- LINK price is testing key support at $17, with a potential path toward $30 if momentum returns.

- Chainlink’s CCIP is attracting major institutions like J.P. Morgan and Mastercard, driving bullish fundamentals.

- Sentiment is slowly shifting from bearish to neutral, hinting at possible accumulation phases ahead.

Chainlink (LINK) wasn’t spared from the latest wave of liquidations hitting the crypto market. The token fell by roughly 4% over the last 24 hours, with trading volumes hovering near $746 million. Despite this pullback, the overall structure still hints at potential strength if the right catalysts emerge.

Sergey Nazarov, Chainlink’s CEO, recently emphasized how tokenized assets are reshaping global currency markets. With over 1.5 million users active on Paul Baron Network, LINK’s fundamentals still carry weight. But the price action seems to be at a make-or-break moment.

Has LINK’s Price Structure Shifted?

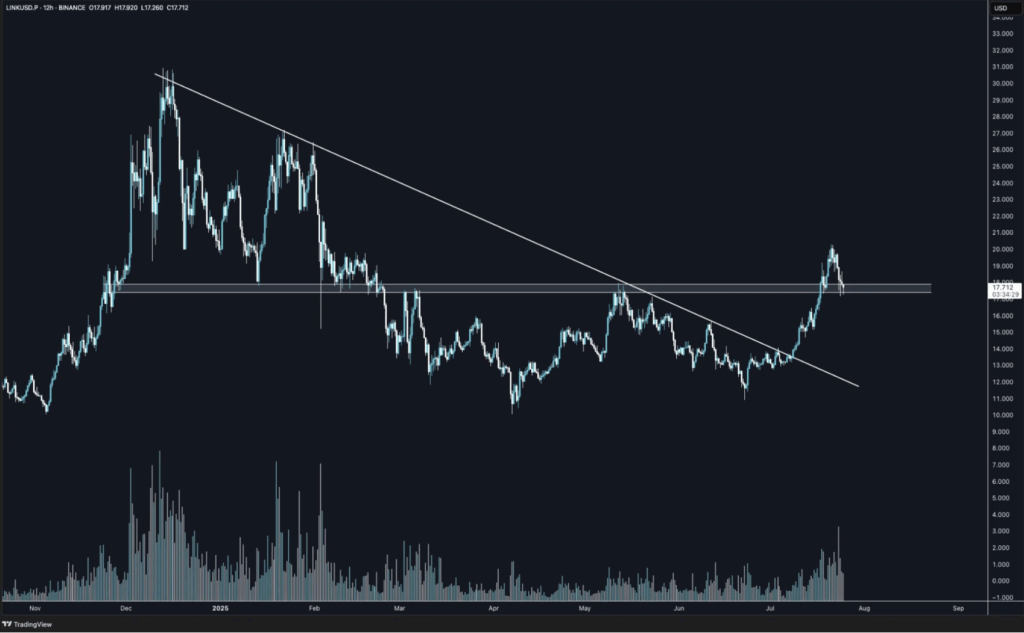

Chainlink recently broke through a long-standing trendline that’s been capping gains since the tail end of the 2024 bull run. Analysts suggest this dip might actually be a buying opportunity, possibly paving the way for a recovery above $20.

PostyXBT, a well-known crypto analyst, remarked on X (formerly Twitter), “But who is gonna bid this to new all time highs?” The sentiment reflects the need for strong narratives or institutional hype to push LINK beyond its previous peaks.

Currently, the price needs to hold its ground above the $17 support level for a chance to climb toward $30. A slip below could mean retesting the broken trendline, which isn’t necessarily bearish but signals caution. The structure still leans bullish, yet momentum feels fragile.

Chainlink’s CCIP and Institutional Adoption

The Chainlink Cross-Chain Interoperability Protocol (CCIP) is becoming a cornerstone of the tokenization narrative. It’s in the process of rolling out on major networks like Solana and Hedera, while also gaining traction with the traditional banking sector.

Key financial giants—Swift, Mastercard, J.P. Morgan, Euroclear, Clearstream, Franklin Templeton, and Fidelity International—are reportedly exploring integrations with CCIP. With these big names, 2025 could mark Chainlink’s most significant growth phase yet.

Notably, Chainlink dominates the decentralized oracle sector, controlling around 61% of the market share. The team is also pushing forward with high-profile appearances; Mark Raynes, Head of Solutions, is set to speak at Swift Community SIBOS 2025 alongside Goldman Sachs and Santander.

Sentiment Around LINK Price

Market sentiment for LINK is currently tilted slightly bearish but is showing early signs of a shift. Data from Market Prophit shows crowd sentiment at -0.62 and smart money sentiment at -0.51. While still negative, this suggests pessimism might be cooling off.

If LINK can reclaim strong levels above $20 and confirm this reversal, bullish momentum could accelerate. Until then, caution is the name of the game—but the institutional push from CCIP and the broader narrative of tokenization are strong tailwinds that can’t be ignored.