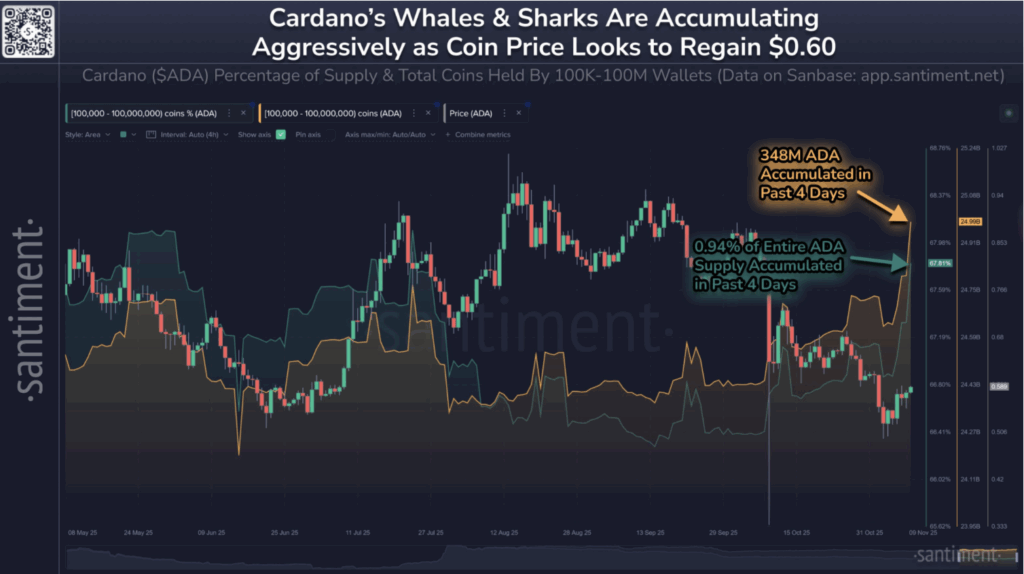

- Large Cardano wallets accumulated around 348 million ADA in four days, grabbing nearly 1% of the circulating supply right after price dipped below $0.50.

- ADA is now trying to reclaim the $0.58–$0.60 resistance zone, with a successful breakout opening potential moves toward $0.65–$0.70 if buy support holds.

- If whales keep accumulating and ADA breaks above $0.60 with strong volume, a short-term rebound could develop quickly, while failure to do so risks a retest of $0.50–$0.47 if Bitcoin turns lower again.

Cardano has been under steady pressure for weeks, and that clean break below $0.50 last week honestly looked like it could open the door to even more downside. Sentiment was sliding, social chatter turned pretty bearish, and a lot of people started writing ADA off as “just another laggard” in this cycle. But while the crowd was getting nervous, something very different was happening in the background.

Fresh data from on-chain analytics firm Santiment shows that Cardano’s biggest buyers didn’t walk away at all. Instead, they quietly stepped back into the market and started loading up, hard, right into the dip. Over just a few days, whales and large holders accumulated a huge chunk of supply – the kind of move that doesn’t always scream from the headlines but usually matters a lot later.

Whales and sharks grab 348 million ADA in four days

Santiment’s latest chart highlights a sharp, almost vertical jump in holdings from wallets controlling between 100,000 and 100 million ADA. These are the so-called “whales” and “sharks” – the type of players that rarely chase green candles and usually prefer to buy when the sentiment feels heavy and uncomfortable. They are often viewed as the “smart money” on the network because they accumulate into weakness and distribute into euphoria.

According to the data, in just four days these big wallets scooped up around 348 million ADA, worth more than $200 million at current prices. That’s close to 1% of the entire circulating supply being absorbed while the broader market was still unsure which way things would break. When you zoom in on the chart, the accumulation line practically shoots upward right after ADA dropped below the $0.50 mark. It’s the same kind of behavior that has often come before strong recoveries for Cardano in the past.

Historically, whenever that accumulation curve spikes sharply higher, ADA tends to follow with a rebound not long after. Retail sentiment can stay mixed and hesitant, but whales don’t usually wait for confirmation or headlines – they position early and let everyone else notice later. And right now, that’s exactly what it looks like they’re doing again.

Can ADA really reclaim the $0.60 zone?

On the price side, the chart shared with Santiment’s data also shows ADA trying to push its way back into the $0.58–$0.60 range. This band has been acting as short-term resistance during the latest downtrend, basically acting like a ceiling that keeps rejecting attempts to move higher. If Cardano can break through that area and hold above it, it would be the first solid sign of strength the market’s seen from ADA in weeks.

A clean move above $0.60 could open the door to a push toward $0.65 or even $0.70, especially if overall market sentiment stays constructive. But the key is consistency: ADA needs real buy support to keep price trading above that range, not just one random spike. Bitcoin still controls the bigger picture across the crypto market, so if BTC decides to pull back sharply again, it can drag ADA down regardless of how bullish the whale data looks.

Whale accumulation on its own doesn’t guarantee an instant breakout, of course. But in crypto, it almost always shows a shift in sentiment long before it appears clearly on the price chart. The fact that deep-pocketed holders were willing to deploy this much capital during a 33% monthly drawdown says a lot. It suggests they see ADA as oversold, undervalued, or both at these levels. It also reflects renewed confidence in Cardano’s long-term story – from its growing DeFi ecosystem and deeper stablecoin liquidity, to upcoming governance and protocol upgrades that could unlock more utility.

What the market watches next for ADA

From here, the next phase for ADA really comes down to two main questions. First: do whales keep buying, or was this just a short-term spike in accumulation? Sustained whale buying over multiple weeks has historically lined up with multi-month rallies for Cardano. If the accumulation line keeps trending upward instead of flattening out, that would strengthen the case that this isn’t just a one-off “buy the dip” moment.

Second: can ADA convincingly break back above that $0.60 zone and flip it into support. If price can reclaim that level and hold it, momentum has a chance to build toward the mid-$0.60s, with the next big resistance sitting roughly in the $0.68–$0.72 area. That’s the region where sellers are likely to show up again in size.

On the downside, if ADA fails to retake $0.60 and Bitcoin decides to retrace, there’s still a real risk that price revisits the $0.50 area or even dips toward the $0.47 support that buyers defended last week. But given the timing and scale of this recent 348 million ADA accumulation, the market feels like it’s leaning a bit more toward recovery than collapse – unless some bigger macro shock or regulatory surprise hits out of nowhere.

Overall, the message from the Santiment data is pretty straightforward: whales are buying weakness again. And historically, that has been one of the strongest early signals that ADA is gearing up for its next move. With close to 1% of the supply snapped up in just four days, Cardano might be quietly preparing for a short-term rebound, as long as the rest of the market doesn’t fall apart in the meantime. If ADA breaks above $0.60 with real volume behind it, the next leg higher could arrive faster than most retail traders are expecting.