- Chainlink has increased its reserve holdings by 377% since Q4 2025

- On-chain fees reached record highs, signaling strong network usage

- Price weakness may reflect market sentiment rather than deteriorating fundamentals

Supply squeezes have a habit of showing up late, but when they do, they tend to matter. From a purely technical angle, locking away a chunk of total supply naturally pushes the value of each remaining unit higher. Add rising demand to that equation, and you’ve got the ingredients for a scarcity-driven move that can surprise people.

It’s not just about charts and math, either. Supply shocks often strengthen holding conviction. When tokens are being pulled out of circulation, it reinforces the idea that someone, somewhere, sees long-term value. The question right now is whether Chainlink’s recent accumulation actually supports that thesis, especially given how weak LINK’s price action has looked.

Chainlink Quietly Tightens Supply

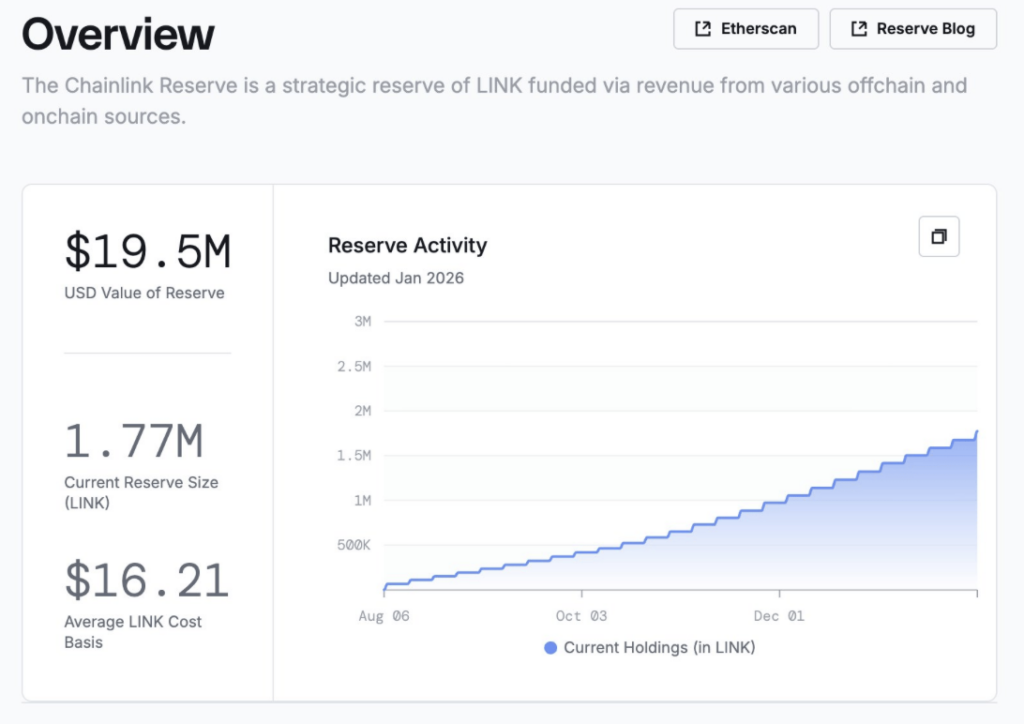

Chainlink recently disclosed that its reserve added 99,103 LINK, the largest single accumulation it’s made so far. That pushed the total amount of LINK locked in reserves to roughly 1.77 million, tightening supply more than at any point before.

Zooming out makes it more interesting. Prior to Q4 2025, the reserve held about 371,000 LINK. Since then, roughly 1.4 million LINK has been added, a 377% increase in a relatively short window. On paper, that’s a meaningful supply squeeze.

In price terms, though, it hasn’t shown up yet. LINK hasn’t reacted the way scarcity models would suggest, at least not so far.

Revenue Keeps Flowing, Price Keeps Lagging

What adds tension to the setup is how Chainlink funds this accumulation. The reserve is built using both on-chain and off-chain revenue, not token emissions or dilution. That points to real adoption and real usage, even if the market isn’t rewarding it at the moment.

Chainlink’s role as a cross-chain bridge gives it a unique fee model. Whenever smart contracts rely on its oracles, whether it’s a DeFi lending protocol pulling price feeds or a derivatives platform managing risk, fees are generated. Recently, fees across 13 different chains hit an all-time high, with Ethereum alone contributing about $6.8 million. That’s not hype, it’s usage.

Those fees flow straight into LINK’s reserve. And yet, price keeps dragging.

Undervaluation Can Be a Feature, Not a Bug

LINK has been one of the weaker performers over the past few months, down roughly 39% in Q4 2025 and another 11.7% so far in 2026. On the surface, that looks ugly. Dig a little deeper, and it starts to resemble broad market FUD rather than project-specific failure.

In this kind of environment, underperformance can actually be bullish. Strong on-chain revenue, growing demand for services, and steady supply lockups don’t disappear just because price is slow to respond. They tend to show up later, sometimes all at once.

If demand accelerates while supply stays constrained, LINK could flip from ignored to scarce very quickly. For patient investors, this stretch may end up looking less like weakness and more like accumulation in disguise.