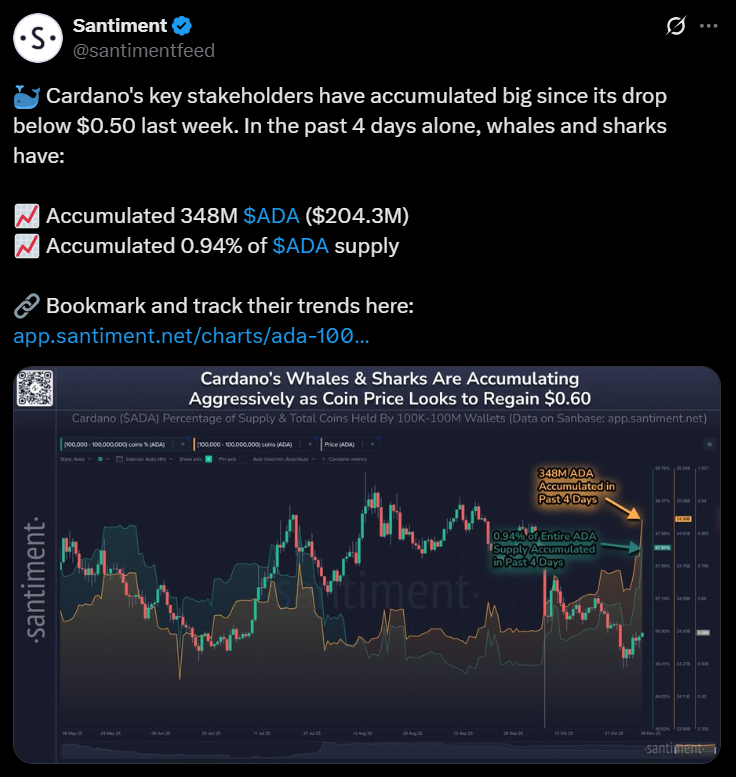

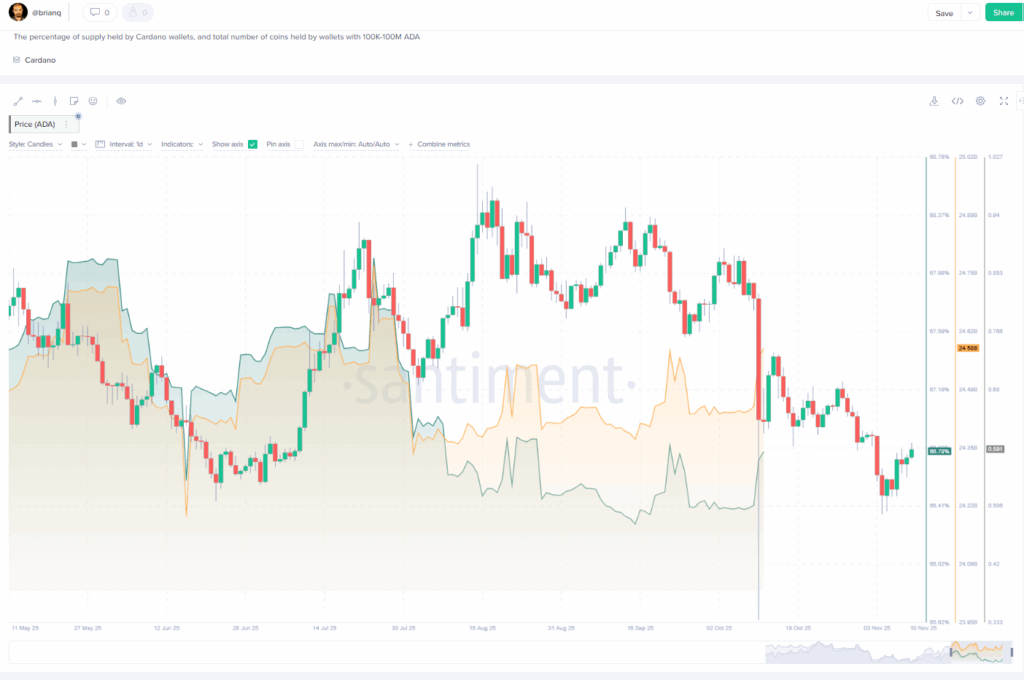

- Whales and sharks holding 100k–100m ADA accumulated 348M tokens (0.94% of supply) after price dropped below $0.50, according to @santimentfeed and Santiment’s on-chain chart.

