- Bitcoin reaches an all-time high above $81,000, triggering $180 million in short liquidations

- Total liquidations surpass $682 million in 24 hours as traders face market volatility

- Increased retail activity following Trump’s win boosts market sentiment and trading volume

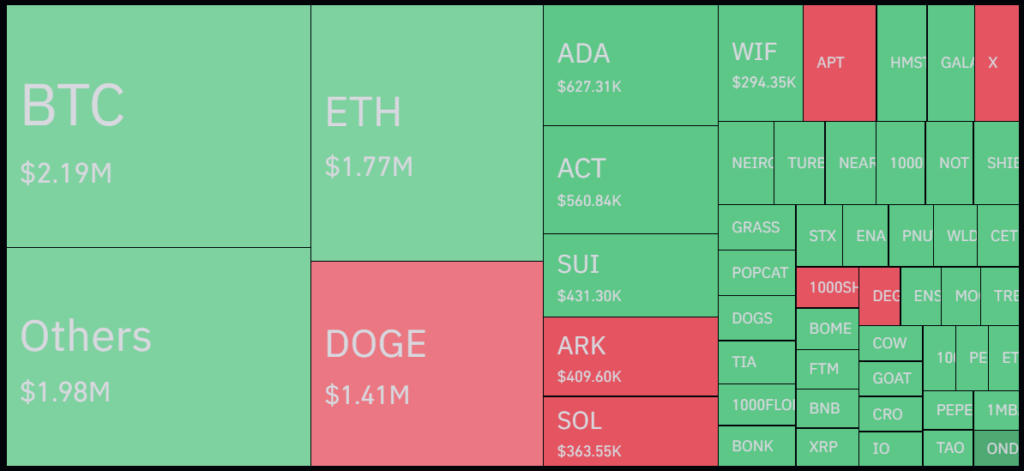

Bitcoin’s price surge to a record high of $81,358 on November 10 led to significant liquidations for traders betting on a market downturn. CoinGlass data reported that in just 12 hours, $180 million in short positions across the cryptocurrency market were liquidated, with Bitcoin shorters facing the heaviest losses.

Source: CoinGlass

Impact of Bitcoin’s New High

Bitcoin’s ascent past $81,000 followed Donald Trump’s recent election victory, sparking a 6% increase in the cryptocurrency’s value and intensifying liquidations. Traders holding short positions in Bitcoin saw the largest hit, with $67 million in losses. Dogecoin and Ether short positions followed, with liquidations of approximately $23 million and $21 million, respectively.

The surge in liquidations extended to long positions as well, with $256 million liquidated across the market. In total, over 218,000 traders’ positions were liquidated, amounting to $682.7 million, including both short and long positions. The largest single liquidation, valued at $15.6 million, occurred on OKX, where a trader swapped Bitcoin for Tether.

Retail Interest and Market Sentiment

Following Trump’s victory, Bitcoin’s market dominance climbed to over 59%, approaching levels last seen in April 2021. Market sentiment has been buoyed by pro-crypto election wins in the U.S., fueling a “Trump Effect” on retail investment, according to Caroline Bowler, CEO of BTC Markets. Bowler noted a 300% increase in user logins at BTC Markets, the highest in six months, reflecting a renewed interest from retail investors.

Onchain analyst James Check observed that Bitcoin’s recent move pushed it into a “Euphoria zone,” as it decisively broke past its previous all-time high. He highlighted that the extended period of price consolidation over recent months has provided a solid foundation for Bitcoin’s latest rally, suggesting a robust market setup for the cryptocurrency’s continued growth.