- SEC Chair Gary Gensler accuses crypto exchanges of breaking the law by doing things that would never be allowed for traditional stock exchanges like the NYSE.

- Gensler claims crypto exchanges lack necessary disclosures and operate in violation of regulations.

- He says crypto tokens do not provide the required disclosures by law, taking aim at the broader crypto industry beyond specific offerings.

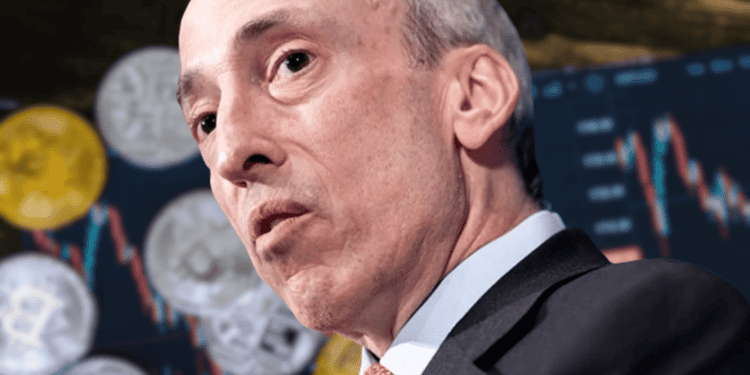

The cryptocurrency industry has had a tumultuous relationship with the SEC. SEC Chair Gary Gensler has continuously accused crypto exchanges of operating outside the law. In a recent CNBC interview, Gensler doubled down on these accusations, claiming crypto exchanges are “doing things the law would never allow NYSE or traditional exchanges to do.”

Gensler Targets Crypto Exchanges

In the CNBC interview, Gensler specifically called out crypto exchanges for their lack of disclosures and transparency. He stated that these exchanges are not providing the necessary information investors need, which goes against SEC disclosure rules.

Gensler also suggested crypto exchanges are trading against their own customers, something regulated stock exchanges cannot legally do. He argued that clearer oversight and regulation of crypto exchanges is needed to protect investors.

The SEC’s Stance on Crypto Regulation

The SEC has taken an aggressive stance on crypto regulation under Gensler’s leadership. This includes launching lawsuits against major industry players like Ripple and LBRY.

Gensler believes most cryptocurrencies are unregistered securities. He wants exchanges to register with the SEC to bring them under existing securities laws. This would require strict disclosure rules and prohibit exchanges from activities like proprietary trading.

The crypto industry has pushed back against this perspective, arguing digital assets should not all be classified as securities. Multiple bills are now working through Congress to provide regulatory clarity.

But Gensler shows no signs of easing up. He recently requested over $1 billion in additional funding from Congress to bolster SEC oversight of crypto.

The SEC’s hardline approach has stifled crypto innovation in the U.S. However, political momentum seems to be building for fair crypto regulation that protects investors while allowing new projects to thrive. Whether the SEC and crypto industry can find common ground remains to be seen.