- Bitcoin has struggled below $90,000, dragging sentiment across crypto-linked stocks

- Strategy remains one of the few crypto equities up in 2026 despite deep drawdowns

- Continued Bitcoin accumulation keeps MSTR tightly tied to BTC’s next major move

Bitcoin has had a rough opening to 2026, hovering around the $87,000–$88,000 range after briefly dipping to a new yearly low near $86,000. That weakness has weighed on broader crypto sentiment, leaving both digital assets and crypto-focused U.S. stocks under pressure. Analysts note that capital has rotated toward gold and other defensive assets, pushing crypto further down the priority list for many investors.

This environment puts companies with direct Bitcoin exposure in a sensitive position, especially as market confidence remains fragile and volatility persists.

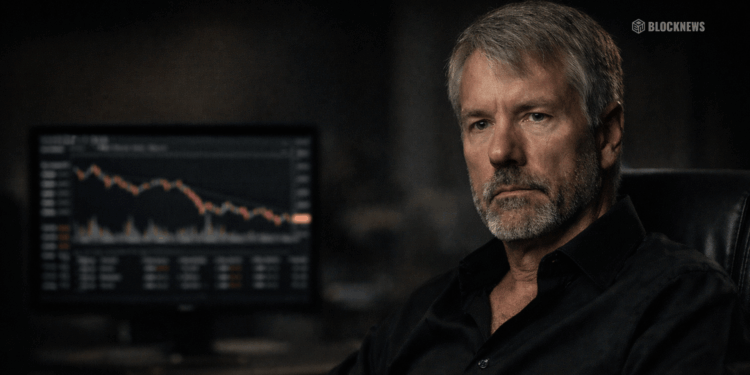

Why Strategy Stands Out Despite the Decline

Strategy has quietly defied the broader trend, posting gains of about 5% in 2026 even as its stock remains down roughly 60% over the past six months. The reason is simple: Bitcoin. With more than 700,000 BTC on its balance sheet, Strategy effectively trades as a leveraged proxy for Bitcoin’s long-term trajectory.

The company recently added $2.13 billion worth of Bitcoin, acquiring 22,305 BTC at an average price of $95,284. Earlier in January, it also purchased 1,283 BTC at an average of $90,391. Under Michael Saylor’s direction, Strategy has shown no intention of slowing its accumulation, regardless of short-term price swings.

What Could Act as the Next Catalyst

For now, there appears to be no immediate catalyst for Strategy beyond Bitcoin itself. The firm continues to frame BTC as a scarce, inflation-resistant reserve asset designed to outperform cash and traditional holdings over long time horizons. That conviction remains unchanged, even as Bitcoin trades well below recent highs.

Regulatory developments could eventually shift sentiment. Crypto-friendly legislation in the U.S. has already helped names like Strategy and Coinbase in recent months. Any further clarity or favorable policy could lift Bitcoin and, by extension, crypto-linked equities. Until then, Strategy’s fate remains closely tied to whether Bitcoin finds renewed momentum or continues to drift lower.