- Chainlink introduced real-time U.S. stock and ETF prices on-chain, targeting tokenized finance growth

- LINK reserve balances increased sharply, signaling accumulation during infrastructure expansion

- Rising derivatives activity and holder growth point to increasing institutional and network participation

Chainlink has taken a meaningful step toward reshaping blockchain infrastructure with the rollout of real-time U.S. stock and ETF pricing on-chain. According to the project’s latest update, this move could unlock access to nearly $80 trillion worth of equity market data for decentralized finance. It’s a bold claim, but one that highlights just how large the ambition is.

By pulling traditional market data directly onto blockchains, Chainlink continues to carve out its position as a core data layer for on-chain financial products. For DeFi protocols, this means something pretty important, the ability to rely on live equity prices without building fragile workarounds or trusting off-chain intermediaries.

As tokenization gains momentum, dependable price data becomes non-negotiable. Products tied to settlements, derivatives, or synthetic assets simply don’t function without it. In that sense, this upgrade feels less like a feature release and more like foundational plumbing finally being installed.

LINK Reserves Show Signs of Accumulation

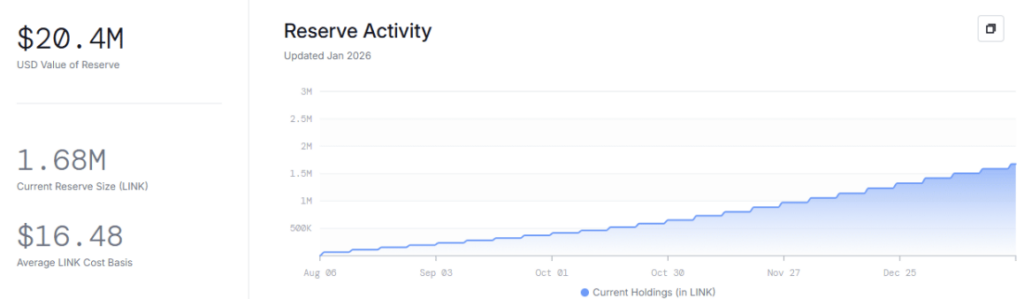

Alongside the infrastructure expansion, activity around LINK itself has started to shift. Reserve balances on the network jumped by nearly 88,846 LINK in just 24 hours. At the time of writing, total reserve holdings stood at roughly 1.67 million LINK, reflecting a steady and deliberate increase.

Historically, this kind of movement has pointed to active treasury management during periods of growing adoption. It’s often seen when infrastructure providers align resources ahead of long-term usage rather than short-term speculation. For LINK, the timing stands out, reserve accumulation is happening just as Chainlink broadens its role in tokenized finance.

It’s not loud accumulation, but it’s consistent, and those are usually the moves that matter later on.

Derivatives Data Suggest Growing Institutional Interest

Derivatives markets are telling a similar story. LINK’s Open Interest climbed to around $233 million, signaling rising capital engagement from traders and investors. Growing Open Interest typically reflects increased participation, not just price movement, but conviction on both sides of the trade.

What’s interesting is how closely this uptick lines up with Chainlink’s latest infrastructure rollout. Institutional players often wait for clear utility upgrades before increasing exposure, and this timing hints that LINK’s expanding role is being taken seriously. Over the long run, that kind of alignment tends to support price stability rather than short-lived spikes.

Holder Growth Adds Another Layer

Beyond reserves and derivatives, holder data paints a supportive picture too. The number of LINK holders has continued to climb steadily, reaching around 177,000 at last count. That slow, persistent growth suggests broader distribution rather than concentration.

Holder expansion often accelerates when adoption narratives start gaining visibility, and that appears to be happening here. More participants, more use cases, and more infrastructure usually reinforce each other, even if price doesn’t react immediately.

Chainlink’s Role Keeps Expanding

Taken together, the move into real-time equity pricing, the rise in reserve balances, increased derivatives activity, and steady holder growth all point to one thing. Chainlink’s relevance within the tokenized finance ecosystem is growing, quietly but consistently.

As the boundary between traditional markets and DeFi continues to blur, reliable data becomes the connective tissue holding everything together. That’s where Chainlink keeps showing up. And as long as that remains the case, its role as a backbone for on-chain finance is likely to stay firmly in focus.