- This accumulation often precedes relief rallies, with key levels around $0.52, $0.55, $0.60 on the upside and $0.45 as a critical support to avoid deeper downside.

- On-chain trends and historical patterns suggest improved odds of a medium-term bounce, though volatility and macro headlines still make strong risk management essential.

Cardano has quietly become one of the more interesting on-chain stories this week. According to data from @santimentfeed, whale and shark wallets holding between 100,000 and 100 million ADA accumulated around 348 million ADA over the last four days after price slipped below $0.50. At recent prices, that stash is worth roughly $204.3 million and represents about 0.94% of ADA’s total supply, based on Santiment’s on-chain chart.

This isn’t just background noise. When a cohort that size rotates from neutral to aggressive buyers in a matter of days, it usually tells you big players see value at current levels, even if retail sentiment still feels shaky. The same Santiment wallet cohort chart shows a clean uptrend in holdings from November 10, 2025, confirming that accumulation has been steady, not just a one-candle anomaly.

For traders, this kind of aggressive dip-buying from large holders often becomes an early signal that the downside move is starting to exhaust, even if the chart still looks bruised on lower timeframes.

Trading Context: Key Levels, Pairs, and Short-Term Setups

The timing of this buying spree matters. ADA broke below the psychological $0.50 mark last week, a level many traders had been treating as both a support and a confidence line. Once that gave way, spot and derivatives flows became more defensive, and ADA drifted toward a more oversold posture.

Santiment’s 100k–100m cohort data shows that as price slid, these wallets stepped in hard. Historically, when whales absorb supply on dips, it can reduce immediate sell pressure and set the stage for a relief rally, especially if broader market conditions stabilize.

For active traders, ADA/USDT and ADA/BTC remain the main pairs to watch. If RSI or similar momentum indicators dip into or bounce out of oversold territory while on-chain accumulation is still rising, that can offer a cleaner entry signal than just buying every red candle. Nearby resistance zones sit around $0.55 and $0.60, where you’d expect some profit-taking or short hedging to kick in. On the downside, the $0.45 area is still a critical line; losing that level with strong volume would suggest whales are early rather than perfectly timed.

Short-term speculators may lean toward breakout plays above $0.52, while more conservative traders might prefer staggered entries or light dollar-cost averaging as long as on-chain data keeps pointing to accumulation instead of distribution.

On-Chain and Volume Trends Backing a Potential ADA Rebound

On-chain, the story is fairly straightforward: adding nearly 1% of supply in four days is a big move, especially when it’s concentrated in whales and sharks rather than scattered across small addresses. That scale of accumulation can change the near-term supply profile faster than most headlines do.

Previous periods where the same cohort increased holdings have been followed, in some cases, by 15–20% price advances over the following weeks. That’s not a guarantee, but it’s enough of a pattern that many traders treat it as a meaningful signal rather than trivia. If daily active addresses and transaction counts start rising alongside this wallet growth, it would further validate the idea that ADA is moving from “capitulation mood” toward “reaccumulation phase.”

Volume trends on pairs like ADA/BTC will also be important. If ADA starts outperforming Bitcoin on a relative basis while whales keep buying, that usually shows the market is re-rating its positioning rather than just bouncing mechanically with the rest of the majors.

Risk management still matters. Volatility can spike fast, and 24-hour moves can flip from green to red on a single macro headline. Stop-loss levels just below recent local lows and clear invalidation points around that $0.45 support can help reduce the emotional side of trading this kind of setup.

Bigger Picture: Why This Accumulation Matters Beyond the Short Term

Beyond the short-term trade, this wave of buying fits into a broader narrative: large players are still interested in layer-1 networks with active ecosystems, even when price action looks discouraging. Cardano’s roadmap, ongoing upgrades, and steady ecosystem development give whales something to anchor a longer-term thesis to, not just a swing-trade view.

On-chain tools like Santiment’s ADA 100k–100m wallet chart make it easier to see where “smart money” is leaning. Right now, that lean is clearly toward accumulation, not exit. If the broader market stabilizes and liquidity rotates back into alts, this kind of positioning can become the fuel for stronger moves later on.

For now, the message from the chain is pretty simple: while retail is still debating whether ADA is “dead” or not, whales just quietly bought 348 million reasons to stick around.