- Chainlink price is compressing above the $12–$12.50 support zone as bearish momentum continues to fade.

- Development activity remains strong, supporting the case for accumulation rather than breakdown.

- A confirmed move above $15 would signal a structural shift heading into early 2026.

As the year winds down, the crypto market feels unusually quiet, but not in a boring way. Bitcoin and Ethereum are both stuck just below key psychological levels, grinding sideways instead of making noise. Chainlink is doing something similar, though its story is a little different. In a market where liquidity has stayed selective, LINK isn’t standing out for explosive upside, but for something subtler, its ability to stay steady near long-term support while others wobble.

Chainlink Price Tightens Around Key Support

On the daily chart, LINK is still trading beneath a descending trendline, so the broader structure hasn’t flipped bullish yet. That part is clear. What’s changed is the pace of the downside. Selling pressure has eased, and price has been holding above a well-defined demand zone between $12 and $12.50. Buyers have stepped in there more than once, and so far, they’ve held the line.

This has created a classic compression setup. LINK is squeezed between falling resistance overhead and flat support below. Price isn’t printing fresh lower lows anymore, which usually hints that sellers are running out of urgency. Momentum indicators echo that idea. The MACD is hovering near the zero line, no longer accelerating downward, while the DMI shows weakening trend strength. That combination points to consolidation, not continuation.

If LINK can close above the descending trendline and then hold above the $14.50 to $15 area, that would mark the first real structural shift in months. From there, the next resistance zone sits around $16.50 to $18. On the flip side, losing the $12 support cleanly would break the base and likely send price back toward the $10 to $11 region. For now, the range is tight, and the market is waiting.

Fundamentals Stay Quietly Strong

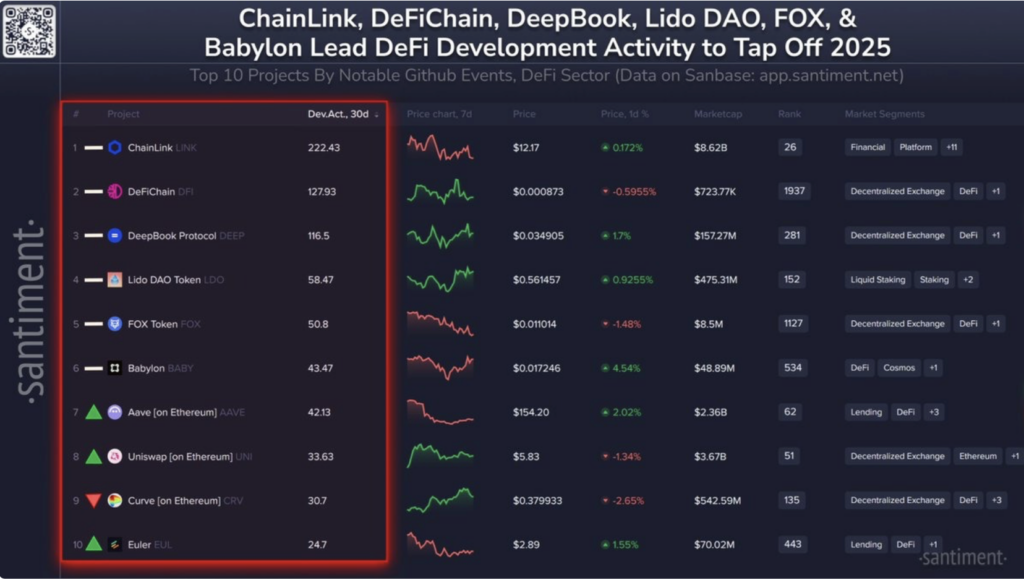

While price action compresses, Chainlink’s fundamentals haven’t slowed down. Data from Santiment shows that LINK ranked among the top DeFi projects for development activity toward the end of 2025, leading in notable GitHub events over the past 30 days. That’s not something traders always react to immediately, but it matters under the surface.

Ongoing development across Chainlink’s core infrastructure, including oracle services and cross-chain solutions, suggests the project is still very much being built out. Development alone doesn’t push price higher overnight, but it often supports accumulation phases, especially when price is sitting on major demand instead of breaking lower.

Is LINK Building a Base for 2026?

Chainlink isn’t in an uptrend right now, but it’s also no longer in free fall. The combination of price compression above $12, slowing bearish momentum, and strong developer activity suggests LINK is trying to form a base rather than extend its decline.

For traders, the roadmap is fairly simple. A sustained break above the descending trendline, followed by acceptance above $15, would significantly improve the outlook heading into early 2026. Until that happens, sideways movement remains the most likely outcome. In short, LINK is showing fundamental strength beneath technical pressure, and the next chapter depends on whether this quiet base can turn into a real breakout.