- SEC leadership supports limited crypto access in retirement plans under strict oversight

- Coordination with the CFTC aims to reduce regulatory gaps and failed products

- Lawmakers and regulators are shifting from opposition to controlled inclusion

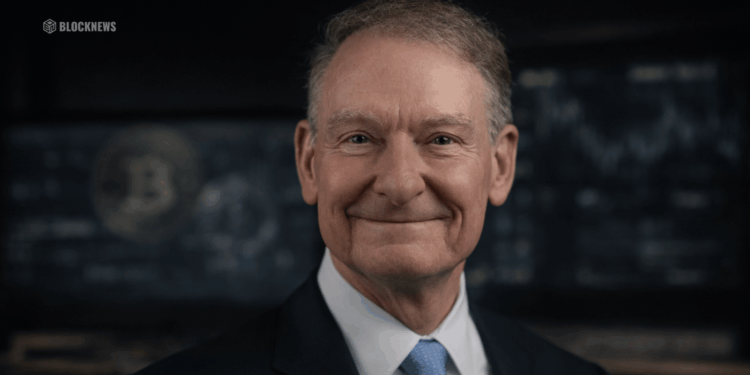

SEC Chair Paul Atkins has publicly backed the idea of allowing crypto exposure inside 401(k) retirement plans, as long as it’s done carefully and under professional management. This marks a notable shift in tone from years of regulatory skepticism. Rather than framing crypto as an all-or-nothing risk, Atkins positioned it alongside private equity and other alternative assets that Americans already access indirectly through pensions.

The emphasis here is not speculation. It’s structured exposure with trustees, managers, and clear limits designed to protect retirees from unmanaged risk.

Why Guardrails Matter More Than Headlines

Critics warn that crypto volatility could harm long-term savers, but Atkins’ point is that exposure already exists — just not transparently. The proposed approach would formalize access while placing it behind fiduciary oversight. That means portfolio allocation limits, professional risk management, and suitability checks, rather than self-directed gambling with retirement funds.

This is less about opening the floodgates and more about acknowledging reality in a controlled way.

SEC and CFTC Cooperation Changes the Equation

One of the most important takeaways is the renewed cooperation between the SEC and CFTC. Atkins described past regulation as fragmented and hostile to innovation, creating a dead zone where products failed before launch. That tone has clearly changed. Both agencies are now working together to help crypto products reach market within clear rules.

For retirement plans, that coordination matters. Trustees and plan providers need regulatory certainty before touching digital assets. Joint oversight reduces ambiguity and legal risk.

What This Means for Crypto’s Long-Term Legitimacy

If crypto is approved for inclusion in 401(k)s under professional management, it represents a structural shift. Retirement accounts are among the most conservative pools of capital in the financial system. Even limited exposure would signal that crypto has crossed from speculative asset to institutionally acceptable allocation.

This doesn’t guarantee inflows or price appreciation. But it does move crypto deeper into the financial core.

Conclusion

The conversation around crypto in retirement plans has moved from fear to framework. With SEC and CFTC leadership aligned on collaboration and guardrails, the path is opening for cautious, regulated access. That shift matters far more than short-term market reactions, because it speaks to where crypto sits in the future of U.S. finance.