- Performance artist Connor Gaydos launched the satirical ENRON token, turning the infamous energy company into a crypto joke.

- ENRON’s tokenomics allocated 20% to presale investors with a short vesting period and 40% to the treasury and team.

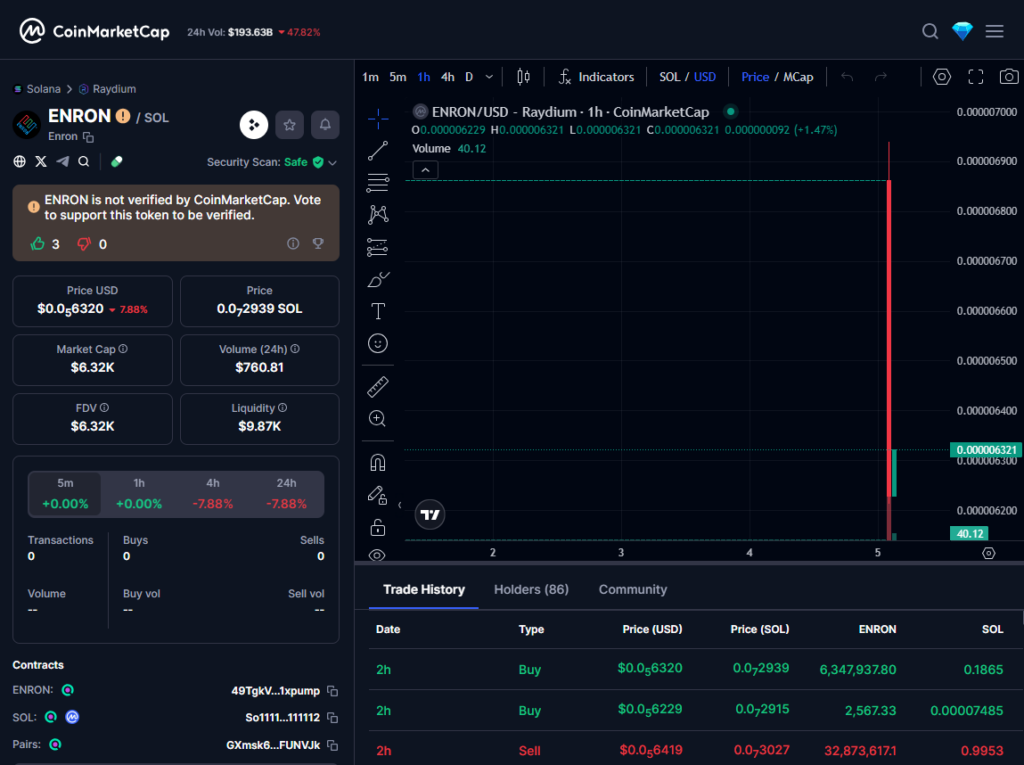

- The token surged to a $900 million valuation before crashing 70% to $250 million within 30 minutes of launch.

Less than a month after the launch of TRUMP, chaos and crime (sort of) have made their way back onto the scene—this time through satire. Performance artist Connor Gaydos has turned one of America’s most infamous energy companies, Enron, into a long-running joke, culminating in the launch of a new memecoin: ENRON.

Gaydos, known for his role in the “Birds Aren’t Real” parody movement, acquired Enron in 2021. He’s since transformed the brand into a satirical symbol, with today’s announcement of the ENRON token on the company’s official X account being his latest spectacle.

A Satirical Launch with ‘Enronomics’

The token’s launch featured a video of Gaydos delivering a deadpan pitch about Enron’s “big plans,” declaring, “$ENRON will be the fuel that powers this journey.” Behind the absurd humor, however, are aggressive tokenomics that have caught the market’s attention.

- 20% of tokens were allocated to early investors from a likely insider presale, vested for just seven days.

- The Enron Treasury and Team control 40% of the supply, vested over six months with a 180-day linear unlock.

This setup, dubbed ‘Enronomics,’ had the token launching at a $500 million valuation, soaring to $900 million within minutes—before crashing back down to $250 million in just half an hour, a 70% plunge.

Market’s Quick Reaction

The rapid price action raised eyebrows across the crypto world. Many speculate that the token’s structure was designed to drive hype and a sharp pump before a predictable sell-off. Still, as with all things tied to Gaydos, it’s hard to tell where the joke ends and the market experiment begins.