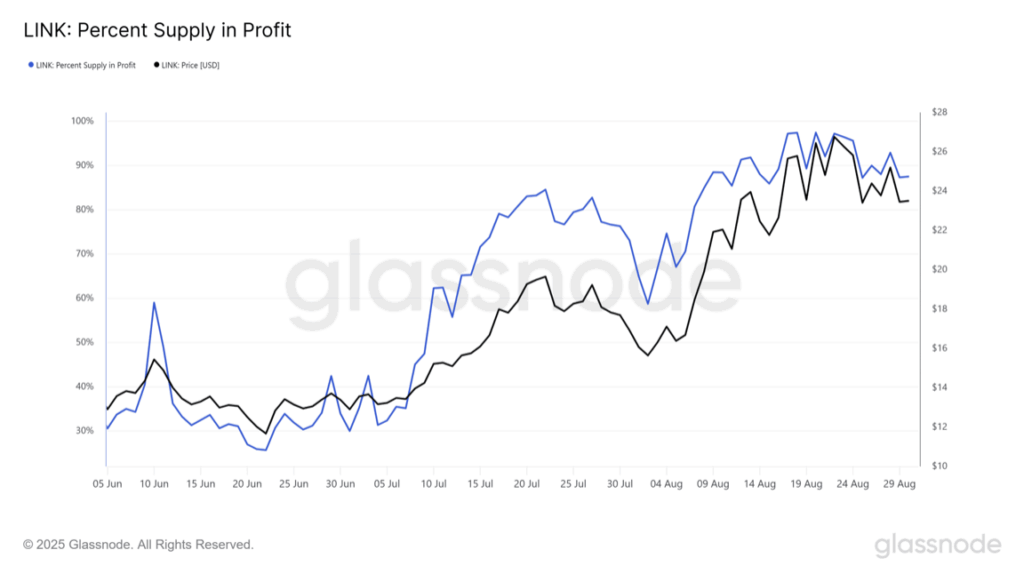

- 87.5% of LINK supply in profit → holders less eager to sell.

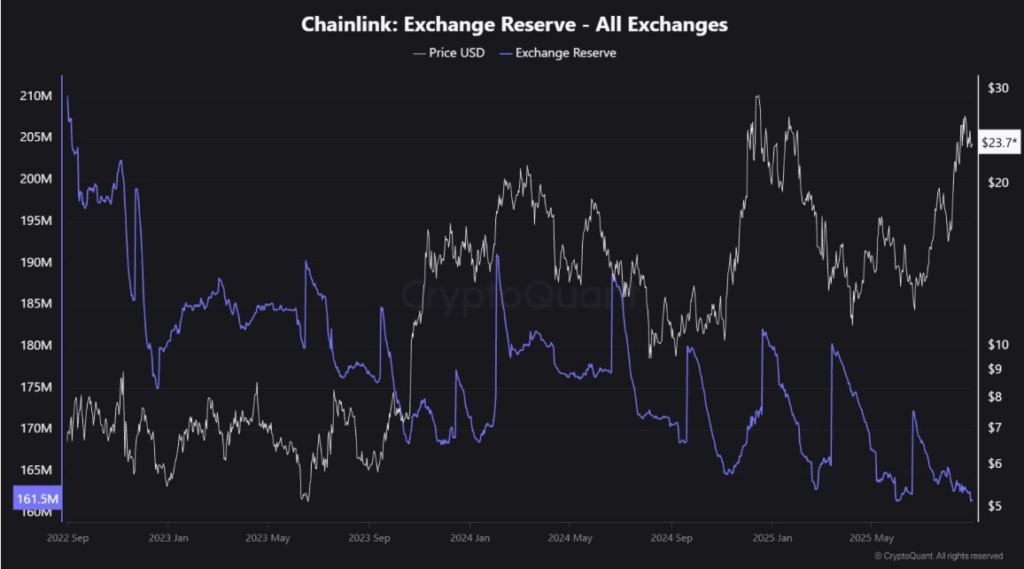

- Exchange reserves at multi-year lows → potential supply squeeze brewing.

- Consolidation near $23.5 → momentum cooled short term, but setup favors bulls if demand returns.

Chainlink feels like it’s sitting on the edge of something big. Almost 90% of its supply is now in profit, and at the same time, tokens sitting on exchanges have dropped to levels we haven’t seen in years. That combination usually sets up for fireworks. If demand even slightly picks up, the lack of sell pressure could send LINK sprinting higher.

Most Holders Sitting Pretty

Right now, about 87.5% of LINK’s circulating supply is in profit, per Glassnode. That’s a big jump since early July when the token was still below $15. Fast forward to today, and LINK has been trading above $25, leaving most holders comfortable with their bags. With little incentive to dump at these levels, it only takes new buyers to push the scales. That’s where momentum could flip from calm to breakout in a hurry.

Exchange Reserves Keep Shrinking

Here’s the kicker—exchange reserves are at a multi-year low, sitting at just 161.5M LINK, according to CryptoQuant. The steady bleed from mid-2023 onwards tells the story: coins are moving off exchanges, maybe to cold wallets, maybe into staking, but definitely not staying where they can be dumped quickly. Less supply on exchanges means tighter liquidity, and tighter liquidity often exaggerates price swings when demand flows in.

Momentum Pauses, But Setup Still Bullish

At the moment, LINK is consolidating around $23.58 after its August surge. The daily chart looks a little tired—price dipped below the 9- and 21-day SMAs, RSI’s sitting near 52, and the MACD just flipped bearish. Short-term weakness, sure, but nothing that breaks the bigger picture. As long as LINK holds above $23 and reserves keep draining, the market remains primed for another leg up once buyers step back in.