9% in the last 24 hours.

These corrections underscore the overall volatility in the cryptocurrency market, as assets adjust after recent bullish runs.

Market Liquidations Reach $620 Million

The downturn in prices has triggered widespread liquidations across the market. Over the past 24 hours, long and short positions worth $620 million have been liquidated, with Bitcoin leading the way at $86 million, according to CoinGlass data.

Amazon Faces Pressure to Add Bitcoin to Its Treasury

In light of Bitcoin’s recent rally, Amazon shareholders, represented by a conservative think tank, have urged the retail giant to consider holding Bitcoin as part of its treasury reserves. A proposal dated December 6 suggested allocating at least 5% of Amazon’s assets to Bitcoin, citing the potential for preserving value in an inflationary environment.

Conclusion

The cryptocurrency market continues to display its characteristic volatility, with Bitcoin and major altcoins experiencing significant price swings. While assets like Dogecoin and XRP have cooled after reaching multi-year highs, broader market corrections and liquidation activity reflect the challenges and opportunities within this rapidly evolving space.