- LINK has formed a double-bottom at $11.56 and broken above a major falling wedge, with price approaching the 50-day MA and Supertrend flip—signaling a potential move toward $20.

- Exchange balances dropped from 264M to 218M tokens as whales bought over 2.18M LINK, with 28 consecutive days of large whale orders indicating steady accumulation.

- Grayscale’s LINK ETF continues to grow with nonstop inflows, now holding $70.6M in assets; combined with rising strategic reserves, this strengthens LINK’s long-term bullish structure.

Chainlink has been drifting around the $14 zone, trying to find its footing after the broader crypto rally cooled off this week. Even with the market slowing down, LINK’s chart is starting to flash a few early signs that a rebound might be forming underneath the surface — almost like the price is quietly loading up energy for the next move.

Technical Patterns Line Up for a Possible LINK Breakout

On the daily chart, LINK has already carved out a double-bottom around $11.56, with a neckline sitting near $13.50. It’s the kind of pattern traders love to see because it often marks a shift from weakness into early recovery. Not confirmed yet, but definitely something.

Even more interesting, the token spent weeks forming a huge falling wedge, with two long, downward-sloping trendlines squeezing tighter. LINK finally broke out above the wedge’s upper boundary — a classic move that often comes before an upside extension.

Price is now creeping toward the 50-day moving average and is inching close to flipping the Supertrend from red to green. The last time LINK flipped the Supertrend green, it ripped upward shortly after. If buyers hold control, the next major target sits around $20, roughly a 45% jump from current levels.

Of course, a drop back under $11.56 would scrap the whole bullish setup — that level is the line in the sand.

ETF Demand Surges as Grayscale’s LINK Trust Gains Steam

The Grayscale LINK ETF continues to surprise the market. According to SoSoValue, the fund has recorded inflows every single day since launch — not something many new ETFs can brag about.

The trust now holds over $48 million in assets, bringing the total to about $70.6M, which equals 0.75% of LINK’s entire market cap. For context, Bitcoin and Ethereum ETFs hold around 5% of their total market caps, meaning the LINK ETF ecosystem still has tons of room to grow.

Whales Quietly Push LINK Supply Off Exchanges

One of the strongest signals lately is what whales have been doing.

Exchange balances of LINK have dropped to 218 million tokens, down from a November peak of 264M — a pretty sizable reduction. This usually points to accumulation since tokens leaving exchanges can’t be sold as quickly.

A massive whale scooped up:

• 1.62M LINK ($22M) from Binance and Kraken

• and earlier 557,940 LINK ($8M) just two days before

This whale alone now holds 2.18M LINK.

Across the whole network, whale holdings jumped from 1.73M in November to 3.56M now. Meanwhile, CryptoQuant shows 28 consecutive days of large whale orders — basically nonstop accumulation.

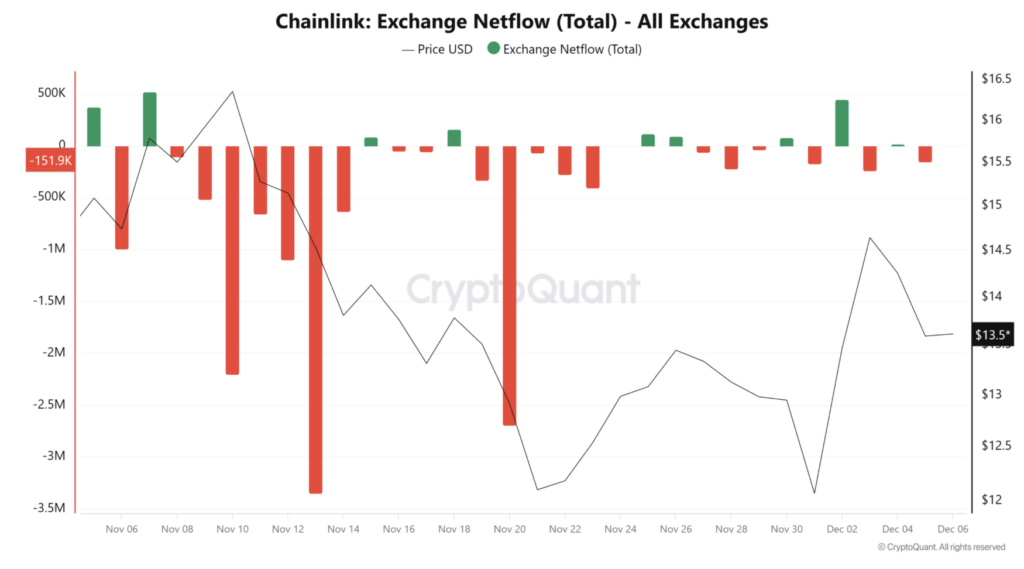

Exchange netflow also hit -151,000 tokens, meaning more LINK is being withdrawn than deposited. In crypto, negative netflow = accumulation pressure.

Strategic LINK Reserves Quietly Grow

Chainlink’s Strategic LINK Reserves — launched in August 2025 — have now grown to 1 million tokens, worth around $14.7M. These reserves are funded by real fees from Chainlink’s network services and are used to buy LINK on the open market, adding even more demand.

Short-Term Pressure Still Exists

LINK trades around $13.63, down around 4% on the day after getting rejected at $14.90 earlier this week. Retail traders took profits aggressively — Coinalyze data shows three straight days of negative Buy Sell Delta, with sellers pushing 8.1M in volume vs 7.32M in buys.

Stochastic RSI made a bearish cross and slid to 74, while the DMI’s positive index remains stuck under the negative index. So short-term signals are mixed, leaning slightly bearish.

If retail selling keeps up, LINK could retest $12.70. But if whales keep absorbing supply — and all signs suggest they’re doing exactly that — LINK could break above $14 again and aim for $15 → $16.70, then eventually toward the $20 region if momentum really picks up.