- Chainlink’s price has fallen 35% since August but accumulation and fundamentals remain strong.

- Whale buying, ecosystem partnerships, and a bullish chart pattern hint at a possible rebound.

- Strategic reserves exceed $10M and could grow past $100M in the next year.

Chainlink hasn’t escaped the broader crypto market crash, tumbling over 35% from its August peak. As of October 24, LINK trades around $17.76, but interestingly, several factors point toward a possible rebound in the coming weeks. The project seems to be quietly setting itself up for a comeback—through accumulation, technical setups, and ecosystem growth that could surprise the market soon.

Strategic LINK Reserves Climb Past $10 Million

One of the strongest bullish drivers right now is Chainlink’s new Strategic LINK Reserves, launched in early August. The idea’s simple but powerful: use all on-chain and off-chain revenue to steadily buy and hold LINK over time. Essentially, the network is betting on itself—locking away tokens to improve its tokenomics while preparing for future rallies.

According to data from Chainlink’s site, developers bought 63,480 LINK this week alone, bringing total reserves to 585,641 LINK. At current prices, that’s roughly $10.4 million worth. If this trend continues, the network could easily surpass $100 million in LINK reserves over the next year, depending of course on market performance. It’s a steady accumulation strategy that signals long-term confidence rather than short-term speculation.

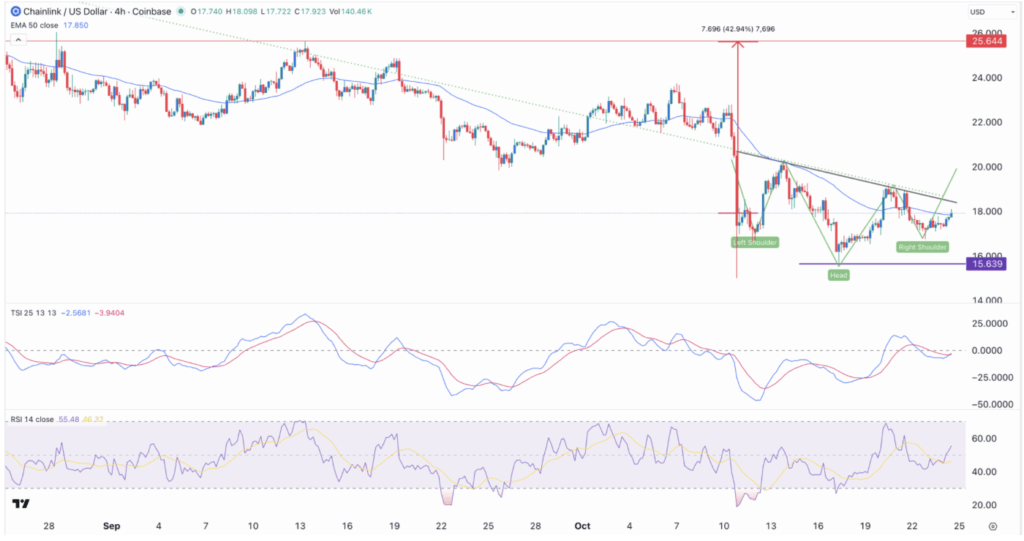

Bullish Chart Patterns Form Amid Downtrend

Technically speaking, Chainlink’s chart might be hinting at a turnaround. On the 4-hour timeframe, LINK has formed an inverse head-and-shoulders pattern—one that often precedes a strong upward breakout. The “head” rests around $15.63, while the neckline slopes upward through recent swing highs from October 13 and 20.

On top of that, momentum indicators are starting to lean bullish. The True Strength Index (TSI) climbed from -46 on October 11 back to neutral territory, while RSI has edged above 50. LINK has also managed to move above its 25-period EMA, another positive sign. If bulls hold momentum, a push toward $25—about 42% above current prices—could be on the horizon. However, the bullish thesis would weaken if LINK falls below the $16 zone, which marks the right shoulder of the pattern.

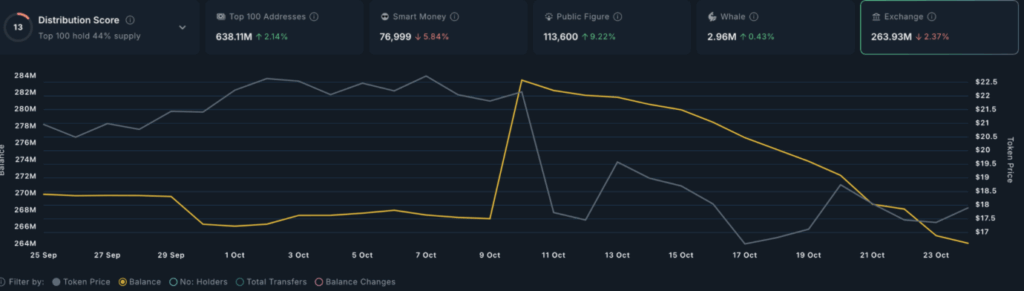

Whale Activity and Falling Exchange Reserves

Whales seem to be making quiet moves too. Data from Nansen shows that large holders have been actively buying LINK throughout October. Collectively, they now control over 2.96 million LINK, worth about $52 million. Historically, this kind of accumulation from big wallets often signals that smart money sees value before a wider rally.

This buying spree has also drained exchange reserves. Total LINK on exchanges has dropped from 284 million in September to 263 million—meaning roughly 21 million tokens (around $357 million) have been withdrawn. When fewer tokens sit on exchanges, it usually points to investor confidence and a lower likelihood of mass selling pressure.

Ecosystem Growth and ETF Speculation

Chainlink’s expanding partnerships add another layer to the bullish narrative. The network was recently chosen by the US government as the oracle solution for moving data on-chain. It’s also collaborating with heavyweights like S&P Global, which plans to use Chainlink tech for its Stablecoin Stability Assessments, as well as established players such as Swift, JPMorgan, and Coinbase.

Meanwhile, the SEC is reviewing proposals for both Grayscale and Bitwise LINK ETFs. If approved, these funds could unlock institutional demand and bring fresh liquidity into the market. Combined with growing reserves and whale activity, Chainlink’s setup looks like a slow burn—one that could turn explosive if sentiment flips.