- A new prediction suggests XRP could surpass Ethereum’s market cap by 2026.

- Critics argue Ethereum faces inflation and centralization challenges due to Layer 2 growth.

- XRP’s fixed supply and payment-focused use cases are central to the bullish argument.

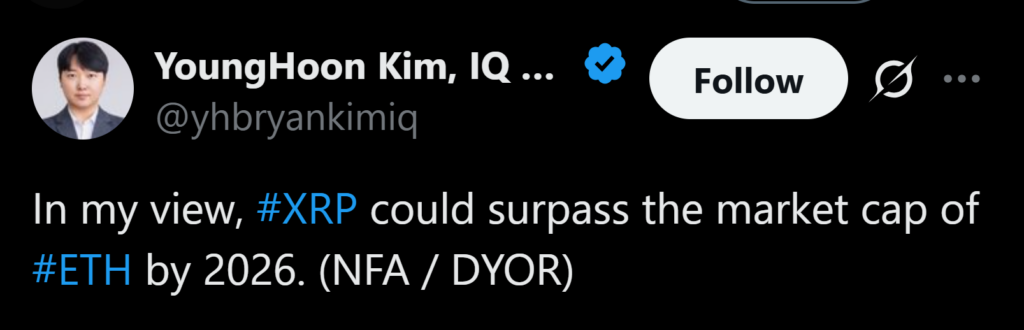

A bold claim is making the rounds in crypto circles after YoungHoon Kim, who publicly states he has an IQ of 276, suggested that XRP could overtake Ethereum’s market capitalization by 2026. In a social media post, Kim clarified that the comment reflected his personal view rather than financial advice, but the statement quickly sparked discussion. The idea of XRP challenging Ethereum’s long-held second-place position is controversial, though not entirely new.

Where Ethereum and XRP Stand Today

Ethereum remains the second-largest cryptocurrency behind Bitcoin, with ETH trading near $2,927 at the time of writing and a market capitalization of roughly $353 billion. XRP, meanwhile, is priced around $1.91 with a market value close to $116 billion. While the gap between the two assets is still significant, XRP’s supporters argue that structural differences could allow that distance to shrink faster than many expect.

Structural Concerns Around Ethereum

Similar arguments surfaced earlier this year from Austin King, a Harvard-educated engineer and co-founder of the Omni Foundation. In an interview on the Good Morning Crypto podcast, King claimed Ethereum faces deep structural challenges that could limit its long-term growth. He pointed to Ethereum’s shift away from a deflationary model, arguing that heavy usage of Layer 2 networks has made ETH inflationary again, increasing total supply instead of reducing it.

King also raised concerns around centralization, noting that many Layer 2 solutions are controlled by single operators. In his view, this undermines Ethereum’s decentralization and has contributed to slower progress, which he believes is reflected in ETH’s weaker performance relative to Bitcoin.

Why Some See XRP as a Challenger

By contrast, King described XRP as structurally simpler and more predictable. XRP has a fixed supply of 100 billion tokens, and while Ripple releases roughly 200 million XRP into circulation each month, he argued that the asset remains more stable than Ethereum. Use cases tied to cross-border payments and asset tokenization continue to anchor XRP’s narrative, especially as institutions explore blockchain-based settlement systems.

What Would It Take for XRP to Flip ETH?

For XRP to surpass Ethereum’s current market value, its price would need to rise sharply. King estimated that an XRP price around $6 could be sufficient to overtake Ethereum’s market cap, assuming ETH remains near current levels. Whether that scenario plays out depends on adoption, regulatory clarity, and whether Ethereum can address the concerns critics continue to raise.