- DOGE trading volume dropped 33.5% in the past 24 hours, with prices slipping 3%, possibly due to a weekend lull and Bitcoin’s pullback.

- Whales accumulated 100M DOGE ($17.5M) and exchange outflows increased, suggesting less selling pressure, but on-chain metrics and user activity remain subdued.

- Despite long-term holders staying firm, retail participation and active wallet activity are low, signaling that DOGE may not be ready for a major rally just yet.

Dogecoin’s been in a bit of a cool-down mode lately. Over the last 24 hours, trading volume tumbled by 33.5% — and yep, it could just be one of those typical weekend slowdowns. Still, the price slipped about 3% during the same period, following Bitcoin’s mini slide from its $97.9k rejection. BTC dropped 2.4% in less than two days, dragging some of the broader market with it.

But here’s the twist: despite the red candles, whales are stacking DOGE. According to recent data, these big players scooped up 100 million tokens — worth around $17.5 million. That kind of accumulation doesn’t happen by accident.

There’s also been an uptick in DOGE leaving centralized exchanges, which usually means folks are moving their coins into cold storage. Historically, that’s often a bullish sign. Fewer coins on exchanges = less immediate selling pressure. That said, not all the metrics are flashing green just yet.

Long-Term Holders Stay Put, But Activity Lags

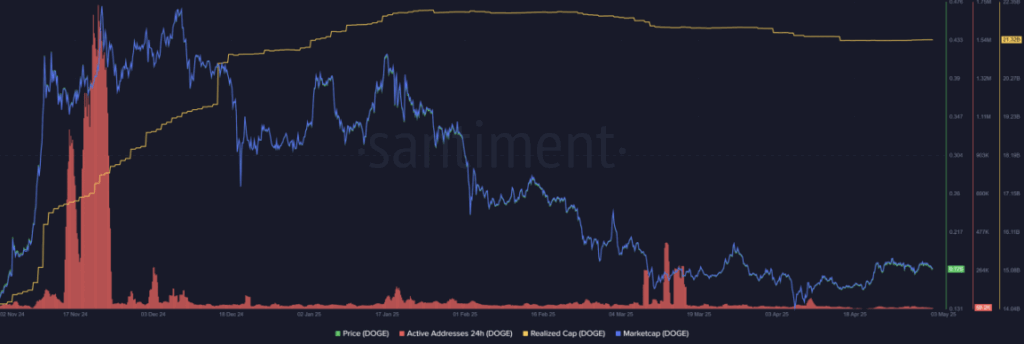

Zooming out a bit — since April 6th, Dogecoin’s market cap jumped from $21B to $26.4B. Not bad, right? Well, the realized cap (which tracks the value of coins based on the last time they moved) actually dipped slightly, from $21.5B to $21.3B.

So, what does that mean? Basically, a lot of the recent price movement might’ve been driven more by hype or short-term trades than actual on-chain value changing hands. If long-term holders (LTHs) had started dumping, we’d have seen a much sharper drop in realized cap — so it’s kind of a relief they’re staying put for now.

Wallet Behavior Is… Mixed

Looking at the wallet breakdown, addresses holding 100 to 1 million DOGE sold heavily around April 8th — and haven’t really gone back to buying. Meanwhile, bigger wallets (1M–10M and 100M–1B DOGE) have done a bit of accumulation, but nothing explosive. Those in the 10M–100M bracket? Just steadily offloading.

Oh, and Daily Active Addresses? They’re down big. Like, 96.6% off their November highs. That’s not exactly the kind of energy you’d want to see heading into a breakout.

Bottom Line: Not Quite Rally-Ready

So what’s the takeaway here? Well, it’s a mixed bag. Yes, whales are accumulating, and there’s been some decent outflows from exchanges. But low user activity, cautious mid-size wallets, and an overall quiet market suggest DOGE might not be ready for a full-blown rally just yet.

The fundamentals aren’t awful — but unless we start seeing more retail activity and stronger buying pressure, we’re probably in for more sideways action than fireworks. For now, patience is key.