- Cardano hovers at $0.70 while whale sell-offs hint at a possible drop to $0.53.

- Technical indicators show consolidation, but a breakout—up or down—seems imminent.

- A move above $0.7746 could spark a rally toward the $1.00 psychological level.

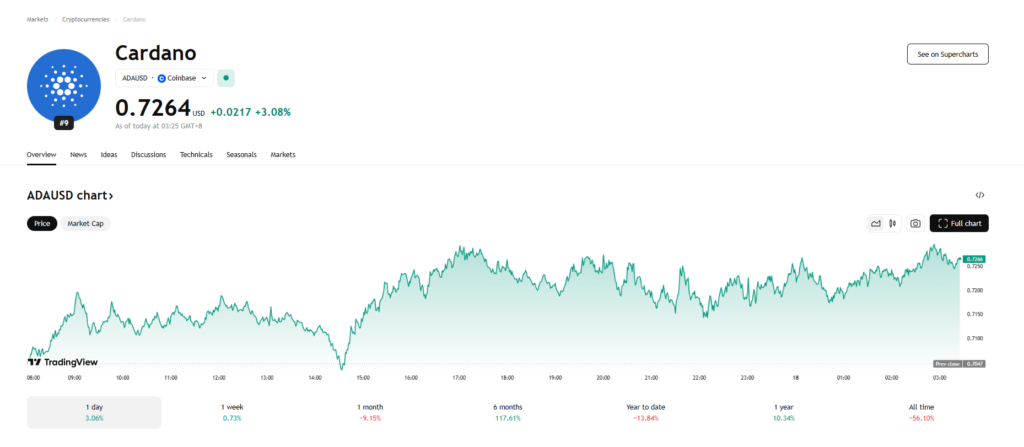

As Bitcoin teeters around the $83,000 mark, Cardano finds itself in a bit of a tug-of-war at $0.70. The weekend saw ADA pacing sideways, locked in a tight consolidation phase as traders grappled with short-term momentum at this psychologically charged level.

Yet, beneath the surface, a surge in whale activity whispers of impending turbulence. Could this be the precursor to a sharp descent toward $0.53? The coming days may tell a volatile tale.

Cardano’s Price Squeeze Signals Impending Breakout

The daily chart paints a picture of compression, with ADA oscillating between the 38.20% and 50% Fibonacci retracement levels—specifically, $0.6673 and $0.7746. A battle zone, of sorts.

At present, Cardano sits at $0.7219, reclaiming 2.44% in an intraday pushback against a harsh 5.61% plunge on Sunday that formed an evening star pattern—typically a foreboding sign in technical analysis.

Momentum indicators, however, remain largely noncommittal. The Bollinger Bands have flattened, suggesting reduced volatility, while the MACD and signal lines hover uneasily around the zero threshold. One notable concern? A bearish alignment creeping into the moving averages, hinting at underlying weakness that could be gearing up for a sharper move.

Whale Exodus Casts Shadows Over ADA’s Future

As uncertainty grips ADA’s price trajectory, large holders aren’t waiting around. Crypto analyst Ali Martinez recently flagged a significant shift—whale wallets offloading in droves.

Data from Santiment shows that in just the past week, these heavyweight investors have shed a staggering 100 million ADA tokens. This mass exodus has driven the collective holdings of addresses holding between 1 million and 10 million ADA down to 5.89 billion tokens.

What does this tell us? A major distribution phase could be in play, increasing the odds of an impending breakdown in ADA’s consolidation.

Critical Levels to Watch

If the current selloff extends, Fibonacci levels highlight a key downside target—the 23.60% retracement level, which aligns closely with a long-term support trendline just above the psychologically significant $0.50 mark. A breach here could invite even steeper losses.

On the flip side, should ADA defy the bearish outlook and reclaim ground above the 50% Fibonacci threshold at $0.7746, it could reignite bullish sentiment. Such a move may pave the way for a rally toward the elusive $1.00 milestone.

One thing is certain: with price compression, whale sell-offs, and technical indicators on edge, volatility lurks just around the corner. Buckle up.