- Cypherpunk Technologies added $18M in Zcash, bringing its total holdings to 233,644 ZEC.

- The Winklevoss-backed firm now controls 1.43% of Zcash’s circulating supply.

- ZEC is up 140% in a month, with Cypherpunk sitting on 120% paper gains.

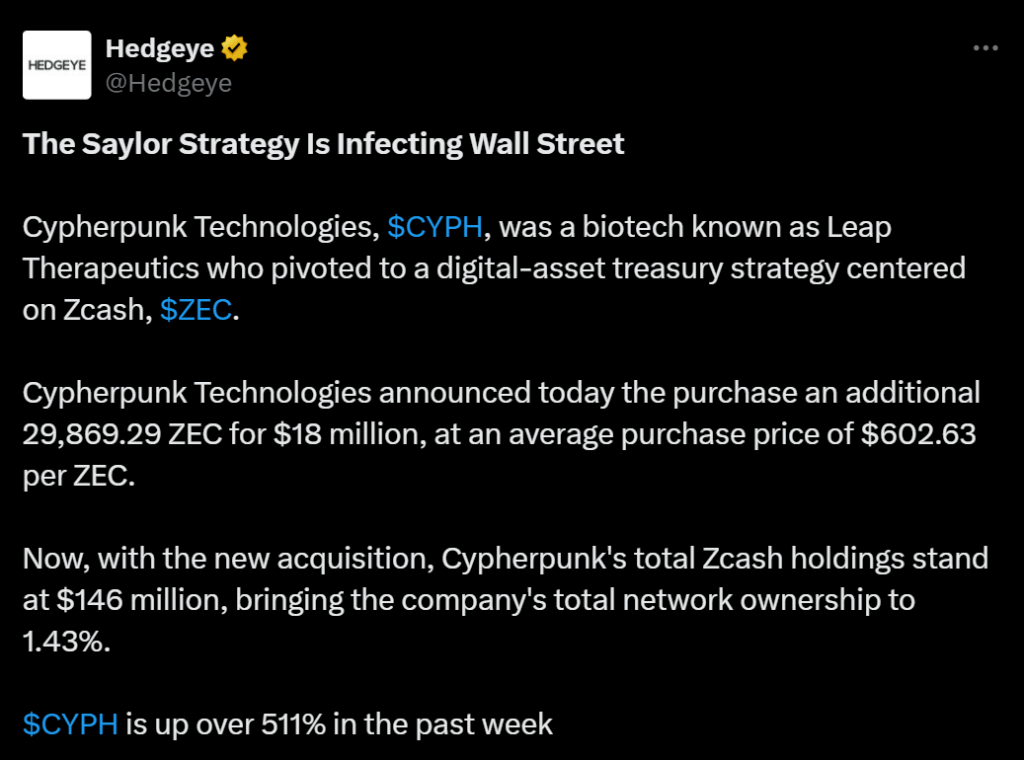

Cypherpunk Technologies (CYPH), the digital-asset treasury firm backed by Cameron and Tyler Winklevoss, has just expanded its Zcash position with an additional $18 million purchase. The firm acquired 29,869 ZEC at an average price of $602.63, raising its total holdings to 233,644 ZEC — now worth roughly $150 million. With this move, Cypherpunk controls about 1.43% of Zcash’s entire circulating supply, a massive stake that underscores its conviction in privacy-focused assets.

A Treasury Firm Built for Censorship-Resistance

Cypherpunk has made it clear that its strategy centers on holding “censorship-resistant” digital assets, and Zcash sits at the core of that thesis. The cryptocurrency uses zero-knowledge proofs to shield transaction details, offering privacy guarantees unmatched by most large-cap crypto assets.

Interest in privacy coins has been quietly returning in 2025, and Cypherpunk is positioning itself as one of the biggest institutional players in this niche. This latest purchase follows an earlier $50 million investment, meaning the firm is aggressively expanding its exposure as the market begins to rotate into assets with privacy and security narratives.

ZEC Price Pops as Cypherpunk Enters Accumulation Mode

ZEC surged more than 10% in the past 24 hours, reaching around $640, significantly outperforming the CoinDesk 5 Index, which fell 1% during the same window. The rally puts Zcash up an incredible 140% over the past month, even as most of the broader crypto market declined.

Cypherpunk’s timing has paid off: the firm now sits on 120%+ paper gains, thanks to its average cost basis of around $291 per token. With this buy, Cypherpunk is signaling it expects ZEC’s momentum to continue.

The Bigger Picture

This aggressive accumulation comes as privacy discussions heat up again in crypto and policy circles. While many institutions have gravitated toward transparent assets like Bitcoin and Ethereum, Cypherpunk is taking a contrarian approach — betting big on assets designed to thrive in a world where financial privacy becomes increasingly scarce.