- David Sacks sold over $200 million in crypto-related assets before taking his role in the Trump administration, with at least $85 million directly linked to him.

- Trump remains heavily invested in digital assets, including his own memecoin $TRUMP, while Elon Musk and other officials also hold significant crypto stakes.

- Sacks emphasized that the U.S. Bitcoin Reserve will be funded through seized assets, not taxpayer money, as he continues to divest his remaining crypto holdings.

David Sacks, the Trump administration’s AI and crypto czar, offloaded over $200 million in digital asset investments—both personally and through his firm, Craft Ventures—before stepping into his role, according to a White House memo.

The documents reveal that at least $85 million of those assets were directly tied to Sacks himself. However, Craft Ventures still maintains stakes in funds holding digital assets, a detail noted by White House counsel David Warrington.

Dated March 5, the disclosure runs 11 pages long—far more detailed than the two-page filing from Robert F. Kennedy Jr., now the Secretary of Health and Human Services. Sacks’ decision to divest stands in stark contrast to others in the administration, where conflicts of interest have often been brushed aside.

Trump’s Crypto Ties Run Deep

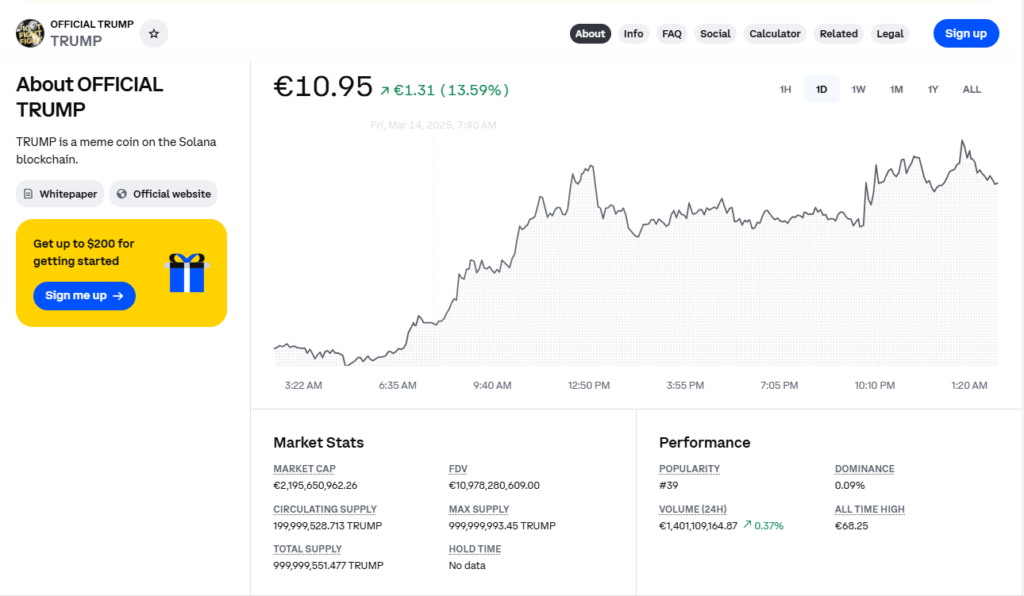

While Sacks was selling off assets to avoid potential conflicts, Trump himself remains heavily invested in digital finance. His stake in Trump Media & Technology Group, the parent company of Truth Social, is just one piece of the puzzle. Add to that multiple crypto ventures, including the launch of his own memecoin, $TRUMP, just days before taking office—through CIC Digital LLC, which still controls 80% of the token’s supply.

And he’s not the only one playing in the space. Elon Musk, a close Trump advisor, oversees SpaceX, social media platform X, and AI startup xAI—all while leading the so-called Department of Government Efficiency (DOGE). SpaceX alone has secured a $1.8 billion contract with the National Reconnaissance Office for a network of spy satellites.

Beyond Trump and Musk, several cabinet members reportedly hold significant crypto investments. Commerce Secretary Howard Lutnick, who recently left his position at Cantor Fitzgerald, has allegedly profited hundreds of millions from his firm’s dealings with Tether.

When asked for comment, neither Musk, the White House, nor the Commerce Department responded.

Sacks: Selling to Avoid the Spotlight

Sacks, best known for co-hosting the All-In podcast, addressed his asset sales in a recent episode, saying he offloaded his holdings “to avoid even the appearance of a conflict.”

His comments were a direct response to scrutiny from figures like Massachusetts Senator Elizabeth Warren, the top Democrat on the Senate Banking Committee. Warren, ahead of last week’s first-ever White House Crypto Summit, demanded that Sacks disclose any financial interests in Bitcoin, Ethereum, Solana, and other assets tied to Trump’s proposed Strategic Bitcoin Reserve.

The U.S. Bitcoin Reserve: A New Financial Play?

Trump’s executive order, signed on March 6, officially created a Strategic Bitcoin Reserve—excluding all other cryptocurrencies. Sacks emphasized that the reserve would be filled exclusively with assets seized in criminal and civil forfeiture cases, ensuring no taxpayer dollars are used.

Additionally, the order introduced a U.S. Digital Asset Stockpile, managed by the Treasury Department, to hold other confiscated cryptocurrencies.

Sacks’ Remaining Crypto Footprint

According to his ethics disclosure, Sacks and Craft Ventures liquidated all their liquid crypto assets, including Bitcoin, Ethereum, and Solana. They also sold positions in the Bitwise 10 Crypto Index Fund, Coinbase, and Robinhood.

Private investments were also on the chopping block—Sacks has begun exiting limited partner positions in crypto investment firms like Multicoin Capital and Blockchain Capital.

While a few crypto-related holdings remain in his portfolio, they reportedly account for less than 0.1% of his total assets. The memo describes their sale as “certain and imminent,” signaling that Sacks is wrapping up any lingering financial ties to the digital asset world—at least for now.