- Chainlink is struggling at the $12.5 resistance level, which used to act as support—failure to hold this level may trigger further downside.

- On-chain data shows increased exchange deposits, hinting at selling pressure, while no higher highs have formed since LINK peaked near $16.

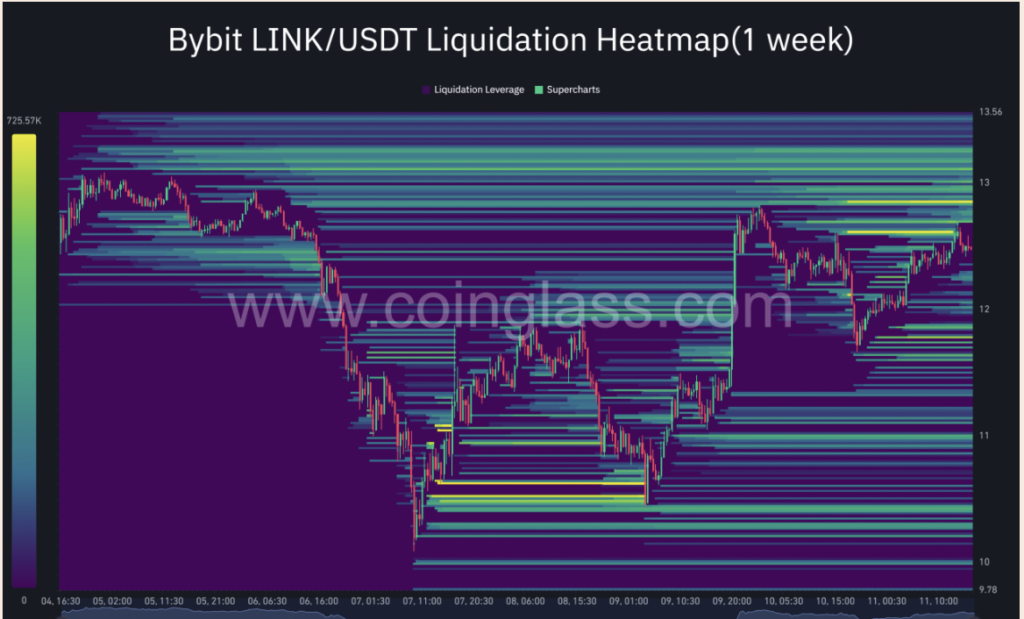

- Liquidation heatmaps reveal clusters near $10, suggesting that if LINK dips lower, it could cascade toward $7.5 due to long positions being wiped out.

Chainlink (LINK) hasn’t had the easiest week—after a string of daily red candles, the token is now hanging around a key resistance level near $12.5. Not too long ago, this same level was acting as solid support… but now? Not so much. The way things are shaping up, it’s looking more like a retest that might flop into resistance instead of a clean bounce.

So, what gives? Let’s break it down a bit.

Structure Looking a Little Shaky

For starters, LINK hasn’t been able to put in a higher high since it topped out near $16, and that’s never a great sign for the bulls. Price action hovering near the descending trendline—without much reaction or bounce—is showing weakness. It’s like the buyers showed up to the party late and didn’t bring enough energy to keep things going.

On-Chain Data? Eh, Not Super Bullish

If you were hoping that some behind-the-scenes data might tell a more optimistic story… not really. According to CryptoQuant, net deposits to centralized exchanges are ticking up just slightly above the 7-day average. That might not seem like a big deal, but it usually means more people are moving LINK onto exchanges with plans to sell.

And when that trend lines up with a weak technical chart? It tends to validate the bearish vibes.

Eyes on the $10 Trap Door

One more thing that could stir up trouble: liquidation heatmaps. There’s a nice fat cluster of long liquidation levels building up around $10. And if the price drops into that zone, you might see a wave of selling kick in, especially from leveraged traders getting wiped out.

Should that happen, the next likely stop could be around $7.50—that’s the level from Q4 last year where LINK found support before running higher.

The Bottom Line

- $12.5 is the make-or-break zone. If bulls can’t hold it, the next steps might not be pretty.

- Bearish on-chain signals + liquidation pressure = trouble.

- A break below $10 could trigger a waterfall to $7.5, especially if the broader market stays uncertain.

For now, all eyes are on that $12.5 level. If LINK can flip it and start building some momentum—great. But if not… buckle up.