- Changpeng Zhao is pushing to dismiss FTX’s $1.8B lawsuit, arguing U.S. courts have no jurisdiction since the deal happened offshore.

- FTX claims CZ’s tweets triggered its collapse—his lawyers say the exchange was already a fraud before he said a word.

- Binance and two former execs also filed motions to dismiss, calling the lawsuit legally weak and blaming FTX’s own misconduct.

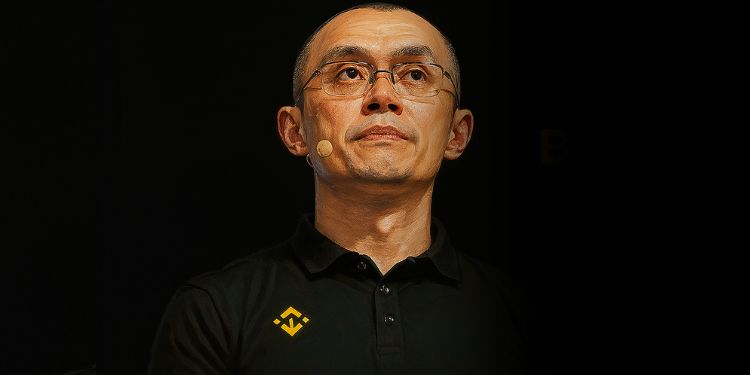

Former Binance CEO Changpeng Zhao isn’t backing down. He’s officially asked a Delaware bankruptcy court to toss out FTX’s $1.8 billion lawsuit against him and Binance, calling it all… basically nonsense. The core of his argument? He lives in the UAE, the transactions happened offshore, and—plainly put—American laws don’t reach that far.

The lawsuit, filed by FTX’s new legal team (aka the folks trying to clean up SBF’s mess), claims that Zhao and Binance received misused customer funds as part of a 2021 share buyback deal. But CZ’s lawyers argue he was just a “nominal counterparty”—he didn’t actually control or receive any of the crypto in question.

Offshore Deal, Offshore Jurisdiction

Zhao’s team laid it out clearly: every part of the transaction happened outside the U.S. The Binance entities? Based in Ireland, the Cayman Islands, and the BVI. The FTX-side? Alameda Ltd—also registered in the British Virgin Islands. Even the assets involved were digital: BUSD and FTT tokens, not USD.

His lawyers say the U.S. court just doesn’t have the reach to apply its laws here. “This isn’t Delaware’s problem,” they more or less argue. And because Zhao wasn’t the one transferring or receiving funds directly, they believe he shouldn’t be pulled into the mess Bankman-Fried left behind.

Social Media Drama Enters the Courtroom

FTX also claims Zhao stirred the pot on purpose—using X (formerly Twitter) to spark panic and trigger a bank run. Remember when CoinDesk dropped that bombshell report about FTX’s sketchy balance sheet? CZ followed it up with a tweet saying Binance was offloading all its FTT holdings. Not great timing for FTX.

Then came the brief announcement that Binance might acquire FTX… which, as we know, fell apart after due diligence. FTX now claims those posts helped tank their platform.

But Zhao’s camp says no way. They’re framing him more like a whistleblower than a saboteur—pointing out that FTX was already “a fraudulent enterprise” long before those tweets. His legal team says blaming CZ is like blaming someone for yelling “fire” in a burning building—after someone else lit the match.

Binance & Execs Push Back Too

CZ’s not the only one fighting the case. Two other ex-Binance execs—Samuel Lim and Dinghua Xiao—filed their own dismissal motions in July. Binance itself tried to get the whole thing thrown out back in May, saying FTX’s legal claims were “legally deficient” and rooted in corporate fraud, not anything Binance did.

For context, both Zhao and Sam Bankman-Fried have already faced criminal charges. CZ pleaded guilty to money laundering violations and served four months. SBF? He’s serving 25 years after being convicted of fraud and conspiracy. He’s appealing, with a hearing set for November 2025.