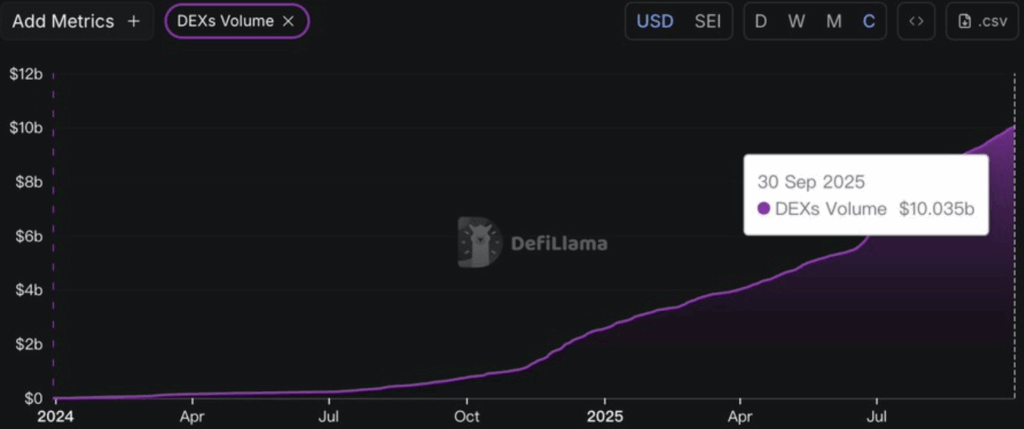

- Decentralized exchange volumes surged past $10 billion in September 2025, reflecting both retail and institutional growth.

- SEI price broke its long downtrend, with buyers defending support between $0.22–$0.26 and eyeing resistance at $0.38–$0.44.

- Risks remain if SEI fails to hold support, but the DEX boom and improving sentiment could fuel a sustained rally.

Decentralized exchange volumes have taken off, crossing $10.03 billion on September 30, 2025, according to DeFiLlama. At the same time, SEI has finally managed to break free from its drawn-out downtrend, hinting that market sentiment might be turning. Together, these moves paint a bigger picture: decentralized platforms aren’t just niche anymore, they’re starting to reshape how crypto trading actually works.

DEX Growth Signals Bigger Shift in Trading Behavior

The rise in DEX activity hasn’t been overnight. It’s been climbing gradually since mid-2024, after a pretty flat start earlier that year. But by early 2025, the curve really steepened, showing liquidity flowing in faster than before. Crossing the $10B mark signals not just retail traders playing around, but also bigger money coming in.

Part of this growth is because centralized exchanges are under heavy regulatory fire, and traders don’t like waiting around. DEXs give more transparency, faster execution, and self-custody — which is becoming a non-negotiable for a lot of users. With networks scaling better and costs dropping, it looks like decentralized platforms are finally moving from being “alternatives” to becoming main pillars of the market.

Institutions Bring Weight to DEX Volumes

It’s not just retail making noise either. Institutions have been showing up more often, and they bring in the kind of liquidity that drives parabolic growth. Big trades need deeper markets, and that seems to be what’s fueling this spike. Institutions also care about clean price discovery, which DEXs are slowly but surely improving.

Meanwhile, retail demand is still strong — people love the variety of tokens and the fact that you don’t have to depend on a middleman. This blend of institutional muscle and retail appetite is shifting the balance away from centralized platforms. If momentum keeps up, DeFi volumes might even cross $12 billion before the year closes.

SEI Price Breaks Out of Downtrend

On the other side of the charts, SEI has finally cracked above its descending trendline after months of boring sideways action. That’s usually a signal the tide is turning, especially when paired with the accumulation phase traders have been watching. These setups often build pressure for weeks before popping higher.

The chart highlights strong demand zones between $0.22 and $0.26, areas where buyers keep stepping in. As long as SEI holds above that band, bulls stay in control. If momentum builds, the next real targets sit around $0.38 to $0.44 — both zones that acted as resistance before. Still, it’s unlikely to move in a straight line; pullbacks are part of the process when a trend reversal kicks off.

Risks That Could Derail SEI’s Bounce

Of course, nothing’s guaranteed. If SEI slips back under its support levels, the breakout could fizzle and drop the token back into its old range. Traders will likely use those same levels as stop zones or invalidation points.

And while the growth in DEX volumes shows real confidence in decentralized platforms, market-wide volatility can still drag SEI down with the pack. Sustained upside will depend not only on how strong buyers are, but also on whether exchanges can keep scaling and managing liquidity without hiccups.