- Dogecoin broke above $0.25 after Bloomberg confirmed Rex Osprey’s DOGE ETF launch set for Friday.

- Futures open interest surged to $4.5B with trading volume up 22.7%, showing heavy speculative inflows.

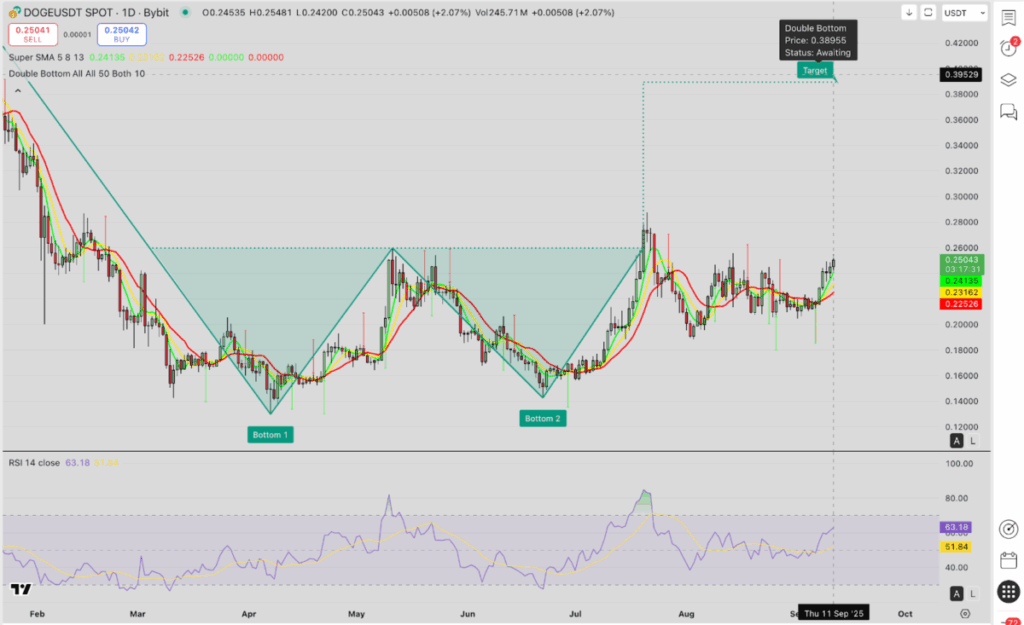

- Technicals suggest a breakout path toward $0.30–$0.39 if $0.24 support holds.

Dogecoin just woke up in a big way. The meme coin ripped past $0.25 for the first time in weeks after Bloomberg’s Eric Balchunas confirmed that Rex Osprey’s DOGE ETF—ticker DOJE—is set to launch this Friday. Traders didn’t waste time. Futures open interest exploded to $4.5 billion as speculators piled in ahead of the debut, setting the stage for what could be one of DOGE’s most bullish weeks in years.

ETF Hype Sends Traders Scrambling

DOGE’s 5% price jump wasn’t just another meme pump. The SEC’s green light on Rex Osprey’s filing gives Dogecoin the same institutional glow Bitcoin and Ethereum picked up when their ETFs launched. Historically, new ETF products mean inflows, more liquidity, and a surge of retail hype. This time is no different—big money’s already circling, and smaller traders are rushing in to front-run the ETF debut.

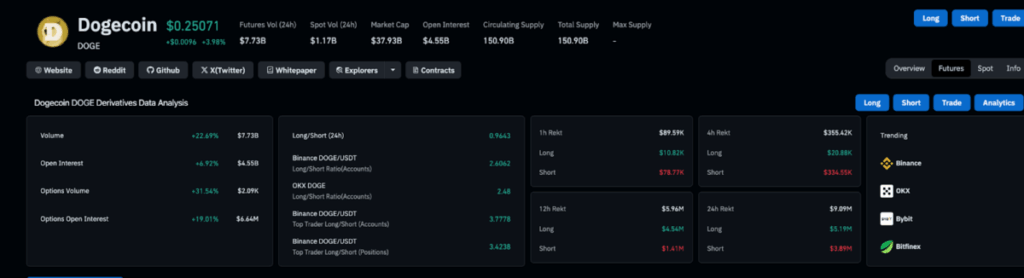

Derivatives Tell the Story

The real fireworks? In the derivatives market. Coinglass data shows open interest up nearly 7% to $4.5B in just one day, with trading volume spiking 22.7%. That means leverage is flowing in fast, often a sign of whales gearing up for a volatile move. It’s not just the spot price—traders are clearly betting on something bigger around Friday’s launch.

Technicals Point to a Breakout

From a charting lens, DOGE looks ready for more. The breakout above $0.25 completed a double-bottom reversal that’s been brewing since April. The neckline sits near $0.28, and clearing it could unleash a run toward $0.30–$0.32 before stretching as high as $0.39. RSI at 63 shows momentum is strong but not overheated, while short-term moving averages are lining up as support. Of course, $0.24 is the line in the sand—lose that, and bulls could see a quick fade back to $0.22.

DOGE hasn’t had this much momentum in months, and with ETF hype about to hit the main stage, the real question is whether Friday marks the start of a parabolic leg higher—or just another meme coin fake-out.