- Circle’s stock jumped 167% on its NYSE debut, reflecting overwhelming demand and raising over $1 billion.

- USDC’s rapid growth and institutional backing helped drive the stock’s strong performance despite crypto market volatility.

- Analysts say Circle’s IPO sets the tone for future crypto listings, especially as stablecoin regulation advances.

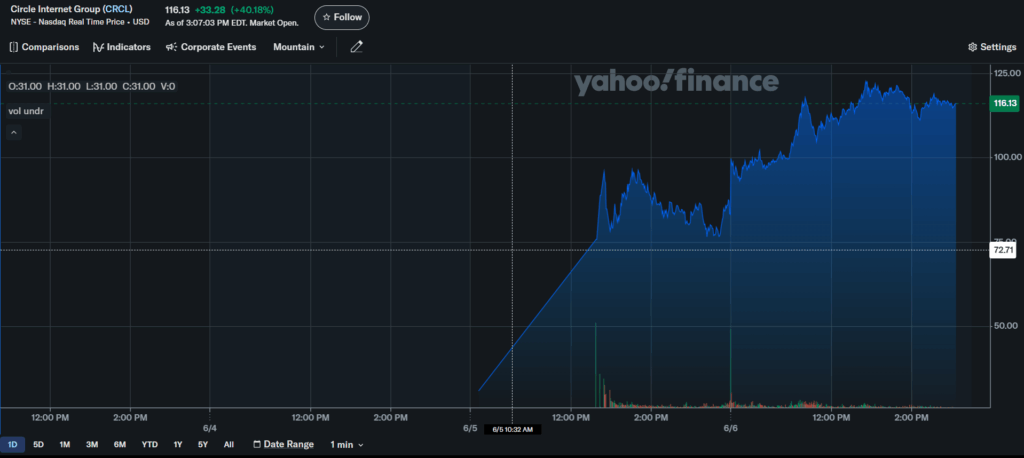

Circle made a thunderous entrance onto the New York Stock Exchange, with its stock soaring 167% from the IPO price of $31 to close at $82. Shares opened at $69 and hit a high of $103.75, underlining massive investor appetite for crypto-exposed equities. The demand was nothing short of astonishing—the offering was oversubscribed by a factor of 25, and Circle raised $1.05 billion, selling 34 million shares instead of the originally planned 24 million.

USDC Demand and Institutional Confidence Drive Surge

The buzz around Circle’s IPO wasn’t just hype—it reflects real institutional interest in stablecoin infrastructure. USDC, the stablecoin issued by Circle, commands a $62 billion market cap and grew 40% this year, significantly outpacing Tether’s 10%. This growth, alongside the backing of major players like Cathie Wood’s ARK Investment, helped propel the stock despite a broader dip in the crypto market. VanEck’s Matthew Sigel compared Circle to the hidden but critical “pipework” of the crypto economy, calling it an essential element of capital flow.

IPO Momentum Sparks Broader Crypto Market Optimism

Circle’s strong debut is being seen as a turning point for crypto firms aiming to go public. Analysts point to the firm’s resilience—stock gains held even as Bitcoin dipped—as evidence of growing market maturity. Ryan Rasmussen from Bitwise likened Coinbase to the Amazon of crypto and Circle to a focused bet on stablecoins, noting that investors will likely want both types of exposure. Meanwhile, ongoing stablecoin legislation could further enhance investor confidence.