- Japan’s rising bond yields are driving a global repricing of risk.

- Tighter funding is pressuring equities and crypto alike.

- Bitcoin is behaving like a risk asset, signaling liquidity stress.

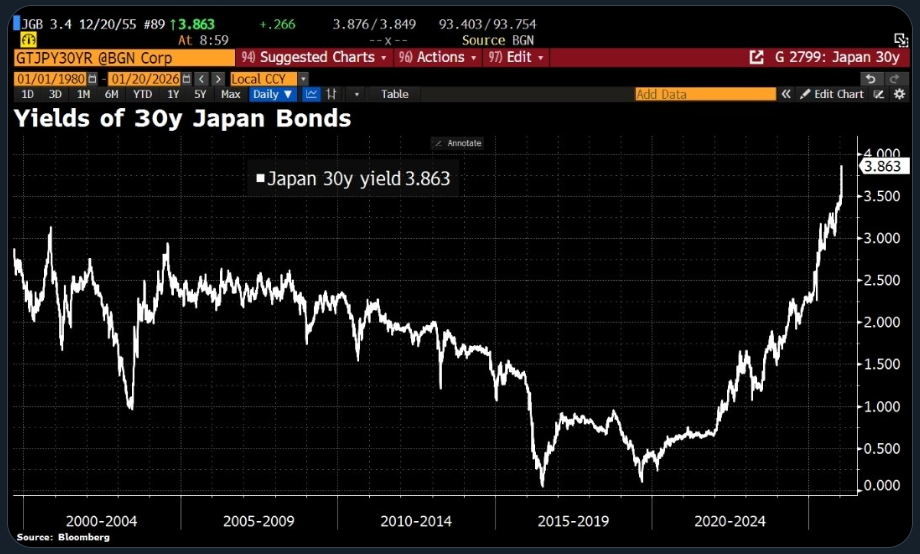

While headlines chase geopolitical flashpoints, the real pressure is building somewhere quieter. Japan’s bond market is pushing into territory not seen in decades, and that shift is forcing a global repricing of risk. For years, Japan carried massive debt under the assumption that near-zero rates would last forever. That assumption is breaking. As yields rise, the math behind equities, leverage, and speculative assets starts to change fast.

Why Japan’s Rates Matter Everywhere

This isn’t a local problem. Higher Japanese yields pull capital back toward safer returns, tightening funding conditions globally. Japanese equities feel it first, but the ripple doesn’t stop there. Global stocks soften, credit spreads widen, and risk appetite thins. This isn’t panic selling. It’s adjustment. Markets are recalibrating to a world where money isn’t free anymore, and those recalibrations tend to be messy.

Bitcoin Is Trading Like Risk, Not Protection

Bitcoin’s behavior in this environment is telling. In theory, it’s supposed to benefit when trust in systems erodes. In reality, during periods of funding stress, Bitcoin trades like a high-beta risk asset. When leverage unwinds and liquidity dries up, BTC is sold alongside equities. Gold benefits from fear tied to stability. Bitcoin reacts to conditions tied to liquidity.

Why This Matters More Than the Narrative

This isn’t a referendum on Bitcoin’s long-term thesis. It’s a reminder that different shocks produce different winners. Japan’s bond move is about rates, debt, and funding costs, not ideology or currency debasement. In that setup, liquidity rules everything. Bitcoin isn’t failing to protect — it’s signaling what kind of stress the system is actually under.

The Bigger Adjustment Underway

Japan is forcing markets to confront a reality they’ve avoided for years. Debt, rates, and gravity eventually meet. This moment isn’t about one country, and it’s not about one asset. It’s about a global system adjusting to tighter conditions. Watching Bitcoin’s reaction helps decode the stress. Right now, the problem isn’t belief. It’s liquidity.