- Chainlink’s social volume hit a five-week high following upgrades to its Data Streams product

- Sentiment is turning more cautious, even as development activity remains strong

- Industry leaders argue Chainlink’s infrastructure role may still be undervalued

Chainlink has pushed its way back into the spotlight across crypto social channels, and not by accident. Fresh data shows the oracle network just hit a five-week high in social volume, driven largely by renewed interest in its growing role within tokenized finance. While the broader market remains shaky, LINK has become a talking point again, for reasons that go beyond short-term price moves.

The timing lines up with a recent infrastructure upgrade. Chainlink rolled out improvements to its Data Streams product, enabling near real-time pricing for U.S. stocks and ETFs, available 24 hours a day, five days a week. That upgrade allows DeFi protocols to track pre-market, regular trading hours, after-hours, and even overnight sessions, closing a long-standing gap between traditional finance and on-chain systems.

Social Volume Spikes, But Sentiment Turns Cautious

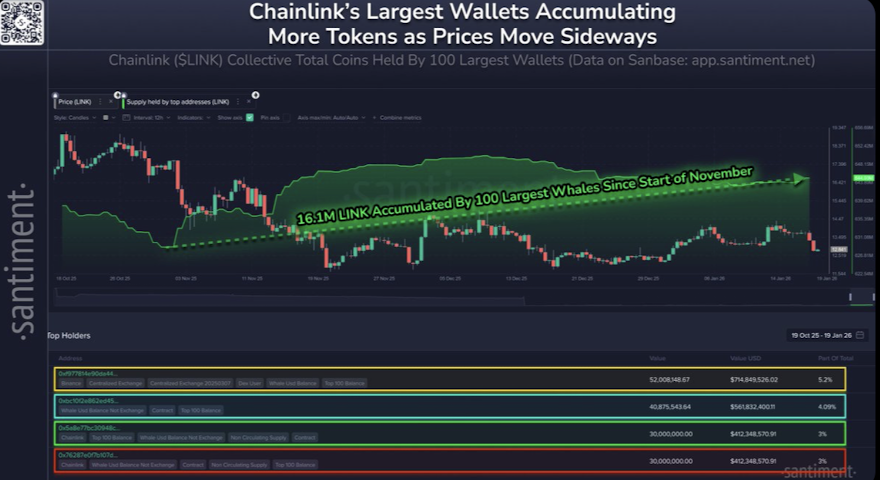

Unsurprisingly, the update sparked a wave of attention around LINK. According to Santiment, Chainlink’s social volume jumped even as the wider crypto market stayed under pressure. That divergence matters. It suggests traders and investors are paying attention to Chainlink’s infrastructure narrative, not just lumping it in with the rest of the altcoin market moving alongside Bitcoin.

Still, the tone of the conversation is shifting. Over the past month, the balance between buying-focused and selling-focused mentions has steadily tilted toward caution. Bearish commentary is now approaching levels not seen in over a year. High engagement remains, but the mood is clearly more skeptical, less euphoric than before.

At the same time, Chainlink’s development activity hasn’t slowed. By multiple measures, including weekly significant GitHub events, it continues to rank as the most actively developed DeFi project by a wide margin. That trend has been consistent since launch, quietly reinforcing the idea that progress is happening regardless of short-term sentiment swings.

Is Chainlink Still Being Mispriced?

Even as social chatter grows more cautious, some industry voices believe the market is missing the bigger picture. Bitwise CIO Matt Hougan recently described Chainlink as one of the most important, yet most misunderstood, crypto assets in the space. In his view, LINK may be deeply undervalued, a comment that stood out given the timing.

Hougan’s remarks came shortly after Bitwise launched a new Chainlink ETP, which saw relatively modest early trading compared to Bitcoin-focused products. He argues that many investors still reduce Chainlink to “just a data oracle,” a label that no longer fits. Instead, he frames it as a rapidly expanding software platform that connects blockchains to each other and to real-world systems.

According to Hougan, Chainlink now holds a dominant position across critical infrastructure layers supporting stablecoins, DeFi, tokenization, and prediction markets. He also pointed to adoption by major institutions such as SWIFT, JPMorgan, Visa, Fidelity, and DTCC. Whether the market fully prices that in anytime soon is another question, but the disconnect between fundamentals and perception is becoming harder to ignore.