- BlackRock filed for a Bitcoin-linked income ETF using a covered call strategy

- The fund blends direct BTC exposure with monthly income generation

- The move reinforces institutional demand for yield-focused crypto products

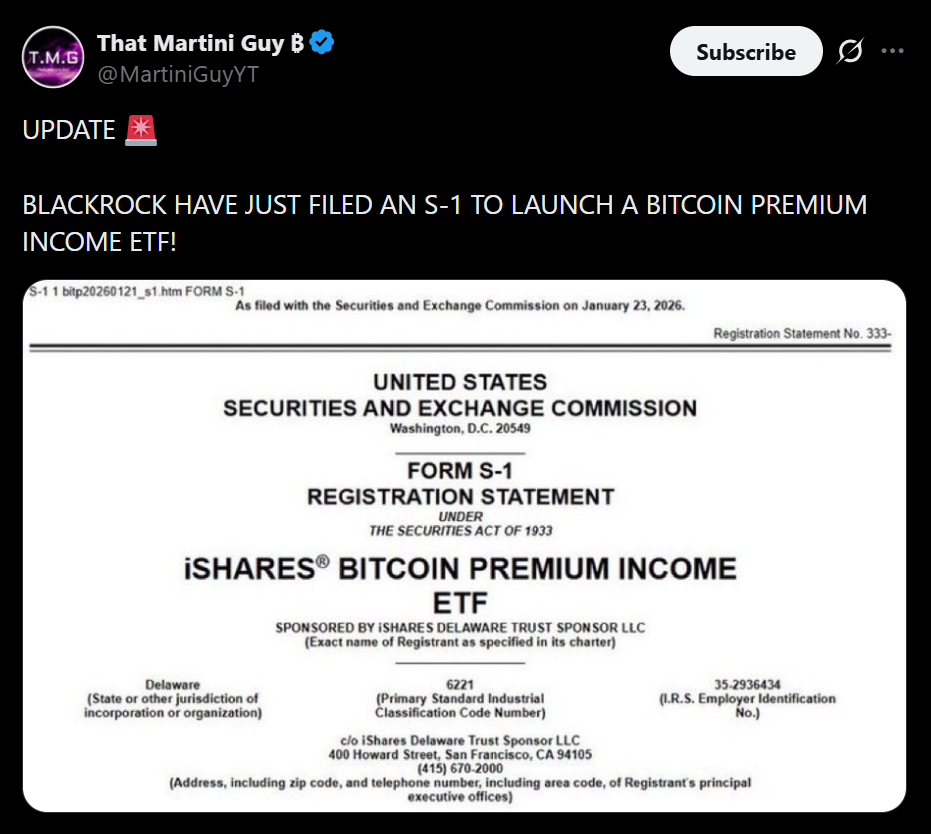

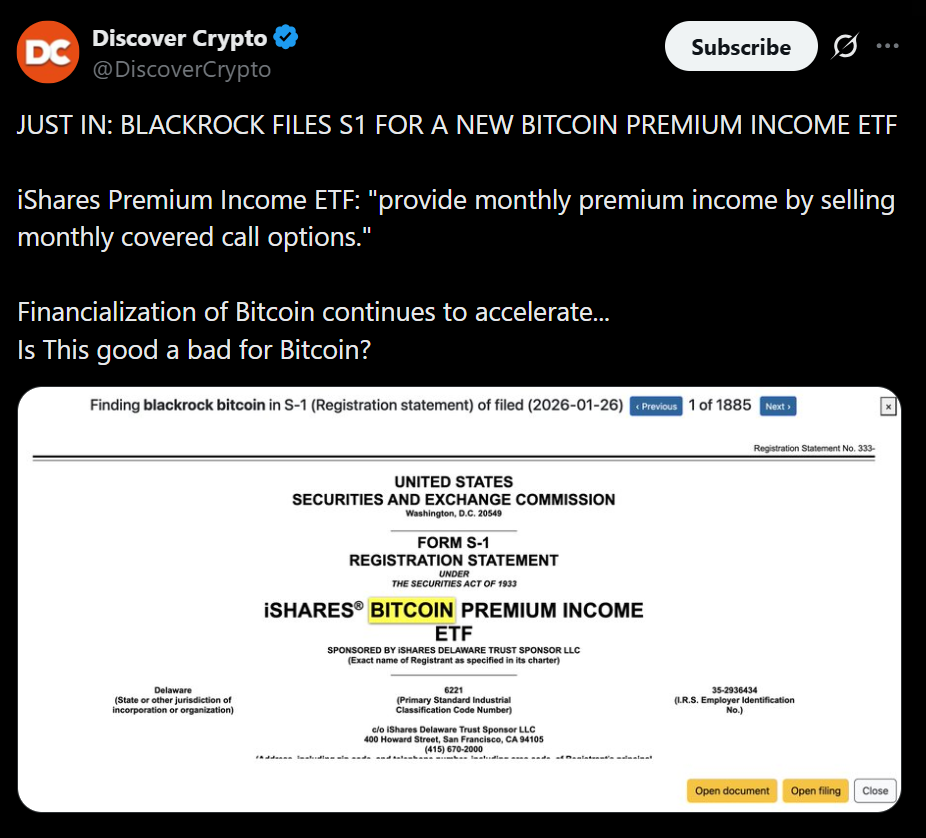

BlackRock has filed with the SEC to launch the iShares Bitcoin Premium Income ETF, a product designed to combine Bitcoin exposure with recurring income. Rather than tracking spot prices alone, the fund uses a covered call strategy to generate yield while maintaining directional exposure to Bitcoin.

The structure reflects growing demand from investors who want exposure to crypto without relying solely on price appreciation. In a market where volatility remains elevated, income-based strategies are becoming more attractive to institutions managing risk-adjusted returns.

How the Covered Call Structure Works

The ETF will hold Bitcoin directly, along with shares of BlackRock’s spot Bitcoin ETF, IBIT, and cash. Income is generated by writing call options, primarily on IBIT shares, allowing the fund to collect option premiums on a recurring basis.

This approach caps some upside during strong rallies, but it provides predictable income during sideways or choppy markets. For many institutional allocators, that tradeoff is acceptable, especially when Bitcoin exposure is already part of a broader portfolio.

Why This Matters for Crypto Markets

IBIT continues to dominate the crypto ETP landscape, with assets under management approaching $70 billion. By building a premium income product on top of that foundation, BlackRock is signaling confidence not just in Bitcoin’s long-term role, but in its ability to support more sophisticated financial strategies.

This filing also highlights how crypto products are evolving beyond simple price tracking. Yield, risk management, and portfolio construction are now central to how large firms approach digital assets.

Institutional Signal, Not a Short-Term Trade

The Bitcoin Premium Income ETF is not aimed at traders chasing short-term moves. It is built for long-term investors who want exposure, income, and structure within a regulated framework. That shift reflects how deeply crypto has moved into traditional asset management thinking.

As more products like this reach the market, Bitcoin’s role continues to expand from speculative asset to financial building block.