- Chainlink gained bullish momentum from SBI partnership, ETF filing, and U.S. government collaboration.

- Technicals show a breakout from the triangle pattern could push LINK toward $102.

- Key levels: $23.40 support, with $31 and $40 as near-term targets.

Chainlink (LINK) has been on the rise after a wave of positive news. The altcoin drew attention with a new partnership with Japan’s SBI Holdings and a bullish push from Bitwise’s Chainlink ETF filing. Both developments fueled traction in derivatives trading and boosted investor sentiment.

Adding LINK into the Chainlink reserve reinforced the network’s sustainability, while news of collaboration with the U.S. Department of Commerce to bring macroeconomic data on-chain drew fresh interest from institutions.

Chainlink Price Analysis: Triangle Pattern Points to $102 Target

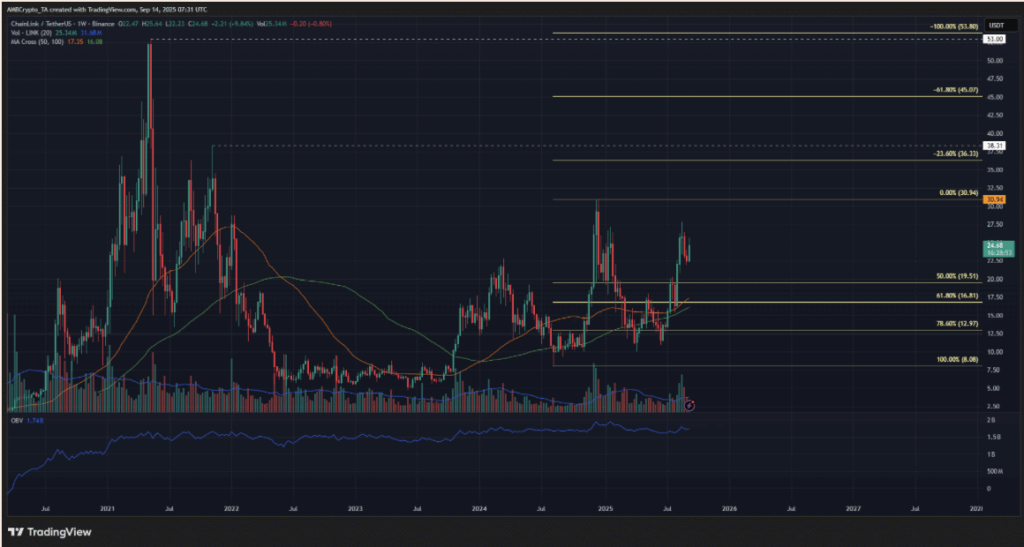

On the technical side, LINK’s long-term chart has formed a symmetrical triangle. Analyst Ali Martinez highlighted that a bullish breakout could send LINK parabolic, with a price target as high as $102 in the coming months.

Exchange data backed this setup, showing over 5.34 million LINK withdrawn within 24 hours. Such large outflows are often signs of accumulation, suggesting whales and long-term holders expect further upside.

Chainlink Weekly Chart: LINK Targets $31 and $40 Next

The weekly timeframe shows a bullish market structure in place since mid-2023, when LINK pushed above $8. Its run to $30.94 in 2024 was used to map Fibonacci extensions, which now highlight $36.33 and $45.07 as upcoming resistance levels.

Moving averages remain in bullish alignment, and OBV data shows consistent buying pressure. Together, these signals confirm a strong foundation for continued growth.

Chainlink Daily Chart: Key Support at $23.40 for LINK Bulls

On the daily chart, LINK displayed a bullish structure break with swing levels at $15.43 and $27.87, while $21.87 marked a minor low. To keep momentum intact, LINK must defend $23.40 as support.

If bulls hold this level, price action could extend toward $31 and possibly $40 in the near term, aligning with the broader bullish narrative.

Chainlink Price Outlook: Bullish Fundamentals and Technicals Align

With whale accumulation, strong technical setups, and major partnerships driving sentiment, LINK looks well-positioned for further upside. A clean breakout from its symmetrical triangle could mark the start of a larger rally, with $31 and $40 as realistic mid-term targets and $102 as a longer-term possibility.