- Core Scientific shareholders rejected a $9B all-stock merger with CoreWeave in a rare 2025 vote.

- The company’s stock rose 5%, trading above the proposed merger price at $21.99.

- Both firms plan to keep their commercial partnership alive despite the deal’s collapse.

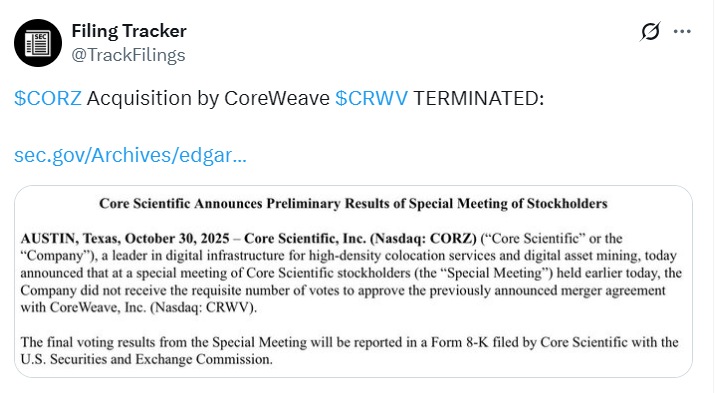

In a surprising twist, Core Scientific’s shareholders just voted down a massive $9 billion all-stock merger with CoreWeave, ending what could’ve been one of the biggest blockchain–AI deals of 2025. The vote, held on October 30, marks a rare moment of pushback in a year packed with crypto mergers and SPAC deals. Even more interesting — instead of crashing, Core Scientific’s stock actually jumped over 5% after the rejection, trading around $21.99, higher than the proposed buyout price of $20.40 per share.

Shareholders Say No

The deal, first announced in July, would’ve valued Core Scientific at roughly $9 billion, making it one of the largest cross-industry mergers in recent memory. But during the special shareholder meeting, CoreWeave failed to secure enough votes to push it through, according to filings with the SEC. While disappointing for some, others saw the move as a sign that investors weren’t ready to hand over control — especially with Core Scientific’s stock performing better than expected in recent months.

CEO Responds, Partnership Lives On

CoreWeave CEO Michael Intrator handled the defeat gracefully, saying the company respects the decision of Core Scientific shareholders and still plans to maintain its commercial partnership. “CoreWeave’s strategy remains unchanged,” he added. So, while the merger’s dead, the collaboration between both companies — particularly in data center operations and AI infrastructure — isn’t going anywhere. It’s more of a “see you later” than a full breakup.

A Break from 2025’s Merger Craze

The rejection stands out in a year that’s seen nonstop consolidation in crypto and tech. From CoinShares’ $1.2 billion merger with Vine Hill Capital to the Trump-backed American Bitcoin Corporation’s Nasdaq debut, most deals have flown through without much resistance. But Core Scientific’s shareholders just proved not every big offer gets a yes — especially when the company’s stock is already outperforming the buyout terms.