Cronos (CRO) was trading above $0.068 with a bullish bias as bulls fought to defend the $0.065 support level. The $0.075 supply area is now acting as the primary resistance suppressing the Crypto.com token from moving higher. Crypto.com, a Singapore-based crypto exchange, has come under scrutiny from the crypto community following rumors that the company may face liquidity issues.

Crypto.com Has A “Strong Balance Sheet” – Kris Marszalek

Reports spread last weekend that Crypto.com mistakenly sent $400 million worth of Ether (ETH) to crypto exchange Gate.io in October. The revelation raised fears that users’ funds may be at risk at the exchange.

Another revelation by Lookonchain, an analytics company, showed that Crypto.com Bitcoin and Ethereum wallets have $2.68 billion worth of BTC and ETH. The analytic firm’s findings also revealed that the Krisk Marszalek-led company crypto reserves have more Shiba Inu (SHIB) than Ether.

According to the data, Crypto.com owns $531 million in SHIB and $446 million in ETH. It also holds its native CRO token worth $80 million. The data provided warned investors that the exchange’s assets pointed to low liquidity, saying:

“If you have funds on Crypto.com, please pay attention to the safety of your funds. They hold a lot of $SHIB and $CRO.”

Lookonchain also found it “very strange” that Crypto.com withdrew 50 million USDC from Circle and 210 million USDT from Binance before the reserve announcement.

Responding to these allegations, Crypto.com CEO Kris Marszalek reassured investors on Monday that the platform was doing “business as usual.” Addressing the crypto community in an Ask Me anything (AMA) YouTube session, Marzalek said:

“People are depositing. People are withdrawing. People are trading. There’s pretty much normal activity, just at a heightened level.”

Marszalek also said that Crypto.com had a “tremendously strong balance sheet,” absolving it from any engagements in the kinds of practices that led to the untimely collapse of Sam Bankman-Fried’s crypto empire last week.

The CEO also reassured clients that the crypto trading platform’s reserves were enough to cover all customer deposits. He also stated that the exchange’s exposure to FTX is less than $10 million, reassuring the community that Cronos is not used as collateral for loans. The exchange is also putting up a Proof-of-Reserves (PoR), which is expected to be released in the coming weeks and reinforce its client’s confidence.

Cronos Price Analysis

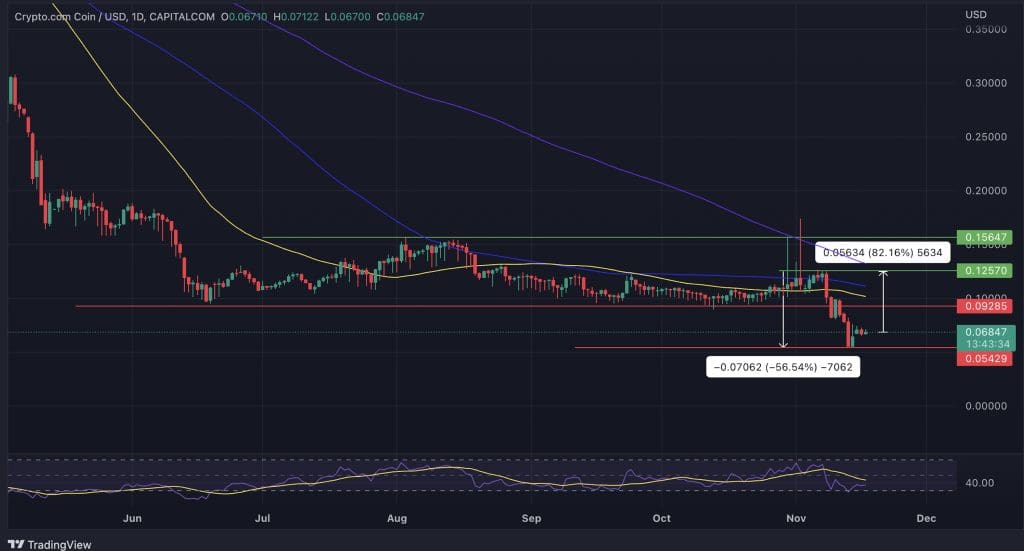

CRO lost 56% of its value after allegations hit crypto news headlines and social media platforms that the company behind the token, Crypto.com, could be facing liquidity issues. The ensuing sell-off saw the CRO price drop to all-time lows below $0.055.

After the Marszalek address, CRO surged 42% from $0.055 to brush shoulders with $0.075 on Tuesday. Rejection from this supply zone has since seen the CRO price retreat to lows of $0.067 on Wednesday.

At the time of writing, CRO was hovering around $0.0684, with a daily trading volume of $50.3 million. Cronos is down by 1.69% on the day and 20% off in the past seven days. CoinMarketCap currently ranks CRO at #29, with a live market cap of $1.76 billion.

Suppose the CEO’s remarks have conceived CRO investors. In that case, they may be bolstered to push the price above the immediate resistance at $0.075 or to the 50-day simple moving average (SMA) currently sitting at $0.1.

Beyond that, the following line of resistance would emerge from the 100-day SMA at $0.11 before making a run for the $0.125 range high. Such a move would represent an 82% climb from the current price.

Conversely, the Relative Strength Index (RSI) was positioned in the negative region. The price strength at 37 and the downfacing moving averages suggested that the price movement still favored the bears.

As such, the next possible direction for CRO would be down toward the $0.055 swing low. Traders could expect CRO to take a breather here before staging a comeback.