- LINK exchange reserves have dropped to a 16-month low, signaling reduced selling pressure and rising scarcity.

- CCIP adoption continues spreading, with major new integrations across AI layers, stablecoin infrastructure, and 12 different chains.

- LINK holds support near $13.31, with upside targets at $15.01 and $17.68 if momentum sustains.

Chainlink started the week in a pretty steady spot, hovering around $13.70 on Tuesday and managing to hold above a key support band that traders have been watching for weeks. The interesting thing is how the fundamentals keep tightening at the same time — exchange reserves dropping, whale orders popping up, and a whole wave of new integrations rolling in. It almost feels like the network is quietly gearing up for something, even if the price hasn’t fully shown it yet.

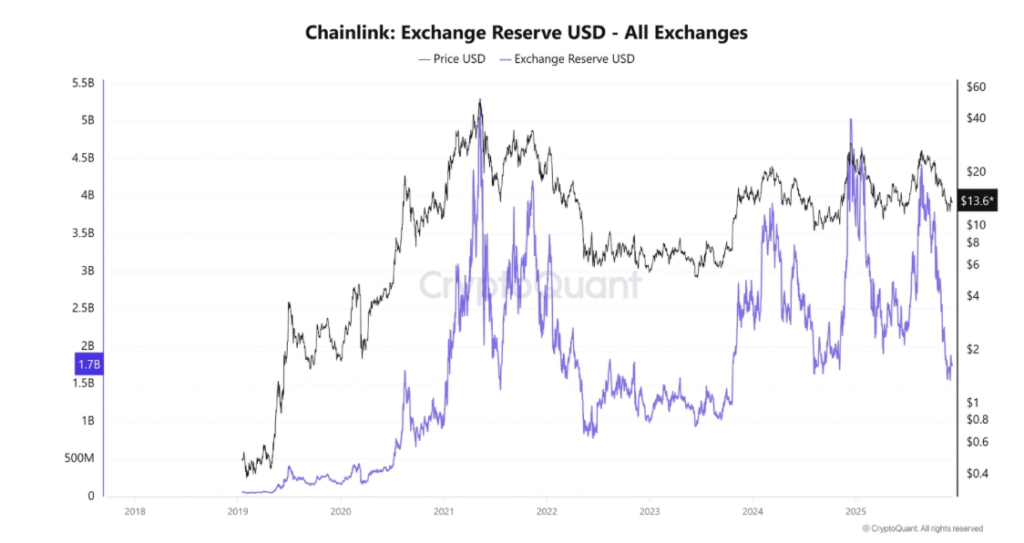

Exchange Reserves Hit a 16-Month Low as Scarcity Builds

CryptoQuant’s data shows the total LINK held on exchanges fell to 1.55 billion on December 1 — the lowest point since August 2024 — before bouncing slightly to around 1.7 billion on Tuesday. That’s still very low compared to the past year. Less supply sitting on exchanges means fewer tokens ready to be dumped, and historically that kind of drain tends to line up with bullish phases.

On top of that, CryptoQuant’s broader summary data points to cooling market conditions, larger whale buys, and buy dominance across both spot and futures markets. Together, these signals hint at a potential move higher if LINK can keep holding its structure without slipping back into a heavier correction.

CCIP Integrations Keep Expanding Chainlink’s Ecosystem

Adoption-wise, Chainlink has been on a roll again this week. Codatta — an AI-focused layer — just announced it’s using Chainlink’s Cross-Chain Interoperability Protocol (CCIP) to transfer XNY between Base and BNB Chain securely. A day earlier, Stable (the StableChain backed by Bitfinex and PayPal Ventures) confirmed its own integration of CCIP to enable cross-chain LBTC transfers.

And beyond those two, the network logged 12 new integrations across six different services spanning a dozen chains — Base, Bitcoin, BNB Chain, Celo, Ethereum, Polygon, Solana, TON, TRON and more. It’s the kind of real-world expansion that reinforces LINK’s long-term utility and builds institutional comfort around the protocol. Every week, the momentum feels a little louder.

Price Outlook: LINK Finds Support and Eyes the Next Levels

LINK broke above its descending trendline on December 2 — a structure formed by connecting multiple highs since early October — and rallied nearly 9% the following day. The move lost some steam afterward, with price pulling back and finding support around $13.31. As of Tuesday, LINK is trading slightly above that zone, hovering near $13.67.

If LINK continues to drift upward, the next target is the 50-day EMA at $15.01. A clean close above that opens the door to the next major resistance at $17.68. The daily RSI at 47 is creeping toward the neutral 50 mark, hinting that bearish pressure is fading, and the MACD remains in a bullish crossover from last week — another small but relevant confirmation.

If price slips again, though, LINK could fall back toward the $13.31 support area before attempting another push.