- Nearly $350 million in liquidations occurred on Nov. 3 as Bitcoin fell below $69,000

- Bitcoin’s price fluctuated sharply leading up to the U.S. presidential election

- Traders anticipate significant Bitcoin price movements depending on election results

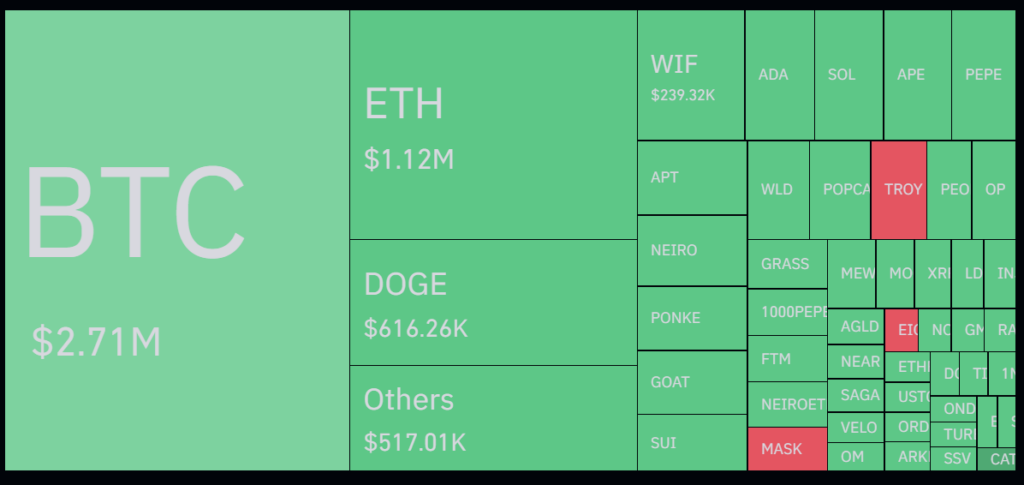

The cryptocurrency market saw significant liquidations on November 3, with total losses reaching $349.8 million as Bitcoin briefly dropped below $67,000. This marked the largest liquidation day since October 25, when Bitcoin’s rally past $70,000 failed to hold. Data from CoinGlass revealed that long positions accounted for $259.7 million, while short positions made up $90.1 million of the liquidations.

Bitcoin experienced notable volatility over the past week. Prices began at approximately $67,700 on October 28, peaked at nearly $73,300 on October 29, and then dipped to a low of $67,719 on November 3 before recovering to $69,145, according to CoinGecko.

Source: CoinGlass

Election-Driven Market Sentiment

The fluctuation in Bitcoin’s price comes amid narrowing odds in the U.S. presidential race between Donald Trump and Kamala Harris, tracked on Polymarket. Trump, who had maintained a lead, saw his winning odds decrease from a peak of 67% on October 30 to 56% as of November 3. This shift aligns with polling data from FiveThirtyEight, which shows the race tightening to a 0.9 percentage point lead for Harris.

The crypto community largely views Trump as a more favorable candidate for the industry. He has pledged to dismiss SEC Chair Gary Gensler and establish the U.S. as a global hub for cryptocurrency. Harris, on the other hand, has indicated support for a regulatory framework but has taken a more measured stance on the industry.

Bitcoin’s Potential Post-Election Moves

Speculation around the election’s impact on Bitcoin has grown, with some traders predicting a significant price surge to $100,000 if Trump wins. Conversely, analysts from Bernstein suggest a Harris victory could lead to a downturn in Bitcoin’s value by the end of the year.

Crypto trader Daan Crypto Trades noted that Bitcoin could move by at least 10% in either direction based on the election outcome, emphasizing the high stakes for market participants as the U.S. heads to the polls on November 5.