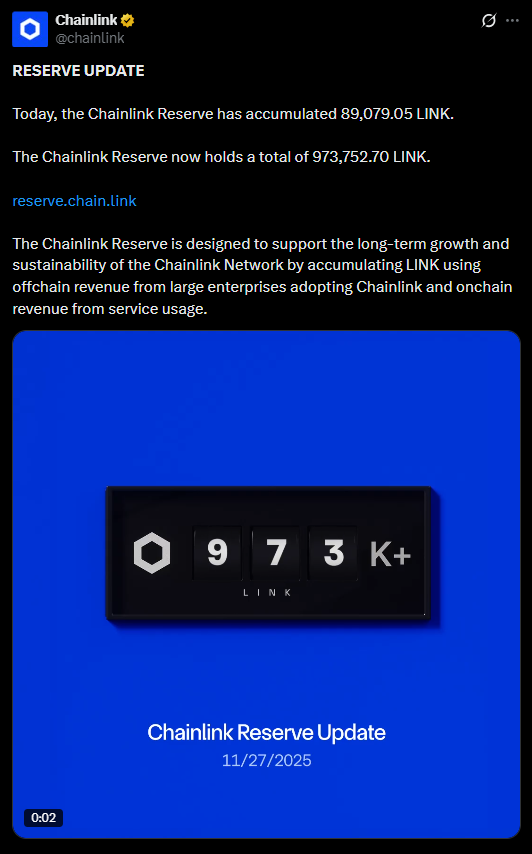

- The Chainlink Reserve has accumulated over 973,700 LINK and is close to hitting the one-million milestone.

- Revenue from off-chain and on-chain network activity is automatically converted into LINK and locked for years.

- Consistent deposits signal expanding enterprise usage and stronger long-term fundamentals for the Chainlink ecosystem.

Chainlink is closing in on a major milestone, with its on-chain treasury system now holding more than 973,700 LINK after a steady three-month accumulation streak. The network confirmed another deposit this week, bringing it within striking distance of one million LINK locked for long-term growth. The pace has been surprisingly consistent, reflecting how much activity continues to flow into Chainlink from both enterprise users and on-chain protocols despite the choppy market backdrop.

How the Autonomous Reserve Actually Works

The Chainlink Reserve isn’t a traditional treasury. It runs automatically through smart contracts that convert revenue—coming from off-chain enterprise payments and on-chain service fees—directly into LINK through decentralized exchanges. Once deposited, the tokens are locked for several years under a no-withdrawal rule, enforced by a timelock. It’s basically a slow-burn accumulation engine designed to keep LINK flowing back into the ecosystem over time, instead of letting revenue sit idle or get redirected elsewhere.

Adoption Continues to Fuel Steady LINK Inflows

A big part of why the reserve keeps growing is simply usage. Enterprises using Chainlink’s off-chain computation tools, data feeds, and cross-chain services contribute real payment volume. Meanwhile, on-chain products such as CCIP and automation continue generating fees that get directed into the reserve. Even in a softer market, usage hasn’t slowed, and those weekly deposits paint a picture of a network with rising real-world traction. Every new integration pushes more LINK into long-term storage, tightening overall circulating supply.

A Foundation for LINK’s Long-Term Stability

With the reserve nearing one million LINK, Chainlink is reinforcing its economic framework at a moment when many networks are still trying to define theirs. The multi-year lock mechanism pushes the project toward sustainability rather than quick liquidity, and that can help stabilize LINK’s market profile over time. Whether the pace of accumulation increases heading into 2026 likely depends on how quickly enterprise adoption scales, but the current trend suggests steady strength beneath the surface.