- Over $507 million in crypto liquidations occurred in 24 hours, with long positions accounting for $380M of that total.

- Ethereum led asset-specific liquidations at $112M, followed by Bitcoin at $52M and XRP at $49M.

- Despite the massive wipeout, BTC and ETH have held key trendlines, and analysts expect a short-term correction before a continued rally.

The crypto market has just taken a serious blow, with over $507 million in liquidations recorded in the past 24 hours, according to Coinglass. A staggering $300 million of that damage happened in just a four-hour stretch, primarily hitting overly bullish long positions. The sudden market downturn caught traders off guard as sentiment had shifted sharply into “Extreme Greed” territory on the Fear & Greed Index, leaving leverage-heavy longs vulnerable.

Long Traders Take the Hardest Hit

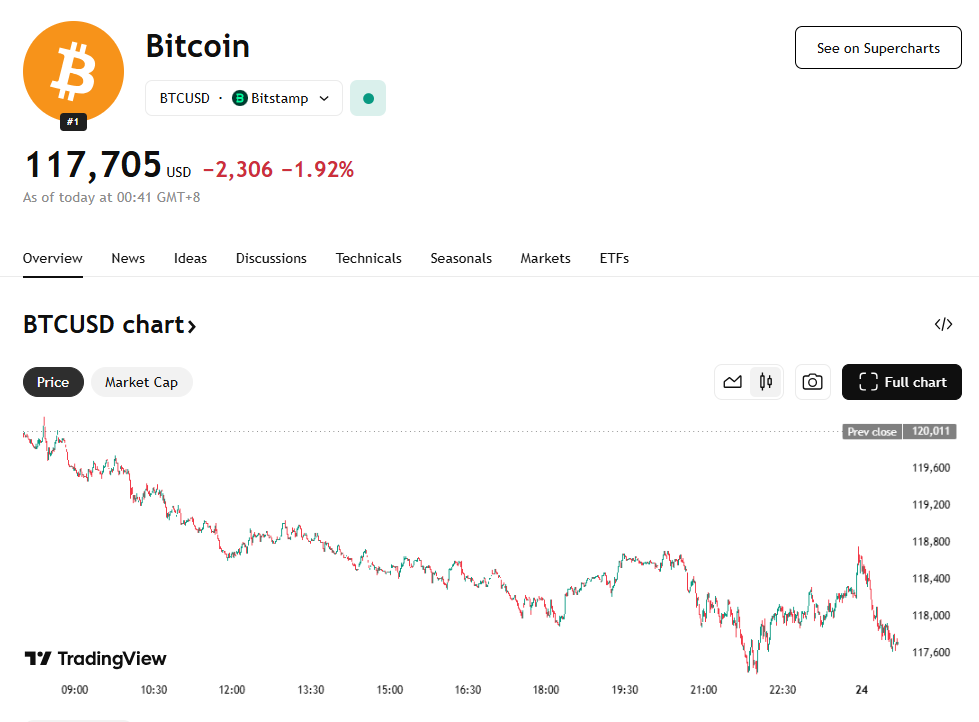

Long traders took the brunt of the hit, losing $380.66 million out of the total liquidations, while short positions accounted for about $126.98 million. The most significant single liquidation was a $3.97 million ETH/USDT order on Binance. Ethereum led the liquidation damage at $112 million, followed by Bitcoin with $52 million, and XRP with nearly $49 million. Interestingly, despite these sharp liquidations, Bitcoin only slipped by 0.37% over 24 hours, hovering near $117,800, while Ethereum and XRP also held onto decent weekly gains despite short-term pressure.

Bitcoin and Ethereum Show Resilience

Analyst Crypto Virtuos pointed out that Bitcoin’s recent sideways movement suggested a healthy pullback may be in play, possibly targeting the $113,000 region based on the 0.618 Fibonacci level.

Yet, he still believes the broader uptrend is intact, with a potential breakout to $138,000 in the cards. Ethereum, meanwhile, has slipped below critical psychological levels of $3,800, $3,700, and now $3,600, but still remains up nearly 13% over the past week.